U.S. millennials and Gen X are both stressed, broke, and in debt – “Deaths of despair” on the rise with millennials

By Hillary Hoffower

10 October 2019

(Business Insider) – Finances are looking a bit bleak for some Americans.

Insider recently teamed up with Morning Consult to survey 2,096 Americans about their financial health, debt, and earnings for its new series, “The State of Our Money.” Findings largely didn’t paint a pretty picture, particularly for millennials and Gen X (672 and 566 respondents, respectively). The margin of error overall is about 2%.

For the purposes of this article, we largely focused on these two generations because they’re in their prime working years. While Gen Z and baby boomers were both surveyed, we refrained from analyzing both generations as many aren’t in the workforce (either not yet working or retired).

The majority of indebted millennials and Gen X are feeling the burden of their debt loads. Gen X is more downtrodden when it comes to their finances, while millennials think they’re doing okay — at least, compared to their peers. And both aren’t adequately preparing for retirement.

Here are some of the key themes that repeatedly popped up in the survey results.

Millennials and Gen X are equally stressed about money

Millennials are known for being financially behind thanks to the fallout of the Great Recession, high costs of living, and staggering student-loan debt — but Gen X is just as nearly just as stressed about money, especially when it comes to debt.

Of the respondents who answered, more than half of all millennials and Gen X respondents said that they were stressed “some” or “a lot” about their credit card, personal loan, or student loan debts:

- Of the 51.5% of millennials who have credit card debt, 67.4% are stressed

- Of the 54.5% of Gen X who have credit card debt, 64.3% are stressed

- Of the 24.3% of millennials who have personal loans, 62% are stressed

- Of the 24.6% of Gen X who have personal loans, 62.5% are stressed

- Of the 28.4% of millennials who have undergraduate student-loan debt, 72.2% are stressed

- Of the 15.5% of Gen X who have undergraduate student-loan debt, 62.5% are stressed

Gen X is most stressed about credit card debt, while millennials are most stressed about student-loan debt. The latter is a particular problem — it’s so stressful that nearly half of indebted respondents in both generations say taking out those loans for college wasn’t worth it. [more]

Millennials and Gen X are both stressed, broke, and in debt — but Gen X is more worried about it

Lonely, burned out, and depressed: The state of millennials’ mental health in 2019

By Hillary Hoffower and Allana Akhtar

10 October 2019

(Business Insider) – Millennials are changing the way people look at and talk about mental health.

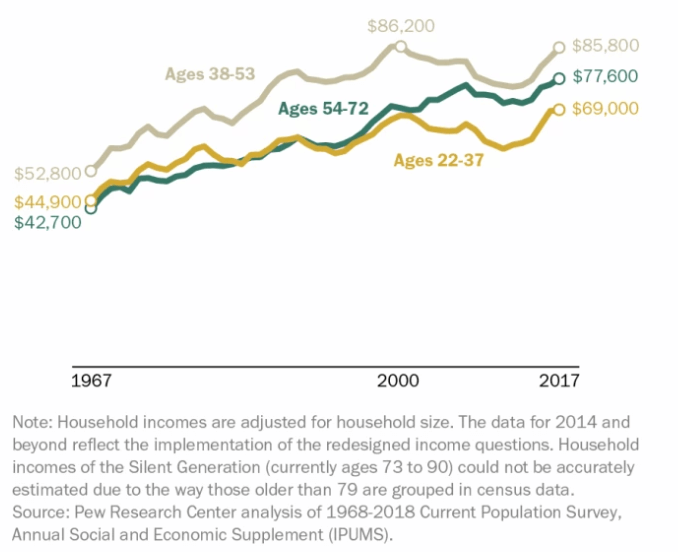

As part of World Mental Health Day, Business Insider took a look at the mental-health state of millennials (defined by the Pew Research Center as the cohort turning ages 23 to 38 in 2019). It doesn’t look pretty — depression and “deaths of despair” are both on the rise among the generation, linked to issues such as loneliness and money stress.

Millennials also feel that their jobs have an outsize role in their overall mental health. Because of longer work hours and stagnant wages, millennials suffer from higher rates of burnout than other generations. Many of them have even quit their jobs for mental-health reasons.

While some millennials can’t afford to get help, they’re more likely to go to therapy than previous generations, destigmatizing the concept in the process.

