Project 2025 proposes eliminating aid for families and businesses rebuilding after storms – Far-right road map would end vital disaster loan program

8 August 2024 (Center for American Progress) – In the devastating aftermath of Hurricane Debby, the Southeast is tasked with the difficult work of rebuilding homes, businesses, and lives. Initial reports indicate at least six people have died from the storm.

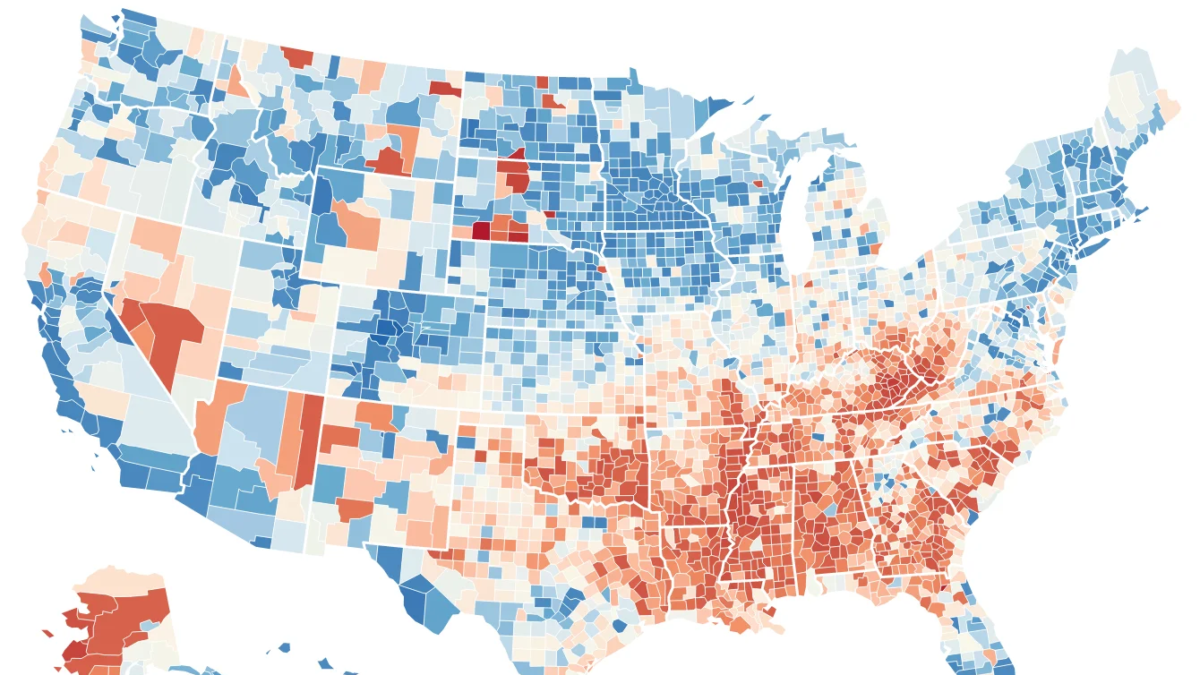

Federal agencies play a critical role in providing swift and efficient support to these families and businesses reckoning with extreme weather events and searching for a semblance of control in their lives during a period of significant instability. One such resource is the Small Business Administration’s (SBA) disaster loan program—the federal government’s largest source of disaster recovery funds for survivors, which provides low-interest direct loans to small-business owners and households who need to repair and rebuild their properties. Southern states on the Gulf Coast, such as Texas, Florida, and Louisiana, are often hit the hardest by extreme weather events; and new analysis from the Center for American Progress finds that the disaster loan program also disproportionately aids affected individuals in those states.

Even still, Project 2025—a far-right road map that would gut the country’s nearly 250-year-old system of checks and balances—proposes, on page 750, an “end to SBA direct lending,” the only instance of which is the disaster loan program. Project 2025 suggests privatization as one potential solution and claims, without evidence, that loan availability “reduces individuals’ incentives to purchase disaster-related insurance.” However, it makes no mention of the skyrocketing costs for families in these situations.

From 2021 to 2023, home insurance rates rose nearly 20 percent nationally. And in states particularly vulnerable to disasters, such as Florida and Louisiana, it was even worse. In 2023, Florida homeowners saw the highest average home insurance rates in the country, paying, on average, $10,996 a year. Meanwhile, Louisiana homeowners, who pay the country’s second-highest insurance rates, are projected to see a rate increase of as much as 23 percent from 2023 to the end of 2024. Homeowners aren’t alone; the U.S. Chamber of Commerce Small Business Index finds that 27 percent of small businesses report being one crisis away from closing.

