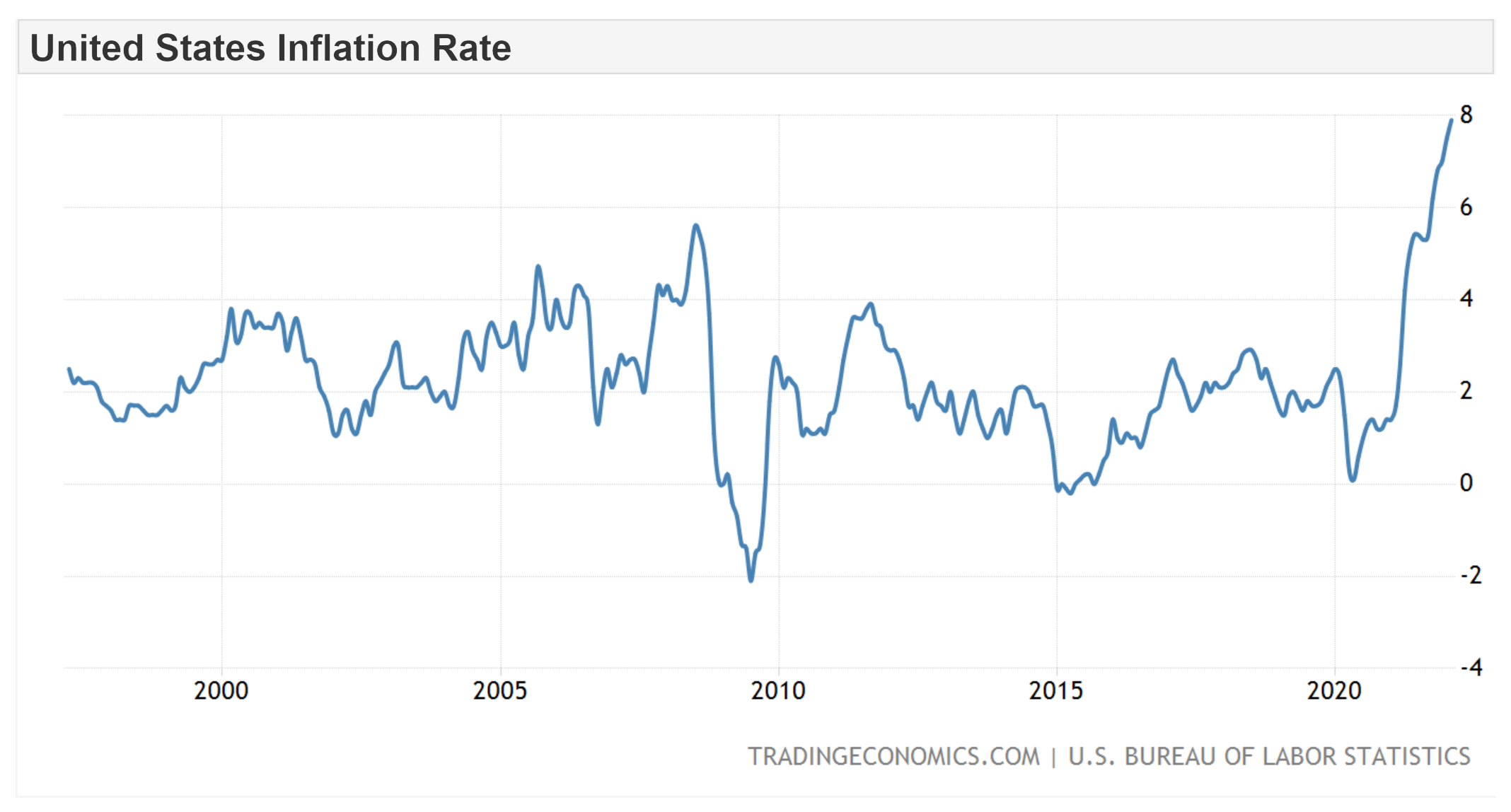

A world that’s more expensive is starting to destroy demand – “A renewed spike in gas prices would see demand destruction become more widespread”

By David R Baker, Allison Smith, and Sheela Tobben

27 March 2022

(Bloomberg) – Prices for some of the world’s most pivotal products – foods, fuels, plastics, metals – are spiking beyond what many buyers can afford. That’s forcing consumers to cut back and, if the trend grows, may tip economies already buffeted by pandemic and war back into recession. The phenomenon is happening in ways large and small. Soaring natural gas prices in China force ceramic factories burning the fuel to halve their operations. A Missouri trucking company debates suspending operations because it can’t fully recoup rising diesel costs from customers. European steel mills using electric arc furnaces scale back production as power costs soar, making the metal even more expensive.

