BP Statistical Review of World Energy 2020: Carbon emissions increase for another year, coal still the single largest source of power generation

By Bernard Looney

17 June 2020

(BP) – The COVID-19 pandemic may well turn out to be the most tragic and disruptive event that many of us will ever live through. As I write this – in the middle of June – over 400 thousand people globally have lost their lives to the infection. Millions more might have done so without the widespread lockdown of economies across the world, which came at huge economic and social cost. [Download Statistical Review of World Energy pdf]

This combined health and economic shock is bound to reshape the global economic, political and social environment in which we all live and work. It has the potential to accelerate emerging trends and create opportunities to shift the world onto a more sustainable path. But it also risks slowing progress if the short-term, domestic issues raised by COVID-19 are prioritized over long-term, global challenges, such as climate change. It feels like the world is at a pivotal moment: it needs to address these short-term concerns but in a way that builds back better.

In that context, this year’s edition of bp’s Statistical Review of World Energy provides a timely reminder of global energy trends prior to the crisis.

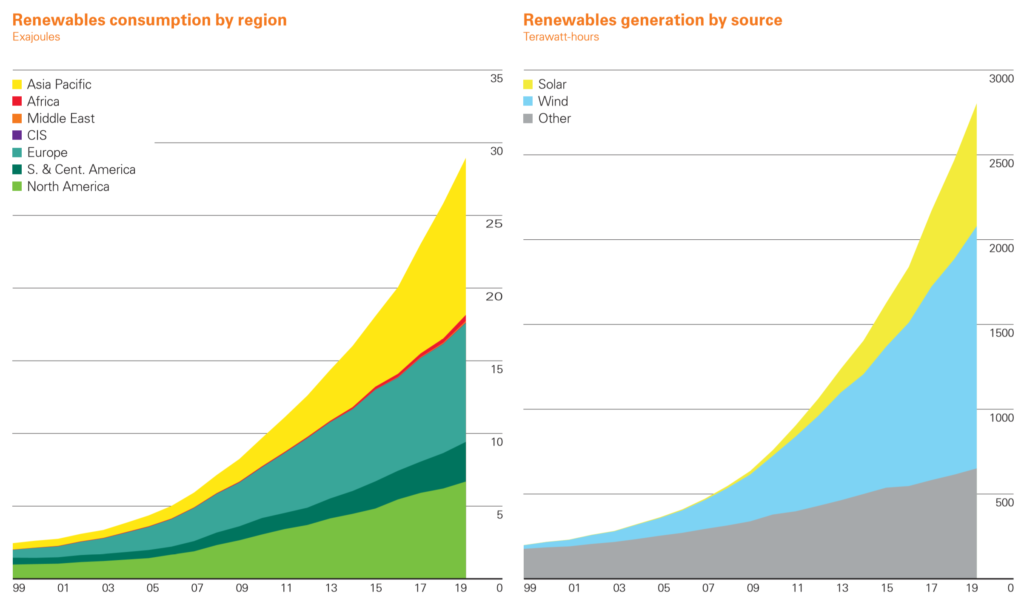

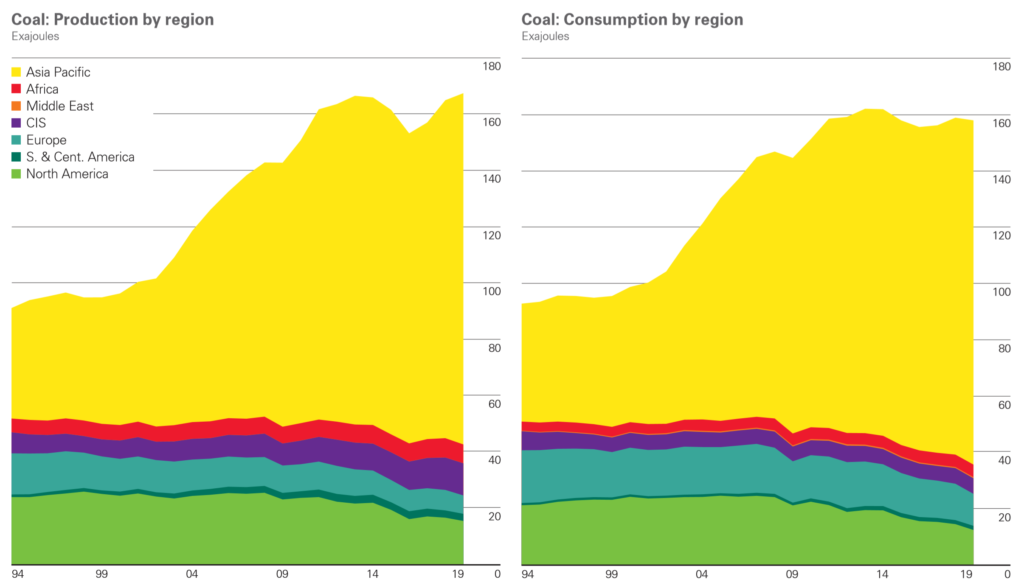

Some aspects are encouraging – particularly the continuing strong growth of renewable energy. Led by wind and solar power, renewable energy increased by a record amount, accounting for over 40% of the growth in primary energy in 2019. At the same time, coal consumption fell for the fourth time in the past six years, with its share in the global energy mix falling to its lowest level for 16 years.