If successful, far-right policies such as those proposed by Project 2025 would force families and businesses facing some of the hardest moments of their lives—including those in Hurricane Debby’s path —to bear even more of the costs associated with natural disasters.

Disasters are becoming more common and more costly

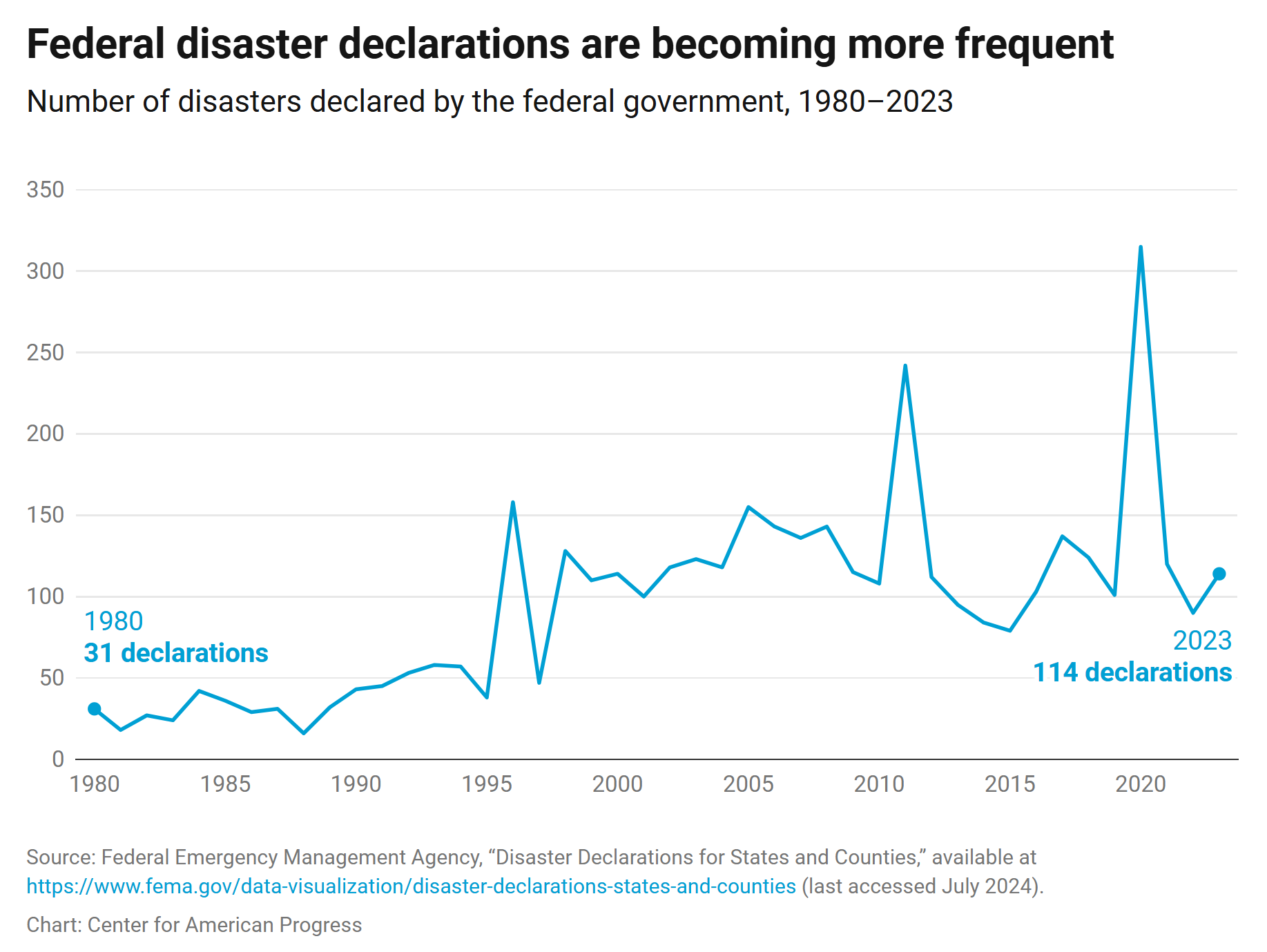

Eligibility for many disaster recovery resources and aid from the federal government, including the SBA’s disaster loan program, hinge on federal disaster declarations. Since 1980, the number of disaster declarations has steadily increased. For example, from 1980 to 1989, the federal government declared 286 disasters, whereas in the past 10 years—from 2014 to 2023—that number more than quadrupled to 1,267, an increase of 443 percent. (see Figure 1) Relatedly, in its section on the Federal Emergency Management Agency (FEMA), Project 2025 proposes the agency increase the threshold for disaster declarations, thereby making it more difficult for states and localities—and, by extension, the families and businesses that call them home—to qualify for federal aid after disaster strikes.