Global food prices set a record last month, according to the United Nations, as Russia’s invasion of Ukraine disrupted shipments from the countries that, together, supply one-quarter of the world’s grain and much of its cooking oil. More-expensive food may be frustrating to the middle class, but it’s devastating to communities trying to claw their way out of poverty. For some, “demand destruction” will be a bloodless way to say “hunger.”

In the developed world, the squeeze between higher energy and food costs could force households to cut discretionary spending – evenings out, vacations, the latest iPhone or PlayStation. China’s decision to put its top steelmaking hub under Covid-19 lockdown could limit supply and push up prices for big-ticket items like home appliances and cars. Electric vehicles from Tesla Inc., Volkswagen AG and General Motors Co. may be the future of transportation, except the lithium in their batteries is almost 500% more expensive than a year ago.

“Altogether, it signals what could turn into a recession,” said Kenneth Medlock III, senior director of the Center for Energy Studies at Rice University’s Baker Institute for Public Policy.

The International Monetary Fund is poised to cut its global growth forecast because of the war, and it sees recession risks in an increasing number of countries, Managing Director Kristalina Georgieva said. The world economy is still set to expand this year, though by less than the 4.4% previously anticipated, Georgieva said in an interview with Foreign Policy magazine.

There’s little doubt that inflation’s going to stay higher for longer as a result of the war in Ukraine. A renewed spike in gas prices would see demand destruction become more widespread.

James Smith, a London-based economist for developed markets at ING

Federal Reserve Chair Jerome Powell said Russia’s invasion of Ukraine is aggravating inflation pressures by boosting prices on food, energy and other commodities “at a time of already too high inflation.” Curbing high inflation is a top priority, and the central bank is prepared to raise interest rates by a half percentage-point at its next meeting if needed, he said.

The danger is more acute in Europe, where energy bills are soaring due to a reliance on Russian supplies. Natural gas prices on the continent are six times higher than a year ago, and electricity costs almost five times more.

Those prices may fuse with the conflict raging on the European Union’s doorstep to make businesses and households averse to all kinds of spending. The U.K. downgraded its economic forecast to 3.8% from 6% as consumers face the worst squeeze on living standards in at least six decades.

“There’s little doubt that inflation’s going to stay higher for longer as a result of the war in Ukraine,” said James Smith, a London-based economist for developed markets at ING. “A renewed spike in gas prices would see demand destruction become more widespread.”

The dynamic is playing out in products as ubiquitous as oil and as specialized as lithium, a key ingredient in advanced batteries for consumer electronics and plug-in cars. Battery makers in China paying five times more for the metal than a year ago have to pass some of that cost on to car companies, potentially slowing EV sales.

“The pressure is on the automakers,” said Maria Ma, an analyst at Shanghai Metals Market. “What worries the market now is that the EV sales in the next couple months may stay flat or may not perform very well after the price adjustments.”

Fertilizer makers, who use natural gas as a raw material, started scaling back operations last year. Italy, Germany and the U.K. are exploring whether to burn more coal next winter to ease the need for gas in power generation. This would free up more of the fuel for industries, such as glassmakers and large steel mills, that can’t easily replace it.

But that still may not be enough, and there are contingency plans to limit some demand. Brick makers in the U.K. have been asked by the government to prepare for production slowdowns if the war chokes energy supplies, the industry’s lobby group said.

Higher fuel costs already are having a dramatic effect in Asia. Foshan, a city in southern Guangdong province, started rationing gas deliveries to industrial users, and half of the province’s ceramics production lines stopped running. [more]