Home insurers cut natural disasters from policies as climate risks grow – “The same risks that are making insurance more important are making it harder to get”

By Jacob Bogage

3 September 2023

(The Washington Post) – In the aftermath of extreme weather events, major insurers are increasingly no longer offering coverage that homeowners in areas vulnerable to those disasters need most.

At least five large U.S. property insurers — including Allstate, American Family, Nationwide, Erie Insurance Group and Berkshire Hathaway — have told regulators that extreme weather patterns caused by climate change have led them to stop writing coverages in some regions, exclude protections from various weather events and raise monthly premiums and deductibles.

Major insurers say they will cut out damage caused by hurricanes, wind and hail from policies underwriting property along coastlines and in wildfire country, according to a voluntary survey conducted by the National Association of Insurance Commissioners, a group of state officials who regulate rates and policy forms.

Insurance providers are also more willing to drop existing policies in some locales as they become more vulnerable to natural disasters. Most home insurance coverages are annual terms, so providers are not bound to them for more than one year.

That means individuals and families in places once considered safe from natural catastrophes could lose crucial insurance protections while their natural disaster exposure expands or intensifies as global temperatures rise.

“The same risks that are making insurance more important are making it harder to get,” Carolyn Kousky, associate vice president at the Environmental Defense Fund and nonresident scholar at the Insurance Information Institute, told The Washington Post.

The companies mentioned those policy changes as part of previously unreported responses to the regulatory group’s survey. The survey was distributed in 2022 by 15 states and received responses — some sent as recently as last month — from companies covering 80 percent of the U.S. insurance market.

Allstate said its climate risk mitigation strategy would include “limiting new [auto and property] business … in areas most exposed to hurricanes” and “implementing tropical cyclone and/or wind/hail deductibles or exclusions where appropriate.”

Nationwide has already pulled back in certain areas. The company said that in 2020, it “reduced exposure levels in some of the highest hazard wildland urban interface areas in California.”

In its response to the regulators’ survey, Nationwide said it no longer underwrites coverage for “properties within a certain distance to the coastline” because of hurricane potential.

Other changes will come. “More targeted hurricane risk mitigation actions are being finalized and will start by year-end 2023,” Nationwide told regulators.

Berkshire Hathaway, which also offers reinsurance — insurance policies for insurance providers — wrote that increased climate disasters mean “it is possible that policy terms and conditions could be updated or revised to reflect changes in such risk.”

U.S. homeowners have faced unprecedented disasters in recent weeks that have underscored the new challenges facing insurance markets.

Hurricane Idalia brought severe flooding to Georgia and the Carolinas, and tore through parts of Florida that had never experienced direct hits from a major storm. Tropical Storm Hilary caused $600 million in damage on the West Coast, according to Karen Clark & Co., a leading catastrophe modeling firm. The fires on the Hawaiian island of Maui, whose cause is still under investigation, led to $3.2 billion in property damage, the firm said.

Those catastrophes, insurance industry insiders said, show just how quickly claims costs are escalating in the face of climate change.

