“It’s a nightmare”: Zimbabwe struggles with hyperinflation – Extreme poverty surges to 34 percent as 1 million more added to poor bracket – “People should brace for worse”

By Alois Vinga

18 October 2019

(New Zimbabwe) – Extreme poverty in Zimbabwe has risen to 34 percent, with 1 million more citizens now added to the existing 4.7 million, World Bank (WB) said in a recent Poverty and Equity brief.

The global lender said there has been a significant growth in the country’s poverty rate over the past years owing to natural disasters, among other factors.

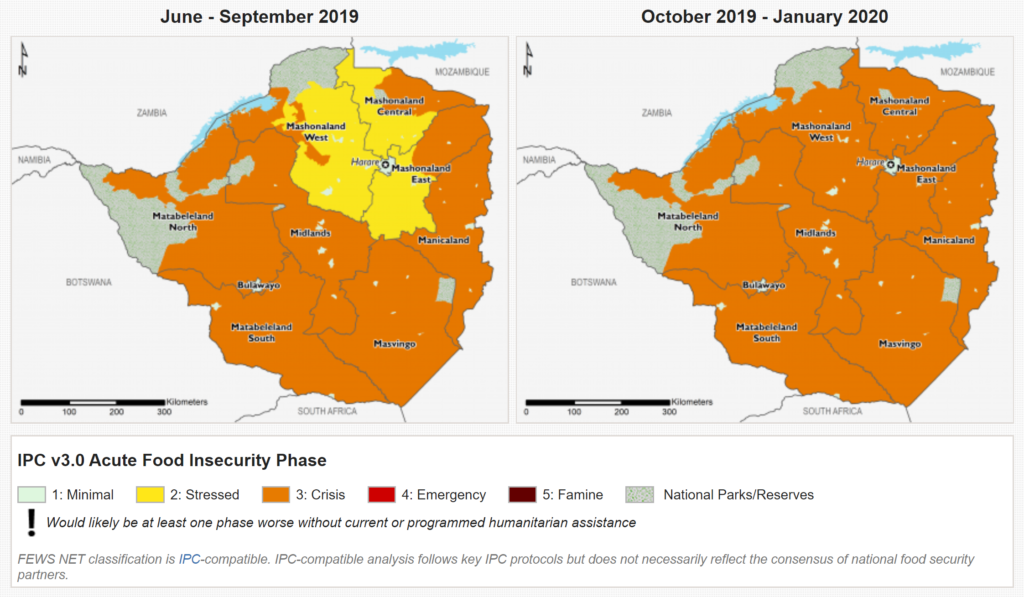

Said WB in part, “Extreme poverty is estimated to have risen from 29 percent in 2018 to 34% in 2019, an increase from 4.7 to 5.7 million people. The increase is driven by economic contraction and the sharp rise in prices of food and basic commodities. Contraction of agricultural production following an El Niño induced drought worsened the situation in rural areas.”

The update says one tenth of the rural households constituting about double the proportion of urban households are going without food for a whole day.

Natural disasters are also cited as part of the factors which have worsened the poverty situation.

“Cyclone Idai has worsened the situation in three key provinces that typically account for 30% of agricultural output.

“The drought has also led to broader impact on the electricity and water sectors, causing widespread rationing and tariff adjustments to manage costs,” says the report.

