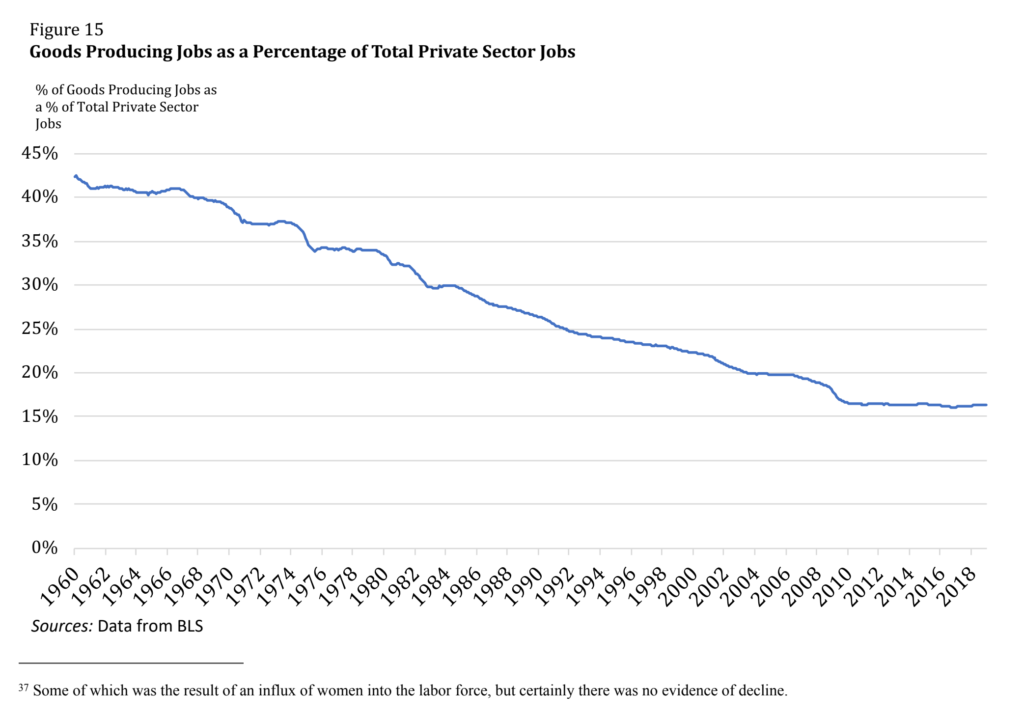

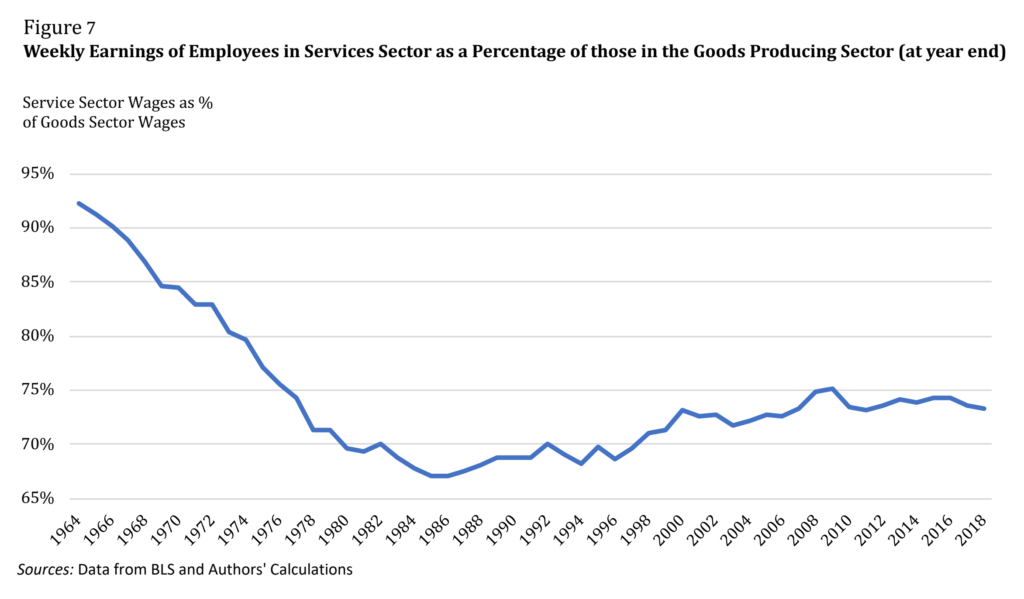

Quality of U.S. jobs declining drastically – “The long-term loss of good-paying manufacturing jobs over the past thirty years has produced troubling ripple effects for many Americans”

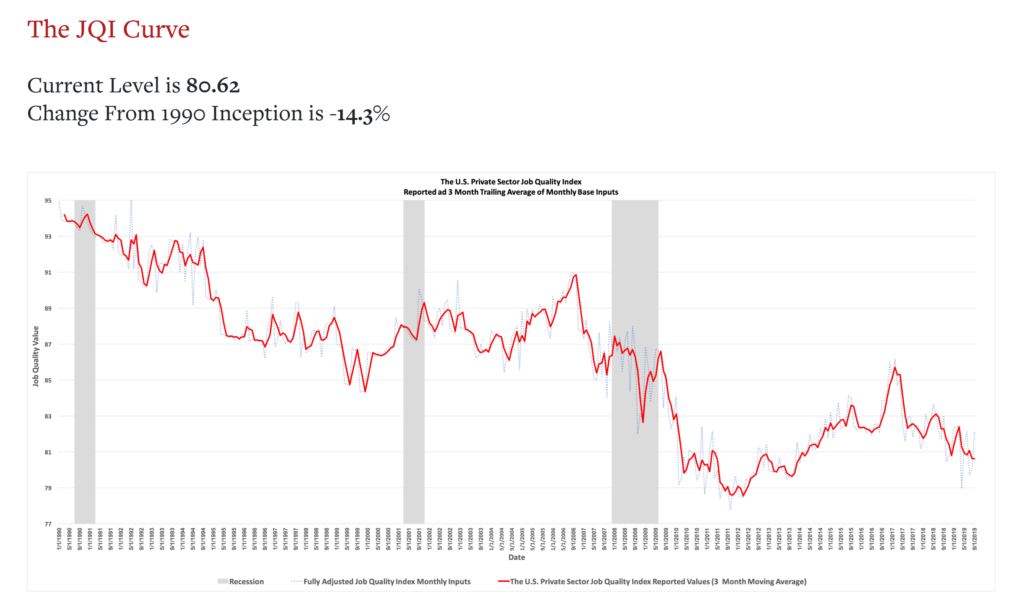

WASHINGTON, 14 November 2019 (CPA) – The Coalition for a Prosperous America (CPA) today announced the launch of a comprehensive new economic indicator, the US Private Sector Job Quality Index (JQI). CPA has partnered with Cornell University, the University of Missouri, and the Global Institute for Sustainable Prosperity (GISP) to unveil a new measure of America’s changing employment situation. The Index reveals that job quality in the U.S. has deteriorated substantially since 1990, and particularly since 2006.

“This powerful new index shows the changing composition of jobs being created in the United States,” said CPA Chair Dan DiMicco. “The long-term loss of good-paying manufacturing jobs over the past thirty years has produced troubling ripple effects for many Americans. CPA is proud to partner in this comprehensive effort to study America’s jobs market and develop solutions to create high quality jobs once again.”

Conceived in 2017, the JQI is the result of 18 months of cooperative work by Daniel Alpert, Jeff Ferry, Robert C. Hockett, and Amir Khaleghi. The resulting analysis offers a thorough assessment of changing indicators across the US jobs base.

