U.S. debt to break World War 2 record by 2031 – “Even if economic conditions were more favorable than CBO currently projects, debt in 2051 will probably be much higher than it is today”

By Niv Elis

4 March 2021

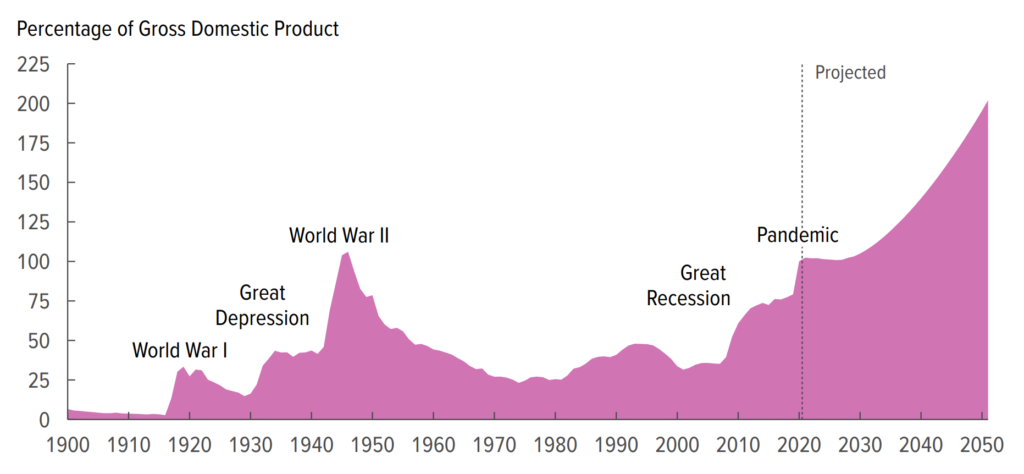

(The Hill) – The nation’s debt burden is on track to surpass its historic high point in a decade, reaching 107 percent of gross domestic product (GDP) in 2031, according to a new report from the nonpartisan Congressional Budget Office (pdf).

The debt surpassed 100 percent of GDP last year for the first time since World War II, when it peaked at 106 percent.

CBO projected that based on current law, the debt would continue to mount, surpassing 200 percent of GDP by 2051.

Economists roundly agree that deficit spending during economic emergencies is good policy, but warn that deficits should be brought under control during sunnier economic times to avoid negative consequences down the road.

“Debt that is high and rising as a percentage of GDP boosts federal and private borrowing costs, slows the growth of economic output, and increases interest payments abroad,” the report said.

“A growing debt burden could increase the risk of a fiscal crisis and higher inflation as well as undermine confidence in the U.S. dollar, making it more costly to finance public and private activity in international markets.” [more]

Debt to break WWII record by 2031

The 2021 Long-Term Budget Outlook

4 March 2021 (CBO) – Each year, the Congressional Budget Office publishes a report presenting its projections of what federal debt, deficits, spending, and revenues would be for the next 30 years if current laws governing taxes and spending generally did not change. This report is the latest in the series.

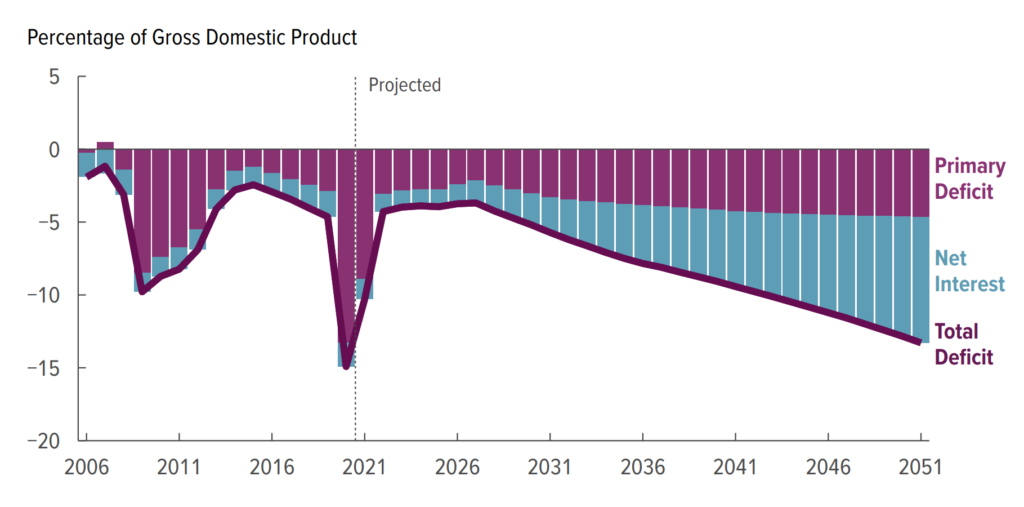

- Deficits. At an estimated 10.3 percent of gross domestic product (GDP), the deficit in 2021 would be the second largest since 1945, exceeded only by the 14.9 percent shortfall recorded last year. In CBO’s projections, deficits decline as the effects of the 2020–2021 coronavirus pandemic wane. But they remain large by historical standards and begin to increase again during the latter half of the decade. Deficits increase further in subsequent decades, from 5.7 percent of GDP in 2031 to 13.3 percent by 2051—exceeding their 50-year average of 3.3 percent of GDP in each year during that period.