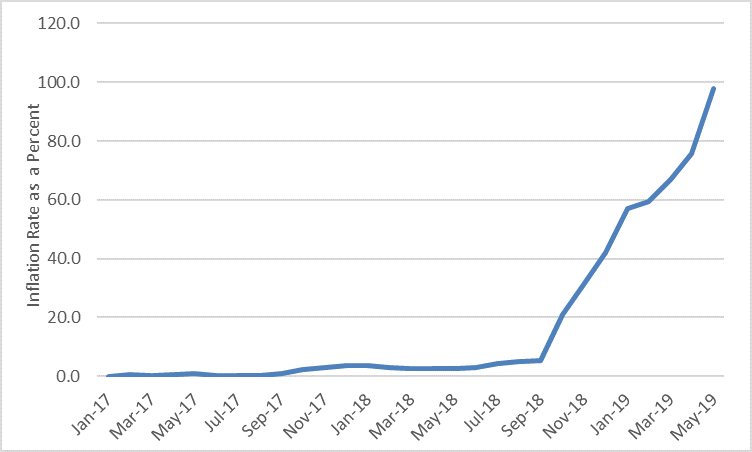

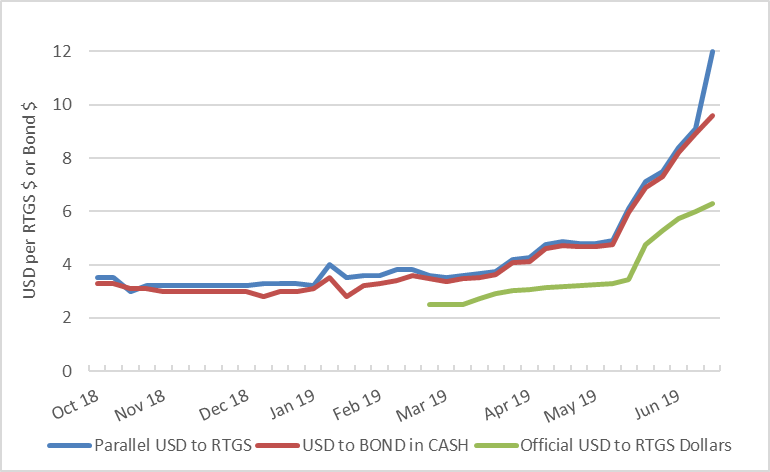

WB said inflation has been increasing since October 2018, driven by monetisation of sizable fiscal deficits of the past, price distortions, and local currency depreciation.

Anyone who thinks a solution is in sight must be very brave. Government officials don’t want to admit the real causes and don’t want to fix the real problems. People should brace for worse.

John Robertson, economist in the capital, Harare

Observed the update, “Annual inflation reached 230% in July 2019 compared to 5.4% in September 2018, with food prices rising by 319% in July 2019 while non-food inflation increased by 194%.”

Going forward, poverty is projected to remain stagnant in 2020 as positive impacts of a rebound in agricultural production will be countered by the negative effects of continued high inflation, further undermining the purchasing power of the poor.

Added the brief, “Poverty is likely to have risen further since 2017 given the sharp rises in food prices, which rose by 319% from June 2018 to June 2019. Together with poor rainfall in the 2018/2019 season. This increased the portion of food insecure people to 51%.” [more]

‘It’s a nightmare’: Zimbabwe struggles with hyperinflation

By Farai Mutsaka

10 October 2019

HARARE, Zimbabwe (AP) – When going shopping, the only thing Isaiah Macheku can budget for is shock.

Hyperinflation is changing prices so quickly in Zimbabwe that what you see displayed on a supermarket shelf might change by the time you reach the checkout.

“It is a nightmare,” Macheku said. “I can’t plan.”

Before a coup unseated the late president Robert Mugabe in late 2017, Macheku could afford all his family’s basics on his salary, which equals about $24. Now the same amount can hardly buy 4 kilograms (8.8 pounds) of beef.

He ended up buying chicken skin for his family’s supper. “I cannot afford the actual chicken,” he said. It is the closest his family gets to eating meat.

Zimbabwe now has the world’s second highest inflation after Venezuela, according to International Monetary Fund figures. The southern African nation went through this a decade ago but says there is no getting used to it, and coping has become both creative and desperate.

This time Zimbabwe’s economy has been on a downward spiral for more than a year as hopes fade that Mugabe’s successor and former deputy, President Emmerson Mnangagwa, will deliver on his promises of prosperity.

“Anyone who thinks a solution is in sight must be very brave,” said economist John Robertson in the capital, Harare. “Government officials don’t want to admit the real causes and don’t want to fix the real problems. People should brace for worse.” He said the real causes include the government spending beyond its means.

To shop, money alone is no longer enough. Calculators, mobile phones and notebooks have become necessary tools. In one sparsely attended groceries wholesaler, there were more people taking pictures of price stickers than those picking items from shelves.

“I sent the pictures to my husband. We have to decide fast before the prices go up again,” said one shopper, Marianne Hove. “He is in another supermarket sending me pictures of the prices there. We compare and decide which items to buy and from where.” […]

The local currency has been rapidly devaluing, “fostering high inflation, which reached almost 300 percent in August,” the IMF said after a review mission last month. […]

The patience of many Zimbabweans is wearing thin, considering the lengths they are going to cope.

“We cannot continue to live like this. Why did they remove Mugabe if they had no solutions?” said Harare resident Praise Sibanda.

“We are tired of 001,” she said, using the local slang for the growing trend of families resorting to a single meal a day. [more]