U.S. consumer debt is now above levels hit during the 2008 financial crisis

By Mark DeCambre

21 June 2019

(MarketWatch) – Consumer debt is growing to worrisome levels.

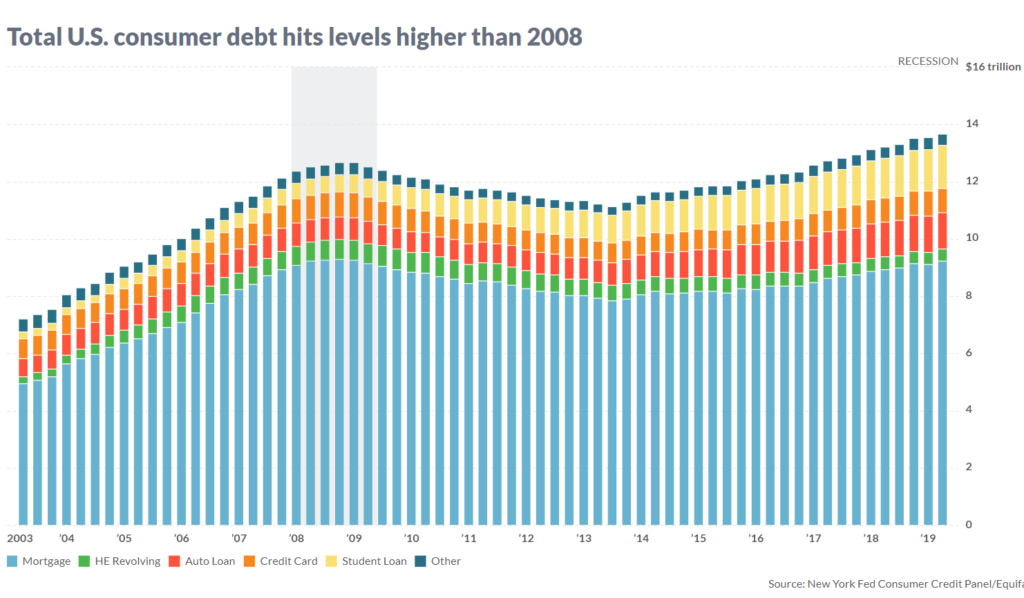

Ben Mohr, senior research analyst of fixed income at investment consultant Marquette Associates, calculated that total U.S. consumer debt hit $14 trillion in the first quarter of 2019, surpassing the roughly $13 trillion of leverage accumulated in credit cards, auto loans and mortgages and other debt back in 2008, when those souring loans and securities pegged to them helped to send global markets into a tailspin (see attached chart).

Mohr told MarketWatch that the increase in student loans — often cited as a source of consternation for economists and strategists — saw a notable increase. At the end of the first three months of 2019, student loan debt hit $1.486 trillion, according to credit data from the New York Federal Reserve. By comparison, student loan at the height of the financial crisis was $611 billion and has been mostly rising since, Mohr said. “It has ballooned and that’s a dramatic increase,” the fixed-income analyst said of the student-debt expansion.

Analyzing growing consumer leverage another way, Mohr said the ratio of debt compared against the U.S. population estimated at 327 million, according to U.S. Census Bureau data, translates to a record per-person debt ratio at $41.77, surpassing the ratio of $41.68 back in 2008. [more]

U.S. consumer debt is now above levels hit during the 2008 financial crisis