- Debt. By the end of 2021, federal debt held by the public is projected to equal 102 percent of GDP. Debt would reach 107 percent of GDP (surpassing its historical high) in 2031 and would almost double to 202 percent of GDP by 2051. Debt that is high and rising as a percentage of GDP boosts federal and private borrowing costs, slows the growth of economic output, and increases interest payments abroad. A growing debt burden could increase the risk of a fiscal crisis and higher inflation as well as undermine confidence in the U.S. dollar, making it more costly to finance public and private activity in international markets.

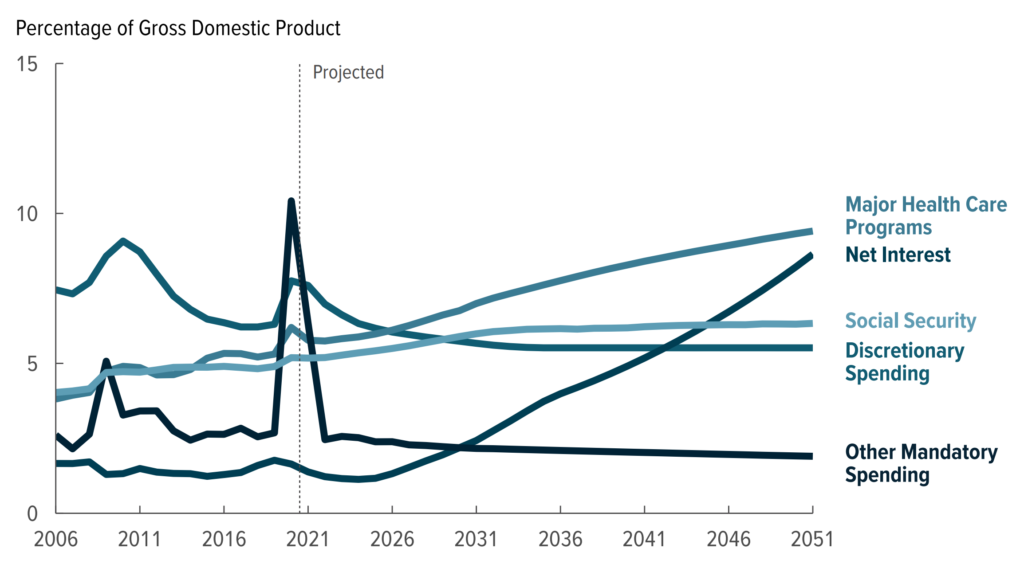

- Spending. After the spending associated with the pandemic declines in the near term, spending as a percentage of GDP rises in most years in CBO’s projections. With growing debt and rising interest rates, net spending for interest more than triples relative to the size of the economy over the last two decades of the projection period, accounting for most of the growth in total deficits. Another significant contributor to growing deficits is the increase in spending for Social Security (mainly owing to the aging of the population) and for Medicare and the other major health care programs (because of rising health care costs per person and, to a lesser degree, the aging of the population).

- Revenues. Once the effects of decreased revenues associated with the economic disruption caused by the pandemic dissipate, revenues measured as a percentage of GDP are generally projected to rise. After 2025, they increase in CBO’s projections largely because of scheduled changes in tax rules, including the expiration of nearly all the changes made to individual income taxes by the 2017 tax act. After 2031, revenues continue to rise—but not as fast as the growth in spending. Most of the long-term growth in revenues is attributable to the increasing share of income that is pushed into higher tax brackets.

Because future economic conditions are uncertain and budgetary outcomes are sensitive to those conditions, CBO analyzed how those outcomes would differ from its projections if productivity growth or interest rates were higher or lower than the agency expects. Even if economic conditions were more favorable than CBO currently projects, debt in 2051 would probably be much higher than it is today.

CBO’s projection of federal debt as a share of GDP is slightly lower in most years over the next three decades than it was in last year’s projections. In current estimates, federal debt rises from 102 percent of GDP in 2021 to 195 percent in 2050, compared with last year’s projected rise from 104 percent of GDP in 2021 to 195 percent in 2050. Projections of spending and revenues differ from last year’s projections for the next decade but are generally similar to them in the longer term. [more]