Top investment banks provide $713 billion to expand fossil fuel industry since Paris climate change agreement – “We can all sit around pointing fingers at each other, but that doesn’t help solve what is a really complex and multifaceted problem”

By Patrick Greenfield

13 October 2019

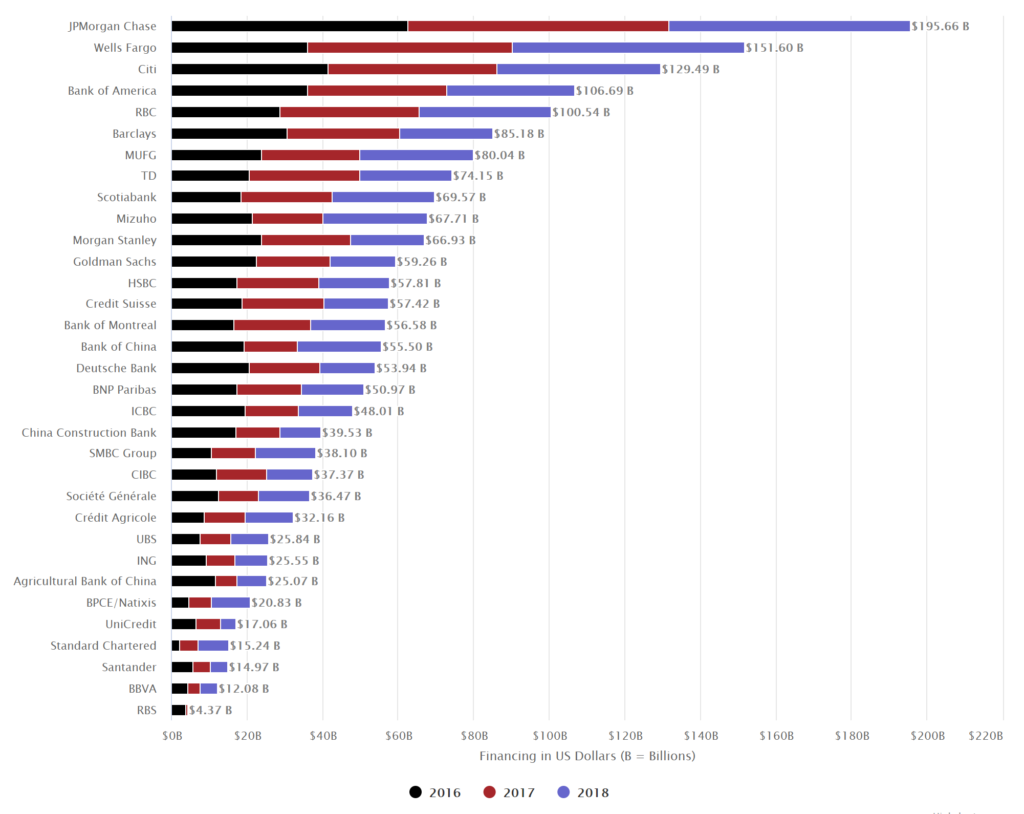

(The Guardian) – The world’s largest investment banks have provided more than $700 billion of financing for the fossil fuel companies most aggressively expanding in new coal, oil and gas projects since the Paris climate change agreement, figures show.

The financing has been led by the Wall Street giant JPMorgan Chase, which has provided $75bn (£61bn) to companies expanding in sectors such as fracking and Arctic oil and gas exploration, according to the analysis.

The New York bank is one of 33 powerful financial institutions to have provided an estimated total of $1.9 trillion to the fossil fuel sector between 2016 and 2018.

The data show the most aggressively expanding coal-mining operations, oil and gas companies, fracking firms and pipeline companies have received $713.3 billion in loans, equity issuances, and debt underwriting services from 2016 to mid-2019.

Other top financiers of fossil fuel companies include Citigroup, Bank of America and Wells Fargo.

Using Bloomberg financial data and publicly available company disclosures, the analysis was compiled exclusively for the Guardian by Rainforest Action Network, a US-based environmental organisation.

The figures update the group’s Banking on Climate Change 2019 report from April, which showed the practices of key investment banks were aligned with a climate disaster.

Figures show fracking has been the focus of intense financing, with Wells Fargo, JPMorgan Chase and Bank of America providing about $80 billion over three years, much of it linked to the Permian basin in Texas.

The New York bank is one of 33 powerful financial institutions to have provided an estimated total of $1.9 trillion to the fossil fuel sector between 2016 and 2018. […]

Elsa Palanza, Barclays’ global head of sustainability and citizenship, said: “We can all sit around pointing fingers at each other, but that doesn’t help solve what is a really complex and multifaceted problem. What can help solve the problem is, firstly, the voluntary mechanisms we are working on, like the Task Force on Climate-related Financial Disclosures, and then the new attention from regulators like the PRA [Prudential Regulation Authority].

“The new requirements make people working in banks think about climate change as a double-sided coin, to look at the risks within our portfolio, but also thinking about the opportunity side in terms of financing renewable energy. That’s leveraging the best of what a bank would offer.”

The big four state-owned Chinese banks, which have no fossil fuel financing policies, have dominated services for coal miners and coal power companies since 2016. [more]

Top investment banks provide billions to expand fossil fuel industry

Business as usual most comfortable mode. Mankind will go far past point of no return, then take frantic, expensive measures to stop global warming. Right up to outbreak of WWII America and England were selling scrap metal to Japanese and Germans, even being aware war was inevitable. Money making is the narcotic that fueled that madness.