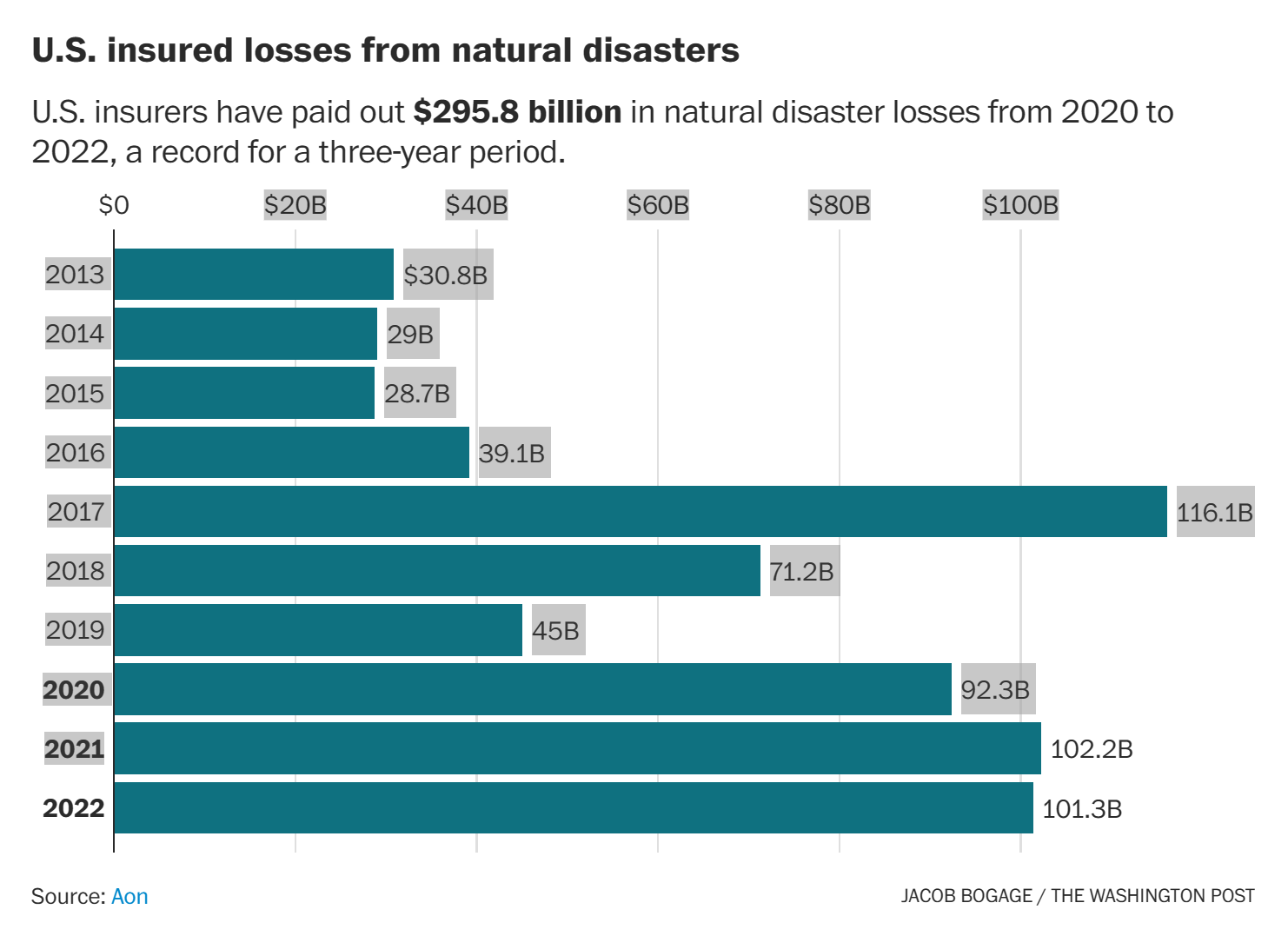

U.S. insurers have disbursed $295.8 billion in natural disaster claims over the past three years, according to international risk management firm Aon. That’s a record for a three-year period, according to the American Property Casualty Insurance Association.

Natural catastrophes in the first six months of 2023 in the United States caused $40 billion in insured losses, the third costliest first-half on record, Aon found.

“There’s no place to hide from these severe natural disasters,” said David Sampson, president of the American Property Casualty Insurance Association. “They’re happening all over the country and so insurers are having to relook at their risk concentration.” […]

The taxpayer-backed Citizens Property Insurance in Florida was the state’s second-largest insurer in 2021 in terms of policies written, according to the Insurance Information Institute. Fourteen insurance firms have either left Florida as of April or have policy portfolios that are failing. Farmer’s, the fifth-largest homeowners’ insurance provider in the United States, said in July that it would not renew nearly a third of its policies in the Sunshine State. A state-backed policy in California, where State Farm and Allstate have withdrawn or significantly cut back on new policies, covers 3 percent of residents.

But even state-backed policies must face climate risks.

“When you see the insurance companies pulling out en masse because the cost of rebuilding homes in Florida is bankrupting them,” said Ben Jealous, executive director of the Sierra Club, “it’s either hubris or folly to think the state wouldn’t be bankrupted stepping in to help.” [more]

Home insurers cut natural disasters from policies as climate risks grow