Global debt soars to $169 trillion, along with fears of crisis ahead – “We were supposed to correct a debt bubble. What we did instead was create more debt.”

By David J. Lynch

3 September 2018

(The Washington Post) – Ten years after the worst financial panic since the 1930s, growing debt burdens in key developing economies are fueling fears of a new crisis that could spread far beyond the disruption sweeping Turkey.

The loss of investor confidence in the Turkish lira, which has surrendered more than 40 percent of its value this year, is only a preview of debt problems that could engulf countries such as Brazil, South Africa, Russia, and Indonesia, some economists say.

“Turkey is not the last one,” said Sebnem Kalemli-Ozcan, an economics professor at the University of Maryland. “Turkey is the beginning.”

For now, few experts think that a broader crisis is imminent, though Argentina last week asked the International Monetary Fund to accelerate a planned $50 billion rescue as the peso crashed to a historic low. But the danger of a financial contagion that could hit Americans by crushing U.S. exports and sending the stock market plunging should be taken more seriously in light of a massive increase in global debt since the 2008 downturn, the economists said.

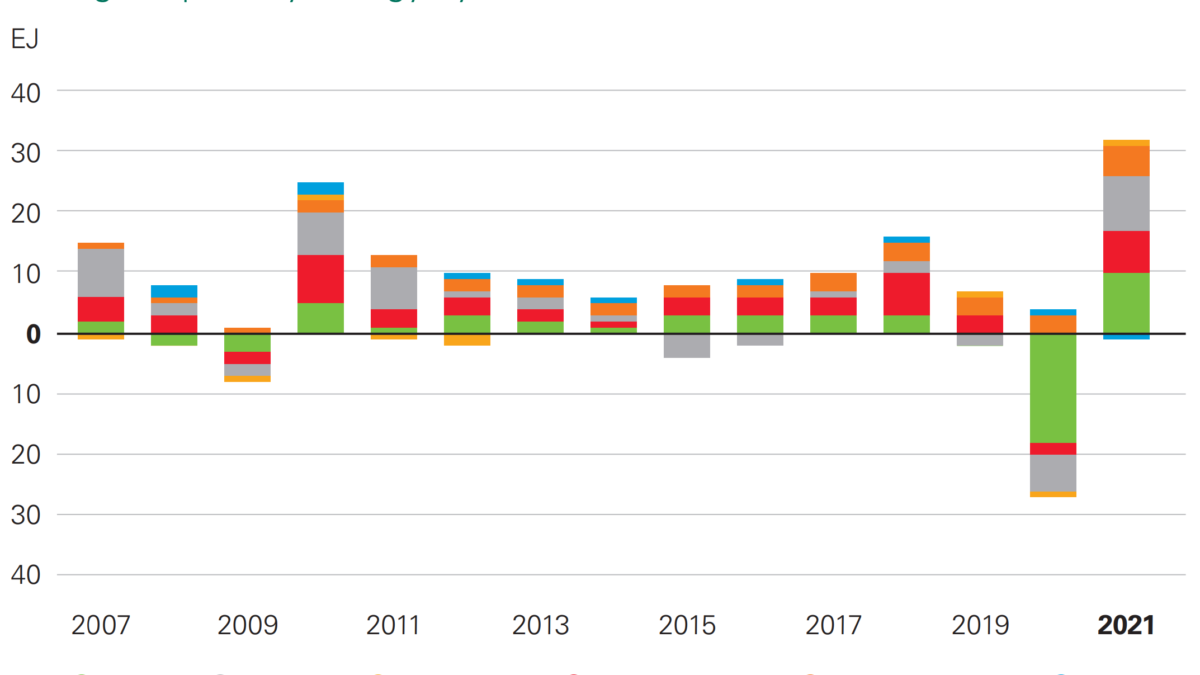

Total debt is a whopping $169 trillion, up from $97 trillion on the eve of the Great Recession, according to the McKinsey Global Institute.

While previous debt crises involved U.S. households and, later, profligate European governments such as Greece, this time the concern centers on companies in emerging markets that borrowed heavily in dollars and euros.

In Turkey, for example, companies and banks borrowed in recent years to finance bridges, hospitals, power plants and even a mammoth port development for cruise ships.

Foreign investors, particularly European banks, lent freely in search of the higher returns these markets offered at a time when the U.S. Federal Reserve and European Central Bank were keeping interest rates low.

“We were supposed to correct a debt bubble,” said David Rosenberg, chief economist at Gluskin Sheff, a wealth-management firm. “What we did instead was create more debt.” […]

The situation could grow even more perilous. Money is fleeing Turkey and similar markets precisely when many of the loans their companies took out in recent years are coming due. Globally, a record total of up to $10 trillion in corporate bonds must be refinanced over the next five years, according to McKinsey.

Last week, Moody’s cut its credit ratings on 20 Turkish financial institutions. The ratings agency cited “a substantial increase in the risk” that banks would struggle to finance normal operations.

The prospect of a new debt crisis is striking because the world has already seen two in the past 10 years.

Authorities in the United States and Europe took steps after the 2008 crisis to avoid a repeat episode.U.S. regulators required banks to hold significantly more emergency reserves. U.S. consumers whittled down their debts. In Europe, authorities forced overspending governments to embrace austerity programs.

Yet debt has grown furiously and is almost 2½ times the size of the global economy. [more]

Turkey’s woes could be just the start as record global debt bills come due