Global rice shortage in 2023 is set to be the biggest in 20 years – “At the global level, the most evident impact of the global rice deficit has been, and still is, decade-high rice prices”

By Lee Ying Shan

18 April 2023

(CNBC) – From China to the U.S. to the European Union, rice production is falling and driving up prices for more than 3.5 billion people across the globe, particularly in Asia-Pacific – which consumes 90% of the world’s rice.

The global rice market is set to log its largest shortfall in two decades in 2023, according to Fitch Solutions.

And a deficit of this magnitude for one of the world’s most cultivated grains will hurt major importers, analysts told CNBC.

“At the global level, the most evident impact of the global rice deficit has been, and still is, decade-high rice prices,” Fitch Solutions’ commodities analyst Charles Hart said.

Rice prices are expected to remain notched around current highs until 2024, stated a report by Fitch Solutions Country Risk & Industry Research dated 4 April 2023.

China is the largest rice and wheat producer in the world and is currently experiencing the highest level of drought in its rice growing regions in over two decades.

Kelly Goughary, Senior Research Analyst, Gro Intelligence

The price of rice averaged $17.30 per cwt through 2023 year-to-date and will only ease to $14.50 per cwt in 2024, according to the report. Cwt is a unit of measurement for certain commodities such as rice.

“Given that rice is the staple food commodity across multiple markets in Asia, prices are a major determinant of food price inflation and food security, particularly for the poorest households,” Hart said.

The global shortfall for 2022/2023 would come in at 8.7 million tonnes, the report forecast.

That would mark the largest global rice deficit since 2003/2004, when the global rice markets generated a deficit of 18.6 million tonnes, said Hart.

Strained rice supplies

There’s a short supply of rice as a result of the ongoing war in Ukraine, as well as bad weather in rice-producing economies like China and Pakistan.

In the second half of last year, swaths of farmland in the world’s largest rice producer China were plagued by heavy summer monsoon rains and floods.

The accumulated rainfall in the country’s Guangxi and Guangdong province, China’s major hubs of rice production, was the second highest in at least 20 years, according to agriculture analytics company Gro Intelligence.

Similarly, Pakistan — which represents 7.6% of global rice trade — saw annual production plunge 31% year-on-year due to severe flooding last year, said the U.S. Department of Agriculture (USDA), labeling the impact as “even worse than initially expected.”

The shortfall is partly due to result of “an annual deterioration in the Mainland Chinese harvest caused by intense heat and drought as well as the impact of severe flooding in Pakistan,” Hart pointed out.

Rice is a vulnerable crop and has the highest probability of simultaneous crop loss during an El Niño event, according to a scientific study.

In addition to tighter supply challenges, rice became an increasingly attractive alternative following the surge in price of other major grains since Russia’s invasion of Ukraine in February 2022, Hart added. The resulting rice substitution has driven up demand.

Whose rice bowls will be affected?

Lower year-on-year rice production in other countries like the U.S. and EU have also contributed to the deficit, said Oscar Tjakra, senior analyst at global food and agriculture bank Rabobank.

“The global rice production deficit situation will increase the cost of importing rice for major rice importers such as Indonesia, Philippines, Malaysia, and African countries in 2023,” said Tjakra.

Many countries will also be forced to draw down their domestic stockpiles, said Kelly Goughary, senior research analyst at Gro Intelligence. She said countries most affected by the deficit would be those already suffering from high domestic food price inflation such as Pakistan, Turkey, Syria, and some African countries.

“The global rice export market, which is typically tighter than that of the other major grains … has been affected by India’s export restriction,” said Fitch Solutions’ Hart.

India banned exports of broken rice in September, a move Hart said has been a “major price driver” for rice. [more]

Global rice shortage is set to be the biggest in 20 years

Forecasting global crop yields based on El Niño Southern Oscillation early signals

ABSTRACT: The El-Niño Southern Oscillation (ENSO), one of the most well-known climate modes, can lead to large-scale climate variability and subsequent crop loss, posing a severe risk to global food security.

