As global debt worries mount, is another crisis brewing? “You can take many, many countries today, and you will see that we are not far away from a public finances crisis”

By Yoruk Bahceli, Dhara Ranasinghe, and Maria Martinez

16 October 2023

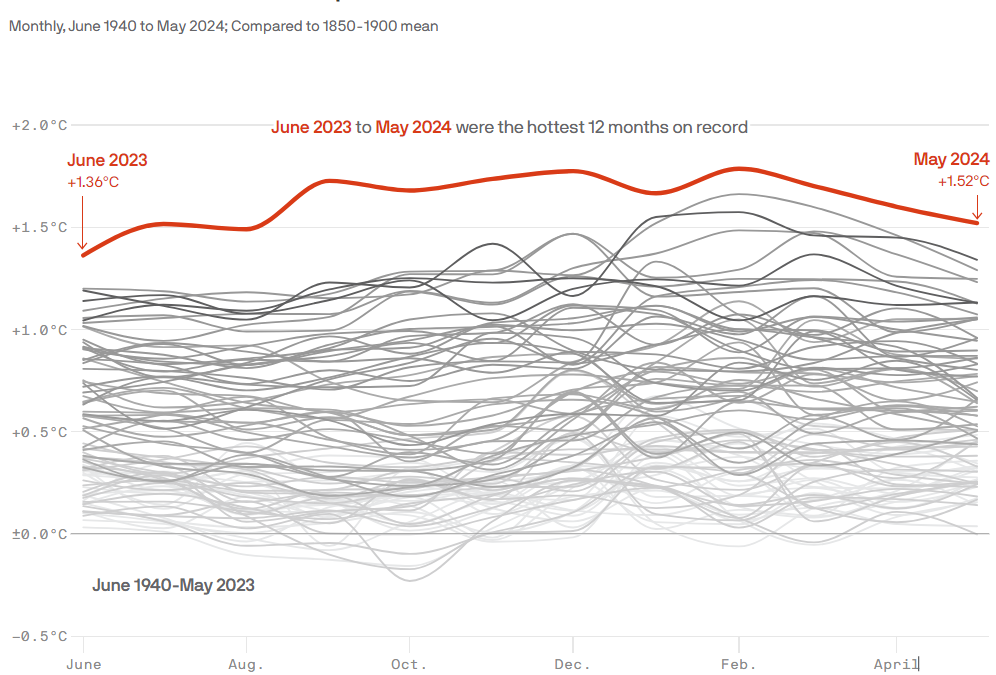

