“Sticker shock” for California wildfire areas as insurance rates double, and policies are dropped – “It’s time to address the impact that more severe weather is having on Americans instead of fighting about climate change”

By Dale Kasler, Ryan Sabalow, and Phillip Reese

18 July 2019

(The Sacramento Bee) – Jennifer Burt knows she lives in a fire-prone community. That’s why she’s done everything she can to fire-proof her home in Meadow Vista, in the bushy, densely wooded Placer County foothills, even installing a sprinkler system on the roof.

Yet a few weeks ago, her insurance carrier — Lloyd’s of London, known for insuring high-risk properties — told her it was declining to renew her homeowners’ policy. Lloyd’s also dropped coverage on two rental properties Burt owns in Graeagle, a heavily forested community northwest of Truckee.

Burt was already paying a lot for insurance — $6,300 a year for the three homes — and now fears that her premiums could double or triple as she shops for replacement coverage. Rising premiums are also hurting her livelihood as a real estate agent: Burt lost a sale in Colfax recently because the buyers couldn’t find insurance for less than $6,900, and their lender backed out of the deal.

“It prevented them from purchasing a home in California,” Burt said. “I get so frustrated that the insurance commissioner won’t do anything. It’s reaching a point where it’s a daily conversation in my office as to whether insurance rates are going to kill real estate in California.”

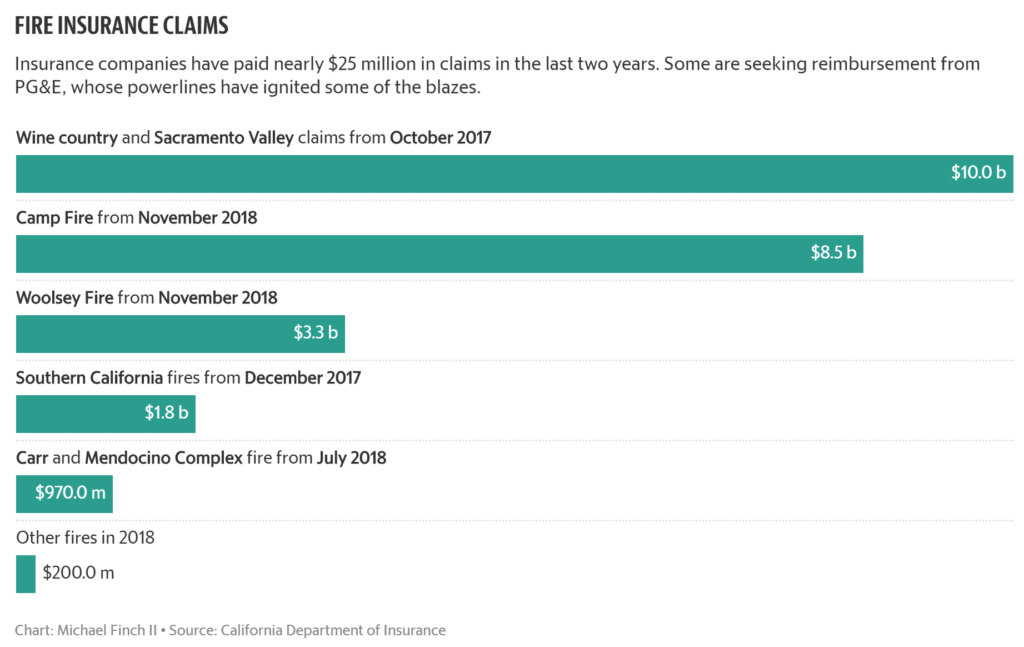

Two consecutive disastrous wildfire seasons have created a budding insurance crisis for thousands of Californians who live in and around fire-prone areas. Stung by $24 billion in losses, insurers are imposing rate hikes or dumping customers altogether, leaving homeowners to seek replacement policies that can be two or three times as expensive.

“It’s really sticker shock for people to see their homeowners’ (premium) go from $1,200 to $3,600,” said Richard Harris of Harris Insurance Services, an independent agency in Grass Valley. “They can’t afford these increases, and they leave crying. We can’t help them. You can only have so many people leaving your office crying.”

State officials know they have a problem on their hands, though lax insurance industry reporting requirements make it difficult to determine just how widespread it is. A task force advising Gov. Gavin Newsom and the Legislature reported in June that homeowners’ insurance costs at least 50 percent more in wildfire zones than elsewhere. […]

“It’s time to address the impact that more severe weather is having on Americans instead of fighting about climate change,” Allstate Chief Executive Tom Wilson said in announcing its pullback from California. “It is now time to come up with longer term solutions, such as ensuring power lines are properly maintained, homes have natural fire barriers and building codes reflect increased severe weather.” [more]

‘Sticker shock’ for California wildfire areas: Insurance rates doubled, policies dropped