Objective

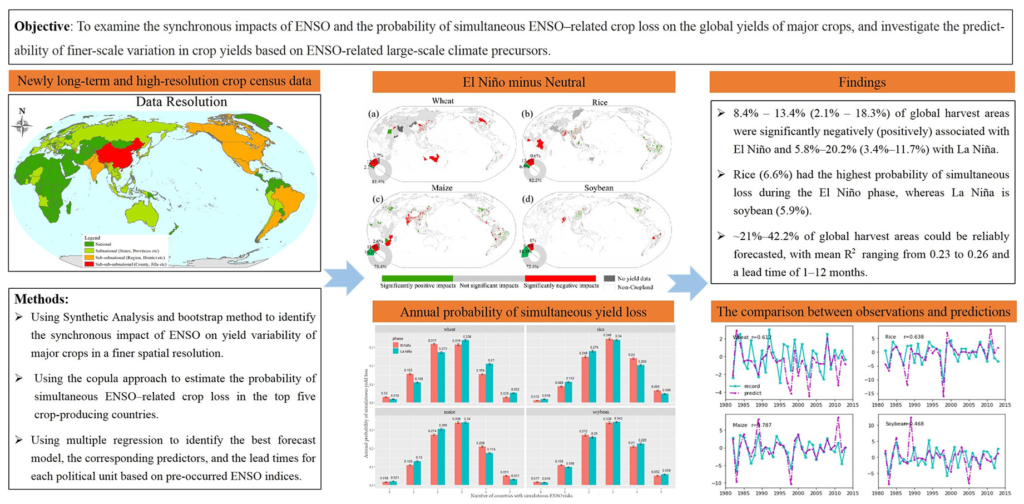

The study’s main goal was to examine the synchronous impacts of ENSO and the probability of simultaneous ENSO–related crop loss on the global yields of major crops and investigate the predictability of finer-scale variation in crop yields based on ENSO-related large-scale climate precursors.

Methods

Here, using updated crop census data for ∼12,000 political units, the study first investigated the synchronous impact of ENSO on yield variability of major crops (i.e., maize, rice, wheat, and soybean) using Synthetic Analysis and bootstrap method, and then estimated the probability of simultaneous crop loss in the top five crop-producing countries by copula approach. Finally, multiple regression was developed to identify the best forecast model, the corresponding ENSO indices, and the lead time for each political unit based on pre-occurred ENSO indices.

Results and Conclusions

The results show that 12.8% (2.1%), 13.4% (6.4%), 11.8% (10.2%), and 8.4% (18.3%) of wheat, rice, maize, and soybean harvest areas were significantly negatively (positively) associated with El Niño, respectively; and 7% (11.7%), 20.2% (3.4%), 5.8% (5.6%), and 14% (6.4%) with La Niña. El Niño reduced global-mean crop yield by 1.32%, 1.33%, and 0.37% for wheat, rice, and maize, respectively, but increased it for soybean by 1.9%. La Niña reduced the global mean yield for rice (2.1%), maize (1.5%), and soybean (1.3%) but increased it for wheat (1.0%). Rice (6.6%) had the highest probability of simultaneous loss during the El Niño phase, whereas La Niña is soybean (5.9%). Based on the early ENSO signals, crop yield could be reliably forecasted for ∼32.05%, ∼42.2%, ∼21%, and ∼ 26.37% of global harvest areas, with R2 being 0.24, 0.26, 0.24, and 0.23 and a lead time of 1–12 months, for wheat, rice, maize, and soybean, respectively. The results suggest that although the reliable yield prediction based on ENSO indexes alone can be developed in a limited proportion of harvest areas, it is skillful in the ENSO-sensitive regions.

Significance

The findings improved the understanding of ENSO-induced crop yield variability and developed novel approaches to forecast global crop yields based on early ENSO signals.

Forecasting global crop yields based on El Nino Southern Oscillation early signals