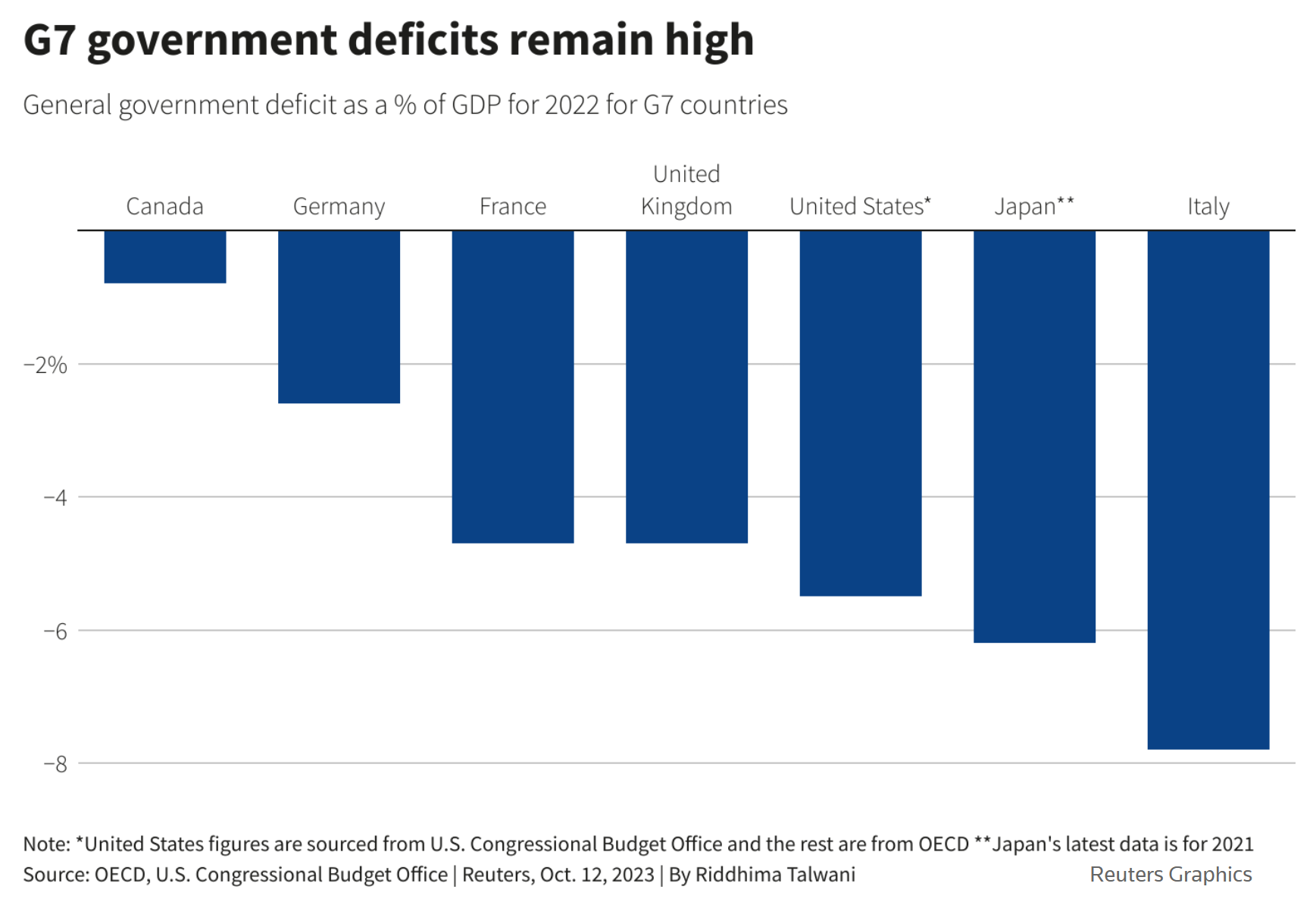

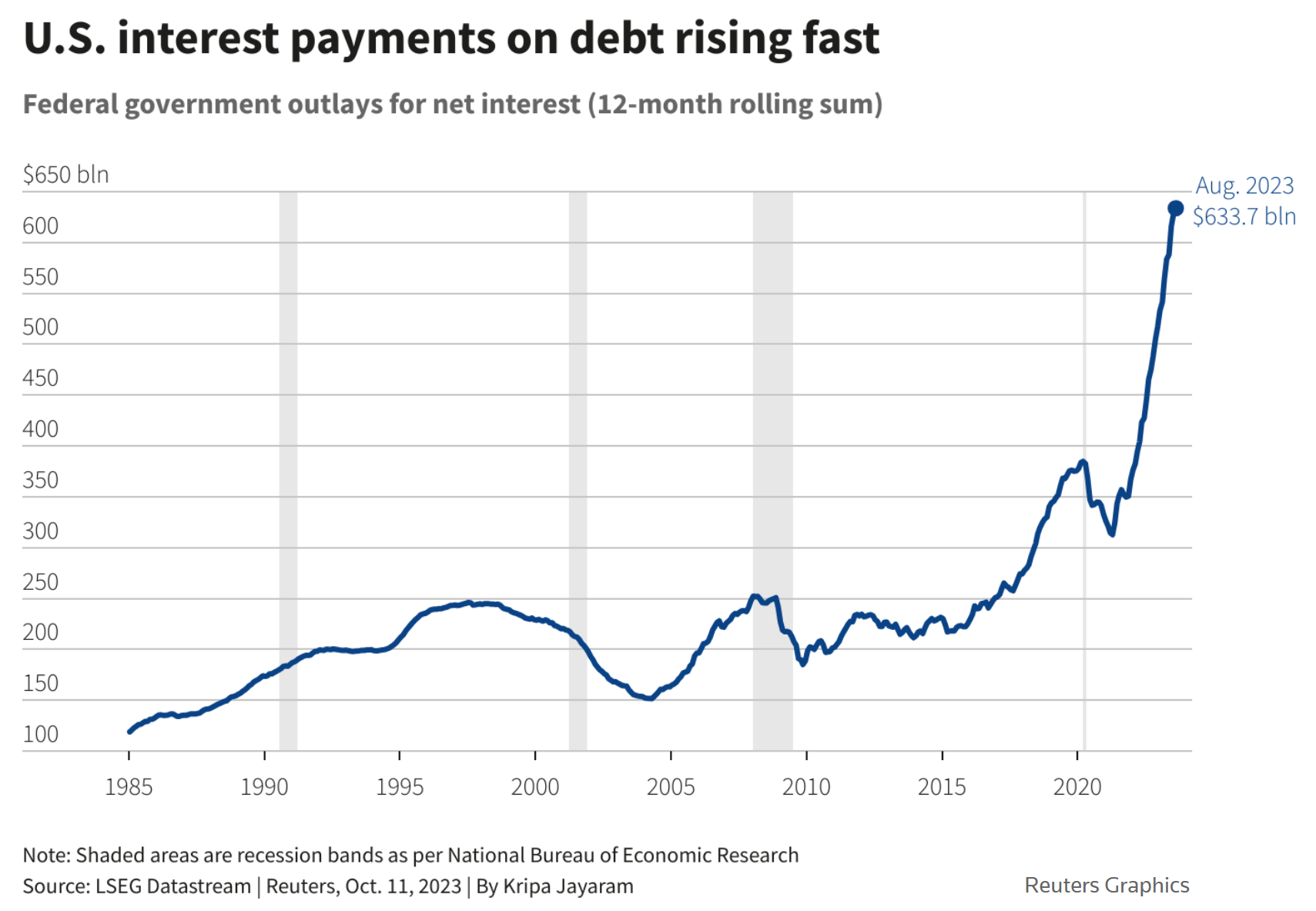

LONDON (Reuters) – Record debts, high interest rates, the costs of climate change, health, and pension spending as populations age and fractious politics are stoking fears of a financial market crisis in big, developed economies.

A surge in government borrowing costs has put high debt in the spotlight, with investors demanding increased compensation to hold long-term bonds and policymakers urging caution on public finances.