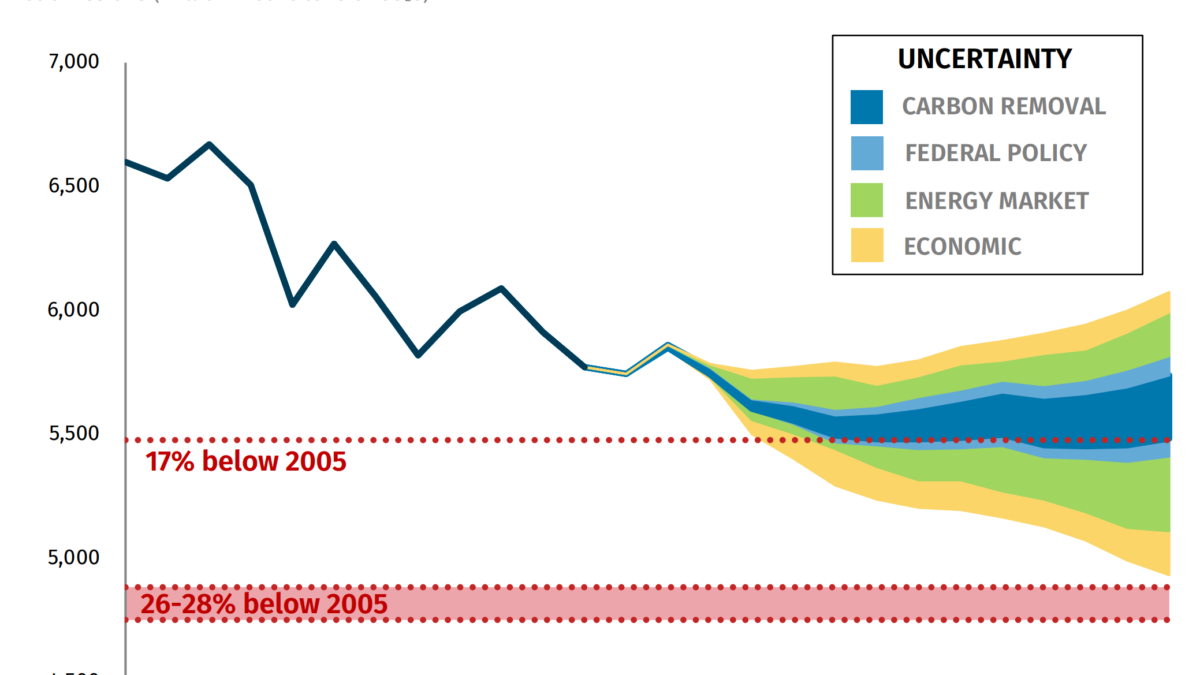

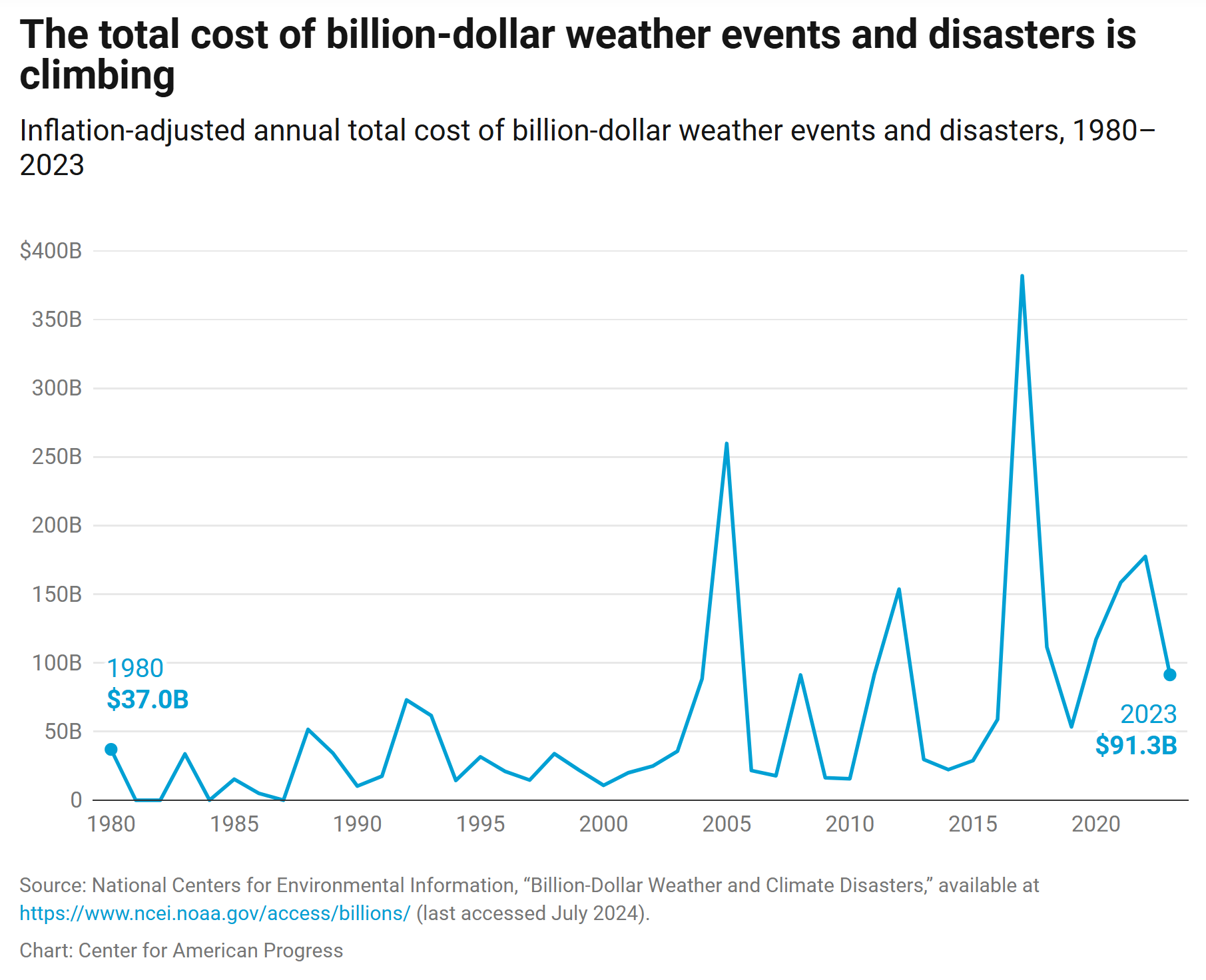

The SBA’s disaster loan program is an increasingly relevant resource as climate change makes extreme weather events not only more common but also more intense and more costly. The National Centers for Environmental Information estimates that since 1980, there have been 391 confirmed extreme weather and disaster events where losses reached at least $1 billion. (see Figure 2) Combined, these storms cost nearly $2.8 trillion when adjusted for inflation and accounted for more than 16,000 deaths. Since 1980, there have been an average of 8.7 billion-dollar storms each year, but in the past five years, that average has more than doubled to 20.4. And a new record was set in 2023, with 28 storms reaching the billion-dollar mark.

Recovering families in Gulf Coast states would be hurt most by Project 2025’s proposed elimination of disaster loans

As of July 31, 2024, data from the SBA show that since 2017, 341,569 disaster loans—totaling more than $28 billion, adjusted for inflation—have been disbursed to affected applicants. (see Table 1) The years 2018 and 2020 marked high and low points, respectively, for the program’s approved loans, with the average loan size during this period being $62,195—more than a full year’s earnings for the median full-time worker in 2023. According to Project 2025’s own analysis, 90 percent of this disaster aid serves individuals such as homeowners, as opposed to small businesses. So, while the program is a crucial resource for helping local economies bounce back, the loans play an even more critical role in helping individuals and families begin the long road to recovery. [more]

Project 2025 Proposes Eliminating Aid for Families and Businesses Rebuilding After Storms