But other aspects of the energy system continued to give cause for concern. Despite last year’s decline, coal was still the single largest source of power generation, accounting for over 36% of global power. That compares with just 10% provided by renewable energy. Renewables will need to grow even more strongly over the next three decades to decarbonize the power sector.

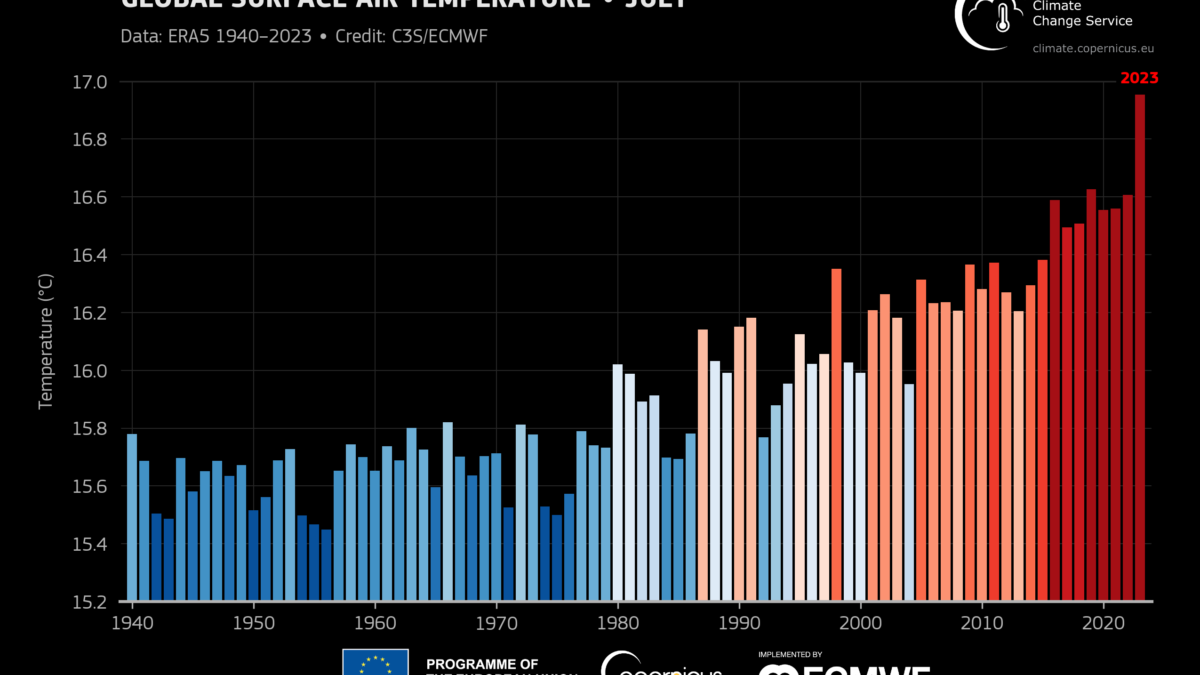

More worrying is the trend for carbon emissions. The slowing in the growth of carbon emissions to 0.5% in 2019 may suggest some grounds for optimism. But this deceleration needs to be seen in the context of the big increase in carbon emissions in 2018 of 2.1%. The hope was that as the one-off factors boosting carbon emissions in 2018 unwound, carbon emissions would fall significantly. That fall did not happen. The average annual growth in carbon emissions over 2018 and 2019 was greater than its 10-year average. As the world emerges from the COVID-19 crisis it needs to make decisive changes to move to a more sustainable path.

The disruption to our everyday lives caused by the lockdowns has provided a glimpse of a cleaner, lower carbon world: air quality in many of the world’s most polluted cities has improved; skies have become clearer. The IEA (International Energy Agency) estimate that global CO2 emissions may fall by as much as 2.6 gigatonnes this year. That has come at considerable cost and as economies restart and our lives return to normal there is a risk that these gains will be lost.

But to get to net zero by 2050, the world requires similar-sized reductions in carbon emissions every other year for the next 25 years. This can be achieved only by a radical shift in all our behaviours. By using resources and energy more efficiently. And by implementing the full range of zero and low carbon energies and technologies at our disposal – including renewable energies, electrification, hydrogen, CCUS (carbon capture use and storage), bioenergy and many more. These technologies exist today – the challenge is to use them at pace and scale.

At bp, we are committed to playing our part. In February, we adopted a new purpose – to reimagine energy for people and our planet. And we announced a new ambition, to be a net zero company by 2050 or sooner and to help the world get to net zero. The experience of COVID-19 has only reinforced our commitment to this purpose and ambition, by highlighting both the fragility of our planet and the opportunities it provides to truly build back better.

As bp along with the rest of the world navigate the energy transition, we will need timely, objective and comprehensive data on the global energy system. That is the role that the Statistical Review has been playing for the past 69 years and will continue to play in the future.

I hope this year’s Statistical Review is useful to everyone else seeking ways to get to net zero and build back better. And I would like to thank the very many people who help our economics team in compiling it, including the governments and statistical agencies around the world who have contributed their official data again this year. The Statistical Review would not be possible without your generous co-operation and transparency. Thank you.

Bernard Looney

Chief executive officer

June 2020

One Response

Comments are closed.