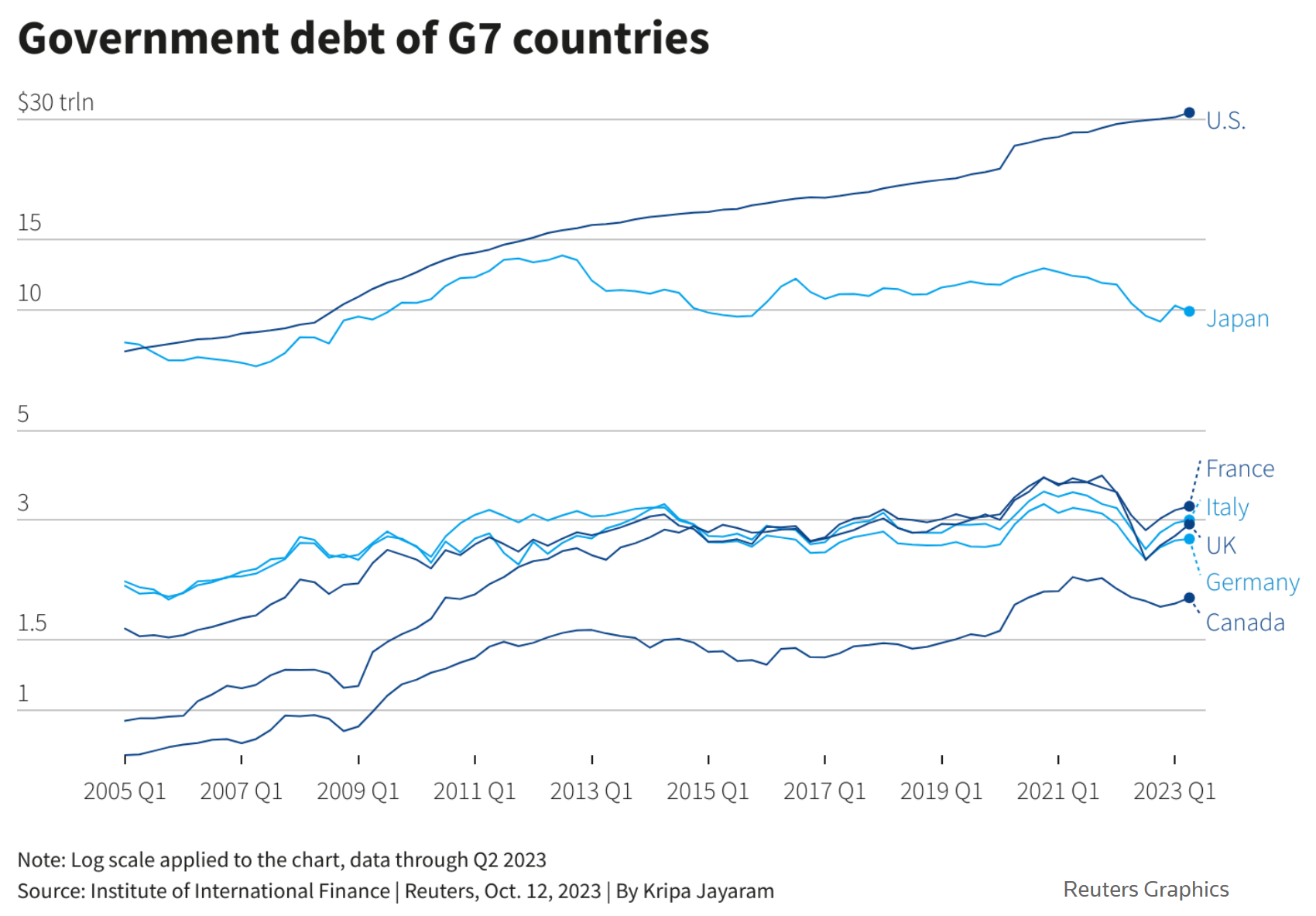

Over 80% of the $10 trillion rise in global debt in the first half to a record $307 trillion came from developed economies, the Institute of International Finance says.

The United States, where brinkmanship around a debt limit brought it close to a default, Italy and Britain are of most concern, more than 20 prominent economists, former policymakers and big investors told Reuters.

They do not expect a developed economy to struggle paying debt, but say governments must deliver credible fiscal plans, raise taxes and boost growth to keep finances manageable. Heightened geopolitical tensions add to costs.

A fragile environment with higher rates and shrinking central bank support raises the risk of a policy misstep sparking a market rout, as shown by Britain’s 2022 “mini budget” crisis.

Peter Praet, former chief economist at the European Central Bank, said that while debt still appears sustainable, the outlook is worrying given longer-term spending needs.

“You can take many, many countries today, and you will see that we are not far away from a public finances crisis,” said Praet, who joined the ECB during 2011’s debt crisis.

“If you have an accident, or a combination of events, then you go into an adverse non-linear dynamic sort of process. That is something which is a real possibility.”

High funding needs and central banks removing support are increasing pricing uncertainty for investors, Sophia Drossos, hedge fund Point72 Asset Management economist and strategist, said.

“Deficit and debt levels make us uncomfortable,” said Daniel Ivascyn, chief investment officer at bond giant PIMCO, which is a little bit reluctant to own a longer-term bond.

Spending plans lacking credibility were seen as most likely to spark market turmoil.

Longer term, “government debt trajectories pose the biggest threat to macroeconomic and financial stability”, said Claudio Borio, head of the Bank for International Settlements monetary and economic department. [more]