Here are 11 ways mental illness has plagued the millennial generation.

Depression is on the rise among millennials.

According to a report analyzing data from the Blue Cross Blue Shield Health Index, major depression diagnoses are rising at a faster rate for millennials and teens compared with any other age group.

Since 2013, millennials have seen a 47% increase in major-depression diagnoses. The overall rate increased from 3 to 4.4% among 18- to 34-year-olds.

The most prominent symptom of major depression is “a severe and persistent low mood, profound sadness, or a sense of despair,” according to Harvard Medical School.

These findings were underscored by an additional Blue Cross Blue Shield report on millennial health. It analyzed the data of 55 million commercially insured American millennials, defined as people ages 21 to 36 in 2017. It found that major depression had the highest prevalence rate, or the likelihood of a person having a disease, among health conditions affecting millennials.

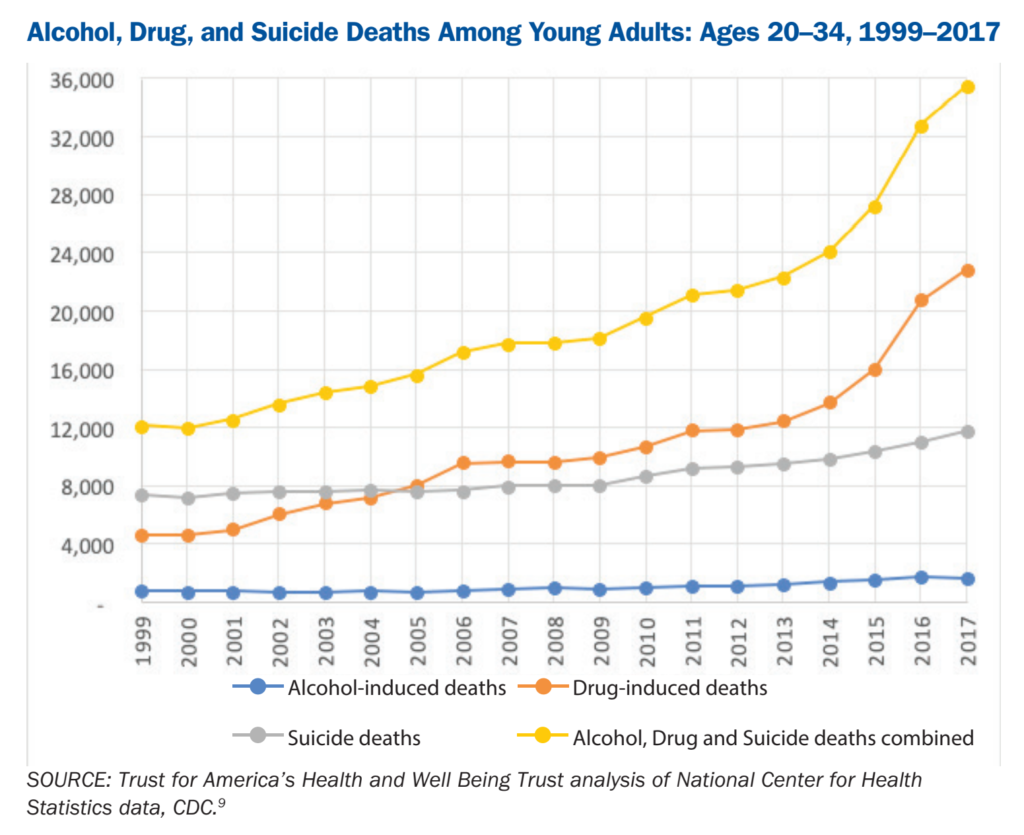

“Deaths of despair” are also on the rise.

More millennials are also dying “deaths of despair,” or deaths related to drugs, alcohol, and suicide, Jamie Ducharme reported for TIME in June, citing a report by the public-health groups Trust for America’s Health and Well Being Trust.

While these deaths have increased across all ages in the past 10 years, they’ve increased the most among younger Americans, Ducharme said. They accounted for the deaths of about 36,000 American millennials in 2017 alone, according to the report. Drug overdoses were the most common cause of death. [more]

Lonely, burned out, and depressed: The state of millennials’ mental health in 2019