A decade after the recession, 40 percent of U.S. families still struggling – No improvement in first years of Trump administration

By Aimee Picchi

13 May 2019

(CBS News) – Four in 10 Americans sometimes face what economists call “material hardship,” struggling to pay for basic needs such as food and housing, according to a new study from the Urban Institute. Even middle-class families routinely struggle financially and are occasionally unable to pay their bills.

The finding is striking given the U.S. has experienced a decade of economic growth in the decade since the recession ended. The unemployment rate is at its lowest in half a century, and the stock market has enjoyed a decade-long bull run. But for many Americans, incomes haven’t kept up with the rising cost of necessities such as housing and health care, resulting in financial anxiety.

Four in 10 Americans sometimes face what economists call “material hardship,” struggling to pay for basic needs such as food and housing, according to a new study from the Urban Institute. Even middle-class families routinely struggle financially and are occasionally unable to pay their bills.

The finding is striking given the U.S. has experienced a decade of economic growth in the decade since the recession ended. The unemployment rate is at its lowest in half a century, and the stock market has enjoyed a decade-long bull run. But for many Americans, incomes haven’t kept up with the rising cost of necessities such as housing and health care, resulting in financial anxiety.

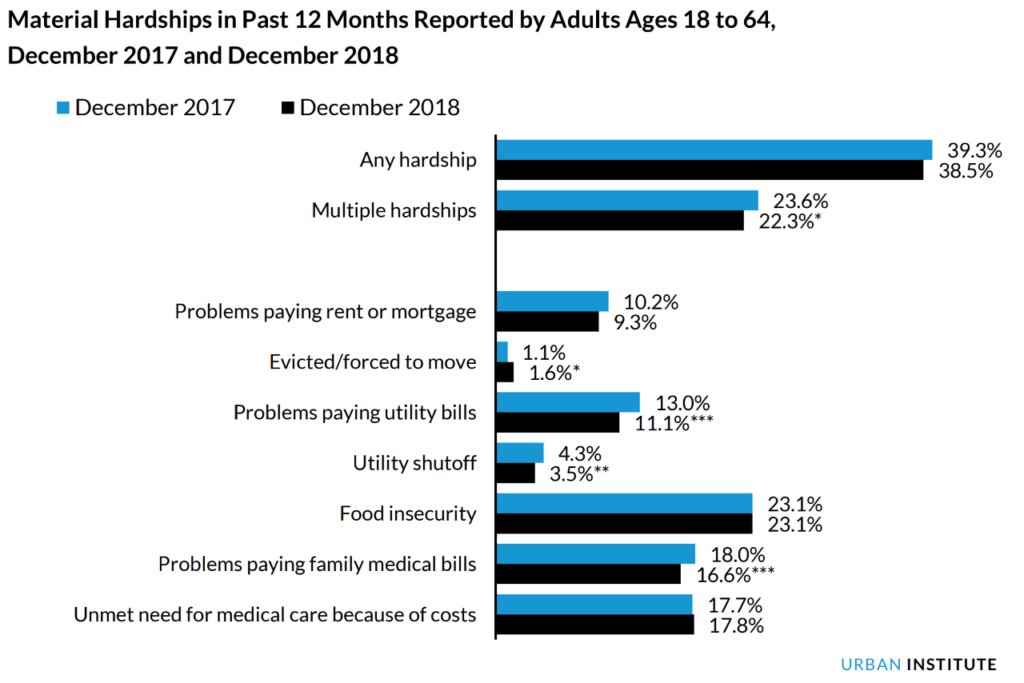

About 39 percent of Americans ages 18 to 65 experienced at least one type of material hardship last year, statistically unchanged from the 39.3 percent who suffered hardship in 2017, the nonpartisan think tank found. The study spans the first two years of the Trump administration, as well as the first year of the tax overhaul. Yet there was little progress easing the financial challenges experienced by U.S. adults last year, the Urban Institute said. [more]

A decade after the recession, 40% of U.S. families still struggling

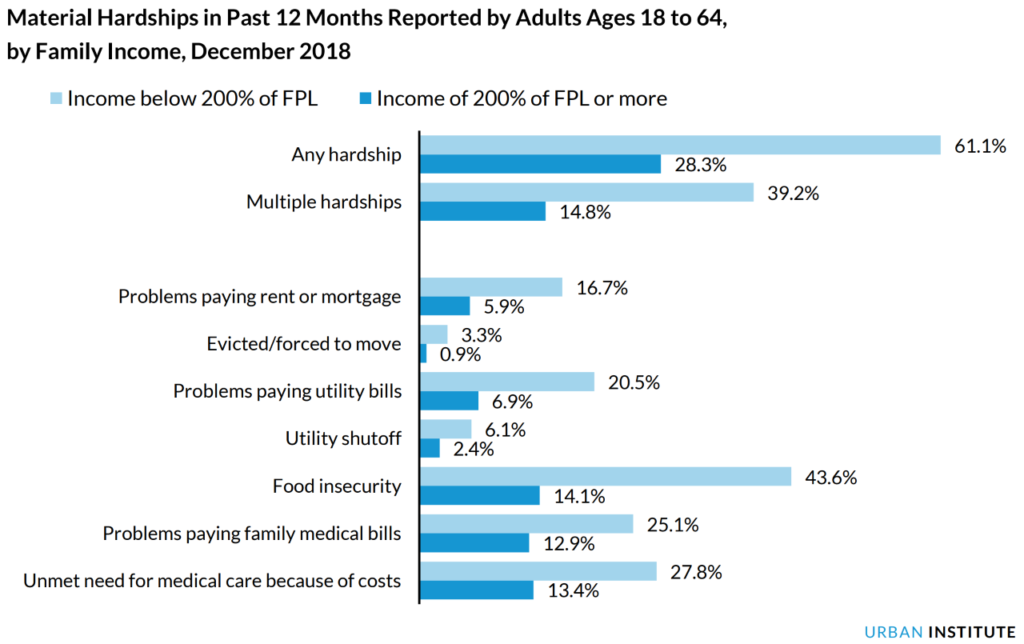

ABSTRACT: This brief uses data from the Well-Being and Basic Needs Survey to examine changes in material hardship between 2017 and 2018. We find that, despite the strong labor market during this period, there was only modest progress in families’ ability to meet basic needs. Nearly 4 in 10 nonelderly adults reported that in 2018, their families had trouble paying or were unable to pay for housing, utilities, food, or medical care at some point during the year—which was not significantly different from the share reporting these difficulties in 2017. There were small but statistically significant declines in the shares of adults reporting being unable to pay utility bills, having utilities shut off, and problems paying family medical bills, and in the share reporting more than one type of hardship. The survey highlights economic challenges beyond employment that may help explain the persistently high rates of hardship among adults in low-income families, including unexpected income losses, inadequate savings, household members with disabilities, lack of health insurance, and high housing costs relative to income. These findings underscore that, although employment is a critical determinant of families’ ability to meet basic needs, it is not the only factor, and further progress will likely depend on policies to raise and stabilize incomes, offset the cost of essential expenses, and provide a buffer against adverse financial shocks.