U.S. families go deep into debt to stay in the middle class – “What we may have to prepare for in the future is that buying a home may become a luxury”

By AnnaMaria Andriotis, Ken Brown, and Shane Shifflett

2 August 2019

(The Wall Street Journal) – The American middle class is falling deeper into debt to maintain a middle-class lifestyle.

Cars, college, houses and medical care have become steadily more costly, but incomes have been largely stagnant for two decades, despite a recent uptick. Filling the gap between earning and spending is an explosion of finance into nearly every corner of the consumer economy.

Consumer debt, not counting mortgages, has climbed to $4 trillion—higher than it has ever been even after adjusting for inflation. Mortgage debt slid after the financial crisis a decade ago but is rebounding.

Student debt totaled about $1.5 trillion last year, exceeding all other forms of consumer debt except mortgages.

Auto debt is up nearly 40% adjusting for inflation in the last decade to $1.3 trillion. And the average loan for new cars is up an inflation-adjusted 11% in a decade, to $32,187, according to a Wall Street Journal analysis of data from credit-reporting firm Experian.

Unsecured personal loans are back in vogue, the result of competition between technology-savvy lenders and big banks for borrowers and loan volume.

The debt surge is partly by design, a byproduct of low borrowing costs the Federal Reserve engineered after the financial crisis to get the economy moving. It has reshaped both borrowers and lenders. Consumers increasingly need it, companies increasingly can’t sell their goods without it, and the economy, which counts on consumer spending for more than two-thirds of GDP, would struggle without a plentiful supply of credit. […]

The U.S. economy roughly doubled in size from 1989 through 2016, data from the U.S. Bureau of Economic Analysis show. Counted together, everyone got wealthier. But gains in assets owned were heavily skewed toward the highest earners, according to a Journal analysis of the Fed’s Survey of Consumer Finances.

The median net worth of households in the middle 20% of income rose 4% in inflation-adjusted terms to $81,900 between 1989 and 2016, the latest available data. For households in the top 20%, median net worth more than doubled to $811,860. And for the top 1%, the increase was 178% to $11,206,000.

Put differently, the value of assets for all U.S. households increased from 1989 through 2016 by an inflation-adjusted $58 trillion. A third of the gain—$19 trillion—went to the wealthiest 1%, according to a Journal analysis of Fed data. […]

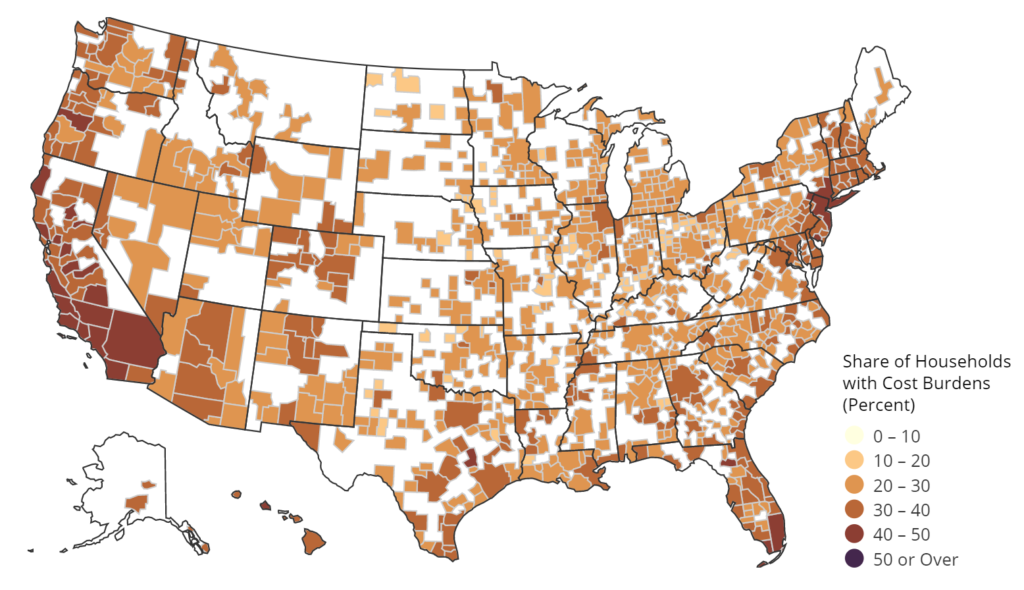

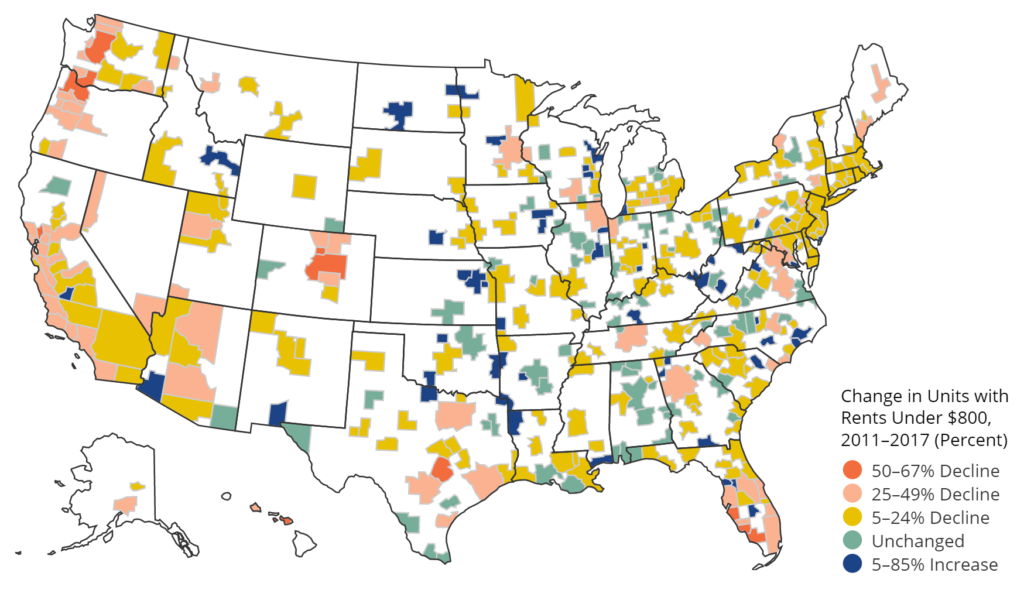

The number of households that have inflation-adjusted annual incomes of $100,000 or greater but are renters nearly doubled from 2006 to 2016, according to the Joint Center for Housing Studies of Harvard University.

Domonic Purviance, a senior financial specialist at the Federal Reserve Bank of Atlanta, said people earning the median income can no longer afford the median-priced new home, costing $323,000 last year, and barely have the means to buy the median existing home, which now about $278,000.

“That’s a radical shift in the structure of the market,” Mr. Purviance said. “What we may have to prepare for in the future is that buying a new home, and in some markets even buying an existing home, may become a luxury.” [more]

Care to tackle this?

https://www.accuweather.com/en/weather-blogs/realimpactofweatherwithdrjoelnmyers/throwing-cold-water-on-extreme-heat-hype/70008963

Hi Bill, thanks for posting! My first reaction is, “Eh, it’s AccuWeather.” They have a well-known denialist bent, so it’s not worth my time to refute each point. Note that he doesn’t show any trend graphs, just plucks various isolated statistics in a pretty standard Gish gallup. This piece is proof by verbosity, not worth responding to.

UPDATE: Hey look, Jason Samenow at WaPo has done the work for us: AccuWeather misleads on global warming and heat waves, a throwback to its past climate denial.