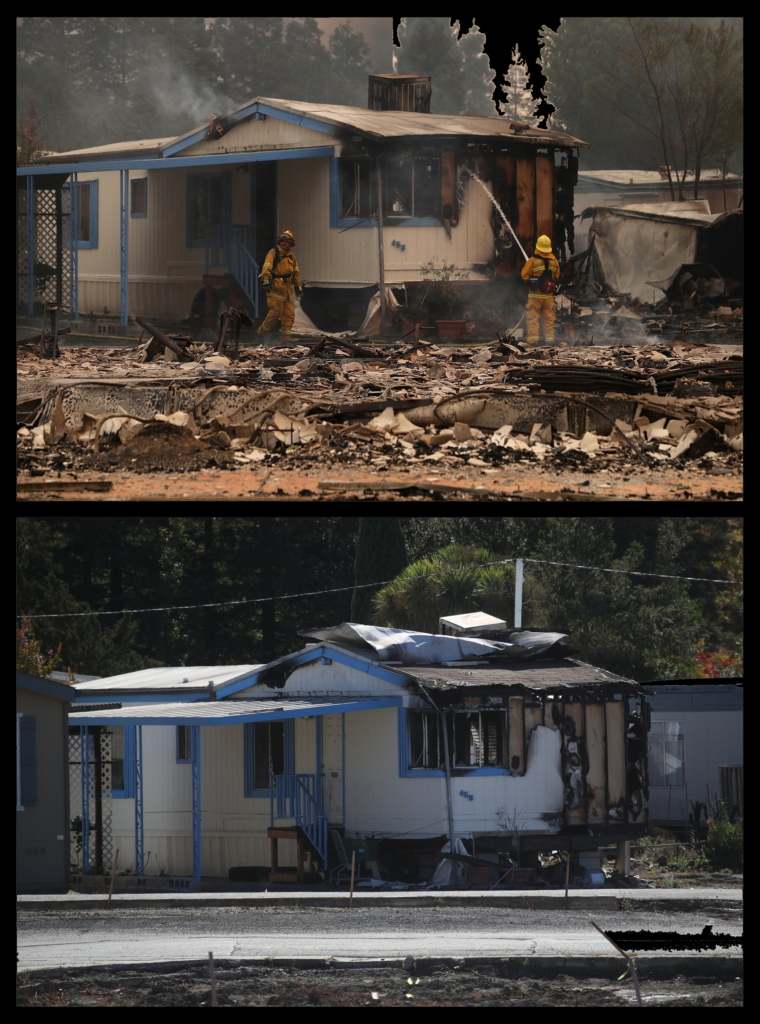

Two years after California wildfires, survivors poised to lose housing funds – Dealing with insurance companies is “the disaster after the disaster”

Bu Vivian Ho

8 October 2019

SAN FRANCISCO (The Guardian) – Two years ago, they lost everything – their homes, baby photos, family heirlooms, keepsakes, jewelry, mementos – in a flurry of wildfires that ripped through California’s wine country.

Now, on the second anniversary of these fires that killed 44 and destroyed thousands of buildings, survivors are poised to lose the insurance coverage that allowed them to pay for temporary housing while they waited out the rebuilding process of their new homes.

Under California law, insurance companies are required to provide coverage for additional living expenses, such as rent or a hotel room, for at least 24 months after a state of emergency. But for the survivors of the 2017 wildfires, two years was barely enough time to begin rebuilding.

Debris removal took time. Geotechnical surveys – many lots had been so decimated by the flames that they were once again deemed undeveloped land – took even more time. Then came the geotechnical engineering, and finding architects and contractors, and then getting building permits.

The coverage the Santa Rosa resident Vita Iskandar has through State Farm expires on 16 October, but construction on her home is not set to be completed until December.

“We requested a continuation,” said Iskandar, a community organizer who runs the resource-sharing website Neighbors Together Strong and Resilient. “We requested an extension from our landlord. But what we really have to decide now is if paying out of pocket for rent is worth it, or if we’ll have to camp out of our incomplete home.”

“We really didn’t have two years,” said Lisa Frazee, who lost her Santa Rosa home in the Tubbs fire. “We had to get our infrastructure back – the bridges, the roads – before we could even start personally thinking of rebuilding. The cities and counties were inundated with that first. Then we had to get builders and there aren’t enough builders. There aren’t enough laborers.”

Around Santa Rosa, only 20% of reconstruction has been completed while 62.5% is still in process.

Many of the wildfire survivors call dealing with the insurance companies “the disaster after the disaster” because of how often they feel retraumatized by the companies’ policy decisions. [more]

Two years after California wildfires, survivors poised to lose housing funds