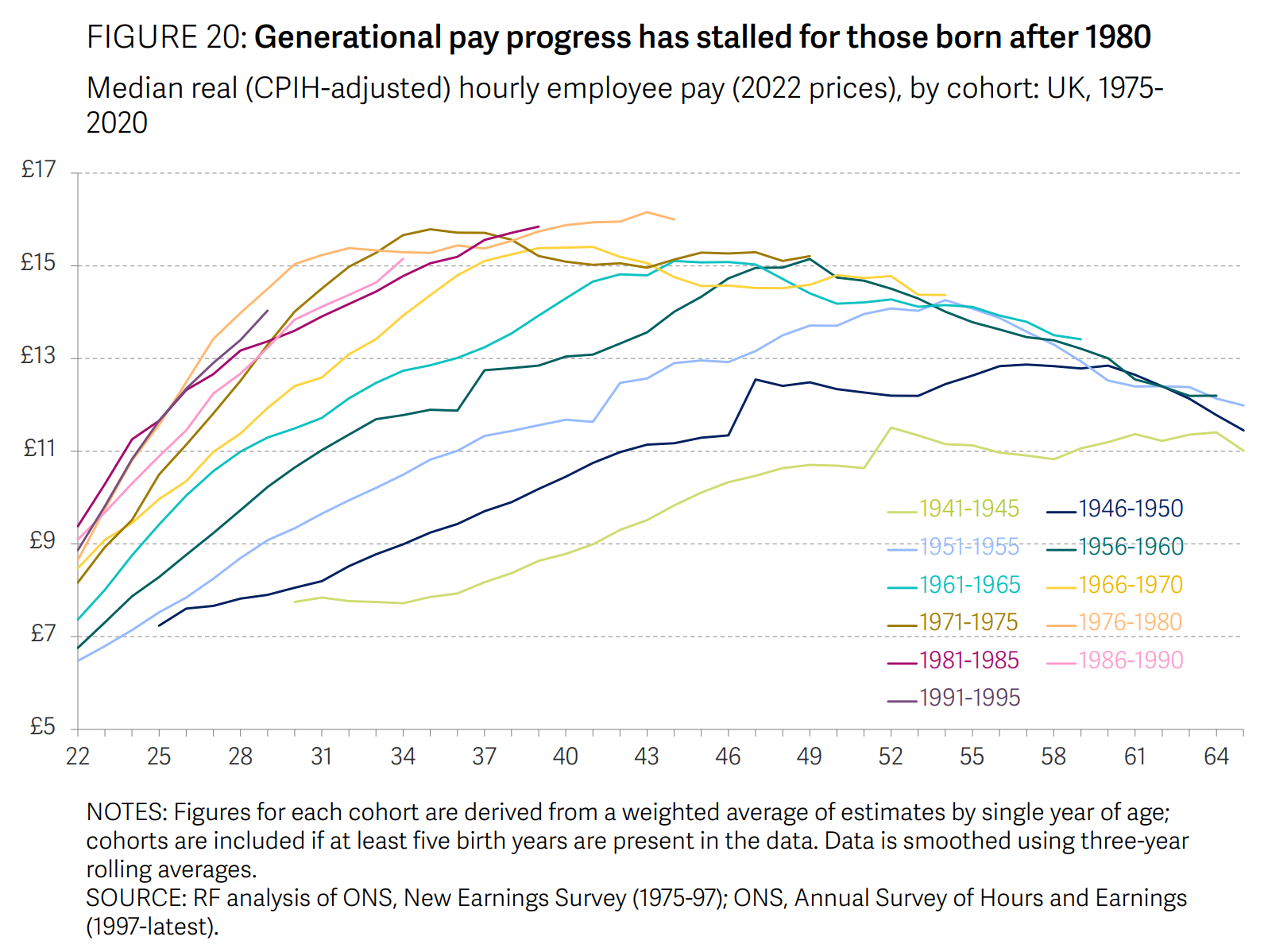

Intergenerational audit for the UK in 2022 – “Decades of low pay growth, higher housing costs, and high and rising intergenerational wealth inequality means the young entered this crisis with low levels of financial resilience”

14 November 2022 (Resolution Foundation) – Our fourth Intergenerational Audit – part of the ESRC-funded Connecting Generations partnership – provides an analysis of economic living standards across generations in Britain. In so doing, it analyses the latest data across four domains:

- Household incomes and costs;

- Jobs, skills and pay;

- Wealth and assets; and

- Housing costs and security.

In each of these domains, we assess how different people of different ages and birth cohorts have fared at different stages of their lives. Although much of our Intergenerational Centre’s work focuses on changes and differences between generations over the longer term, this year’s Audit also zeros in on shorter-term changes: analysing how the cost of living crisis has to date and will continue to be experienced by different age groups.

Overall, we find that the cost-of-living crisis is likely to have profound, but varying, impacts across different age groups and generations.

Key findings

- This year’s Audit finds that as older age groups are more likely to live in larger and less energy efficient homes, they are more exposed to rising prices of energy. They face the biggest hits to their disposable incomes, with those aged 75 and above expected to spend 3 percentage points more of their disposable income on energy bills this financial year, compared to pre-crisis levels.

- However, decades of low pay growth, higher housing costs and high and rising intergenerational wealth inequality, means the young entered this crisis with low levels of financial resilience. This means younger age groups are far less likely to have a ‘savings buffer’ to cover unexpected or higher costs – over two thirds of 20-29-year-olds had savings of less than one month’s income, compared to a fifth of 65-74-year-olds.

- The package of support measures announced will offset some of the rising costs for all age groups, but will leave those aged 65 and above £500 worse off than those aged 40-49, on average. However, those 65 and above will be least affected by other tax and benefit policy changes announced this parliament.

- High inflation has meant that the real value of take-home pay has been falling since May 2022, with the youngest employees experiencing the largest falls in real wages: in the year to August 2022 annual real earnings fell by 2.6 per cent for employees aged 18-24, compared to 1.4 per cent for employees aged 25-34, 2.1 per cent for employees aged 35-49 and 2.4 per cent for employees aged 50-64.

- Inflation has also eroded the spending power of existing wealth. Those 65 and above are expected to see the real value of their wealth fall by £24,000, between January 2020 and January 2024, after also accounting for the expected passive changes to wealth over this period. However, for younger age groups (under 40-year-olds) the passive gains, primarily from rising house prices in recent years, have outweighed the fall in the real value due to inflation.

- The middle-aged are most likely to be hit by higher mortgage payments, but those young homeowners that have managed to get on the housing ladder face the biggest risks from higher interest rates. Households headed by a 25-34-year-old face paying an additional 8 per cent of their incomes on their mortgages on average by the end of 2026. A fall in house prices is more likely to result in young homeowners going into negative equity or high-risk loan to value ratios (of greater than 90 per cent).

- The large share of young households that are prospective first-time buyers though could be set to gain. The combination of higher interest rates on savings and lower house prices could reduce the amount of years required to save enough for a deposit and a sustained house price fall will reduce the real lifetime cost for first-time buyers, which by 2024 could fall to its lowest level since 2017.