Lake Powell hits historic low, raising hydropower concerns – “We clearly weren’t sufficiently prepared for the need to move this quickly”

By Sam Metz and Felicia Fonseca

16 March 2022

SALT LAKE CITY (AP) – A massive reservoir known as a boating mecca dipped below a critical threshold on Tuesday raising new concerns about a source of power that millions of people in the U.S. West rely on for electricity.

Lake Powell’s fall to below 3,525 feet (1,075 meters) puts it at its lowest level since the lake filled after the federal government dammed the Colorado River at Glen Canyon more than a half century ago — a record marking yet another sobering realization of the impacts of climate change and megadrought.

It comes as hotter temperatures and less precipitation leave a smaller amount flowing through the over-tapped Colorado River. Though water scarcity is hardly new in the region, hydropower concerns at Glen Canyon Dam in Arizona reflect that a future western states assumed was years away is approaching — and fast.

“We clearly weren’t sufficiently prepared for the need to move this quickly,” said John Fleck, director of the University of New Mexico’s Water Resources Program.

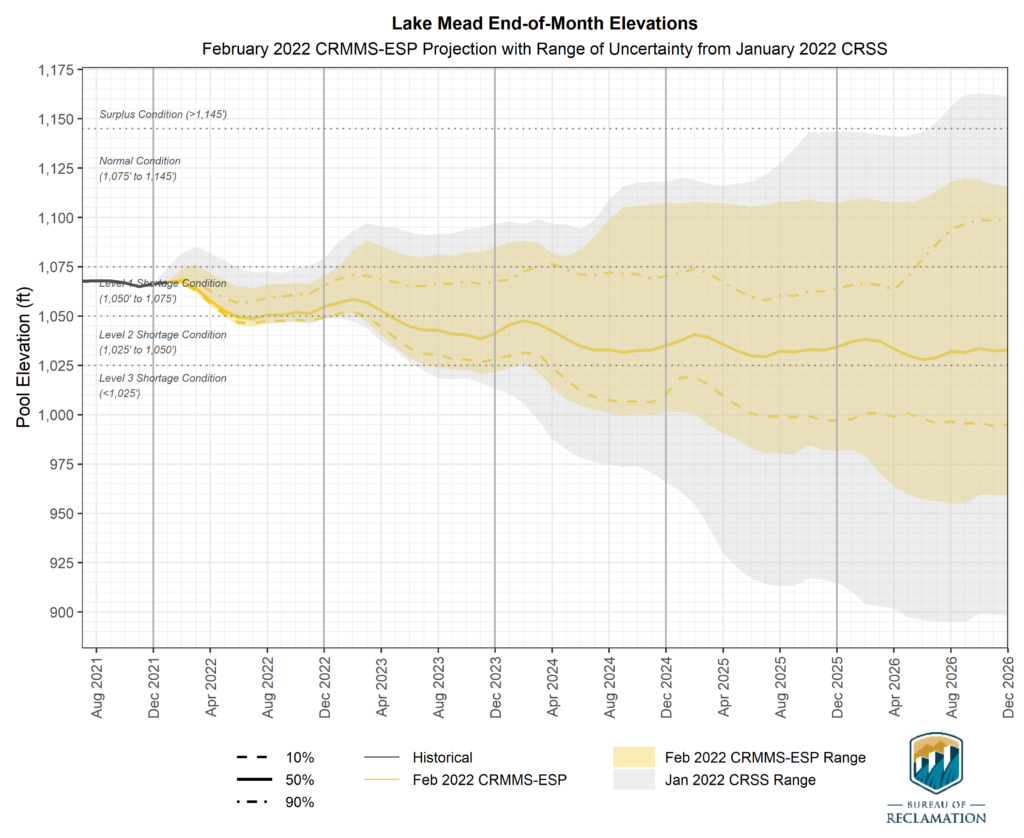

Federal officials are confident water levels will rise in the coming months once snow melts in the Rockies. But they warn that more may need to be done to ensure Glen Canyon Dam can keep producing hydropower in the years ahead.

“Spring runoff will resolve the deficit in the short term,” said Wayne Pullan, regional director for the U.S. Bureau of Reclamation, which manages water and power in more than a dozen states. “However, our work is not done.”

Though both Lake Powell and its downstream counterpart, Lake Mead, are dropping faster than expected, much of the region’s focus has been on how to deal with water scarcity in Arizona, Nevada and California, not electricity supply.

For Glen Canyon Dam, the new level is 35 feet (11 meters) above what’s considered “minimum power pool” — the level at which its turbines would stop producing hydroelectric power.

If Lake Powell drops even more, it could soon hit “deadpool” — the point at which water likely would fail to flow through the dam and onto Lake Mead. Arizona, Nevada, California, and Mexico already are taking a combination of mandatory and voluntary cuts tied to Lake Mead’s levels.

About 5 million customers in seven states — Arizona, Colorado, Nebraska, Nevada, New Mexico, Utah and Wyoming — buy power generated at Glen Canyon Dam.

The government provides it at a cheaper rate than energy sold on the wholesale market, which can be wind, solar, coal or natural gas.

For the cities, rural electric cooperatives and tribes that rely on its hydropower, less water flowing through Glen Canyon Dam can therefore increase total energy costs. Customers bear the brunt.

The situation worries the Navajo Tribal Utility Authority, one of the 50 tribal suppliers that rely on the dam for hydropower. It plans to spend $4.5 million on an alternative energy supply this year.

“It’s a very sensitive issue for all of us right now,” said Walter Haase, the tribal utility’s general manager.

Bureau of Reclamation officials last summer took an unprecedented step and diverted water from reservoirs in Wyoming, New Mexico, Utah and Colorado in what they called “emergency releases” to replenish Lake Powell. In January, the agency also held back water scheduled to be released through the dam to prevent it from dipping even lower.

Anxieties stretch beyond hydropower. Last summer, tourism and boating were hobbled by falling lake levels. The Glen Canyon National Recreation Area is taking advantage of the low levels at Lake Powell to extend boat ramps. Most are now closed or come with warnings to launch at your own risk. […]

The record low also comes after a tough year for hydropower. Last year, as U.S. officials worked to expand renewable energy, drought in the West drove a decline in hydropower generation, making it harder for officials to meet demand. Hydropower accounts for more than one-third of the nation’s utility-scale renewable energy.

Nick Williams, the bureau’s Upper Colorado Basin power manager, said many variables, including precipitation and heat, will determine the extent to which Lake Powell rebounds in the coming months.

Regardless, hydrology modeling suggests there’s roughly a 1 in 4 chance it won’t be able to produce power by 2024. [more]