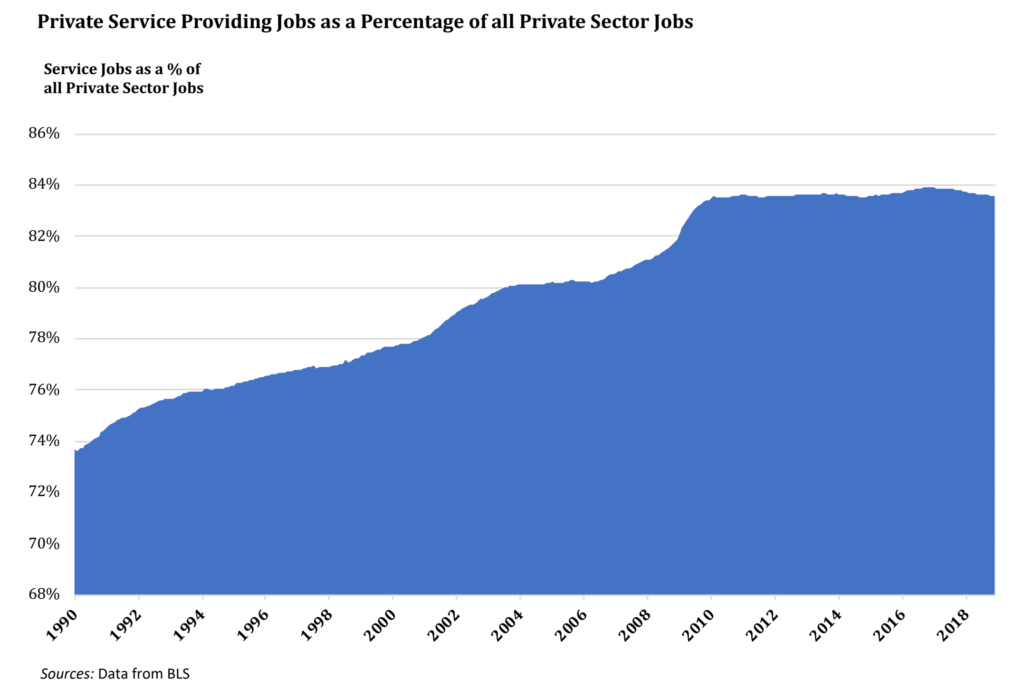

Overall, the JQI finds a shift in the United States from high-wage/high-hour jobs toward more low-wage/low-hour positions. Specifically, since 1990, the United States has been creating an overabundance of lower-quality service jobs. The JQI reveals that 63 percent of the production and non-supervisory jobs created over the past 30 years have been in low-wage and low-hour positions. That’s a marked contrast from the start of the 1990s, when almost half of these jobs (47 percent) were high-wage.

As JQI co-author and CPA Chief Economist Jeff Ferry observes, “The path of economic growth the US has opted for since around 1980, and accelerating after 2000, has produced widespread underemployment, deteriorating job quality, and slower economic growth. The new index captures this phenomenon and points the way to new, superior measures of the US employment market. This has important implications for growth strategies and labor market policies, and can also help us better understand voter decisions.”

Ferry explains that the JQI is a real-time economic indicator that uses private sector jobs data aggregated by the US Bureau of Labor Statistics (BLS) and Current Employment Statistics (CES). It will be published monthly.

Michael Stumo, CEO of the CPA, said, “We need to reverse the trend of low quality job production in the US. The JQI should serve as a game-changer for everyone who is concerned about the health of the US economy and income insecurity. This new tool will help policymakers, business leaders, and academics better understand employment trends, household demand, aggregate economic growth, demand for capital, and more. We’re excited about its potential impact on policy strategies for trade, exchange rates, and industrial policy.”

The paper is jointly produced by The Jack G. Clarke Institute of Cornell University Law School Program on the Law and Regulation of Financial Institutions and Markets (Cornell-Clarke), the Coalition for a Prosperous America (CPA), the University of Missouri – Kansas City Department of Economics (UMKC), and the Global Institute for Sustainable Prosperity (GISP). An explanatory deck and future JQI releases are available at: www.jobqualityindex.com.