U.S. household debt hit record $16.9 trillion in Q4 2022, as consumers loaded up their credit cards – “It’s triple trouble for credit card borrowers”

By Alicia Wallace

17 February 2023

Minneapolis (CNN) – Americans continued to add to their debt at the end of last year — and grew their credit card balances at record rates, according to data released Thursday by the Federal Reserve Bank of New York.

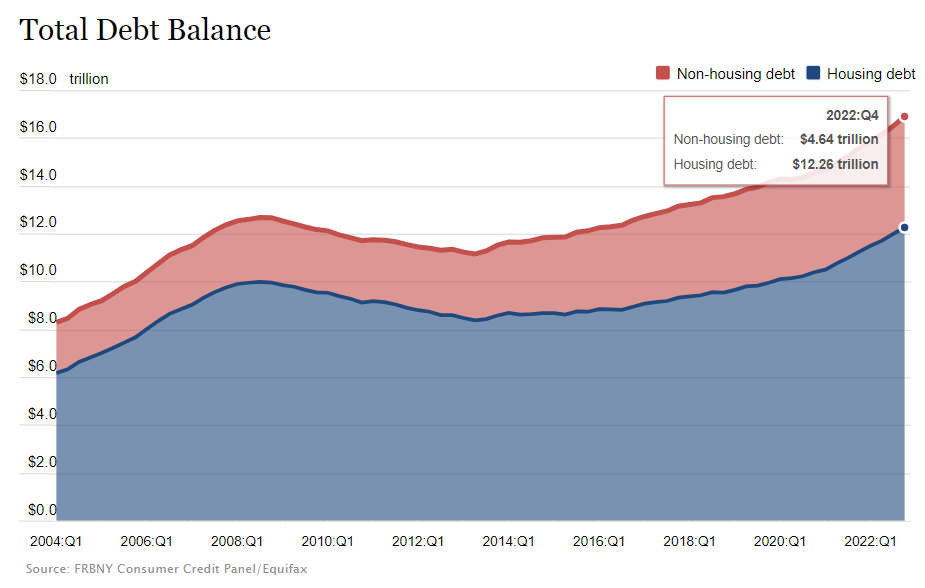

Total US household debt hit a record $16.9 trillion during the fourth quarter, an increase of $394 billion, or 2.4%, from the prior three-month period, according to the Fed’s latest Quarterly Report on Household Debt and Credit. While the lion’s share of the debt is attributable to mortgages, the report showed that not only are credit card balances swelling at record levels, but delinquencies are also on the rise as well.

Credit card balances increased nearly 6.6% to $986 billion during the quarter, the highest quarterly growth on record, according to New York Fed data that goes back to 1999. Year over year, credit card balances grew 15.2%.

The Federal Reserve has made sweeping rate hikes over the past 11 months in an effort to combat high inflation. Climbing interest rates have taken a toll on the housing sector: During the fourth quarter of last year, mortgage originations dropped to 2019 levels, according to the New York Fed report.

A historically strong labor market has helped to keep consumers spending; however, they’re doing so in an environment with historically high inflation and rising interest rates.

“It’s triple trouble for credit card borrowers,” Ted Rossman, senior industry analyst for Bankrate, said in a statement. “Balances are up, rates are up and more people are carrying credit card debt.”

And in this high inflationary and interest rate environment, Americans are having more trouble meeting payment obligations: The share of current debt becoming delinquent increased across nearly all debt types, with credit cards and auto loans showing delinquency transparency rates of 0.6 and 0.4 percentage points, respectively.

At the end of 2022, 18.3 million borrowers were behind on a credit card, according to New York Fed researchers. That compares to 15.8 million at the end of 2019.

Younger borrowers in particular, those in their 20s and 30s, are struggling with credit card and auto loan payments, New York Fed researchers said.

While total delinquency levels remain below what was seen pre-pandemic — 2.5% of outstanding debt was in some stage of delinquency as of December versus 4.7% at the end of 2019 — the fact that delinquency rates are escalating in spite of a strong labor market environment is concerning, New York Fed researchers said.

“Although historically low unemployment has kept consumers’ financial footing generally strong, stubbornly high prices and climbing interest rates may be testing some borrowers’ ability to repay their debts,” Wilbert van der Klaauw, economic research adviser at the New York Fed, said in a statement. […]

A restart of student loan payments “is absolutely going to put more pressure on the consumer and force people to make touch choices,” Mike Loewengart, head of model portfolio construction at Morgan Stanley, said in an interview with CNN.

All in all, this current spending dynamic is “just not sustainable,” he said. [more]

Household debt hit record $16.9 trillion last quarter, as consumers loaded up their credit cards

One Response

Comments are closed.