Solar energy projects are grinding to a halt in the U.S. amid investigation into parts from China – “We’re getting crushed because we literally can’t buy a module today”

By Ella Nilsen

6 May 2022

(CNN) – The solar energy industry has been thrown into a panic and projects are grinding to a halt after the Biden administration launched an investigation that some solar CEOs worry could tank the industry.

The Commerce Department launched the probe in March into whether four countries in Southeast Asia that supply about 80% of US solar panels and parts — Cambodia, Malaysia, Thailand, and Vietnam — are using components from China that should be subject to US tariffs.

The fallout within the industry has been significant.

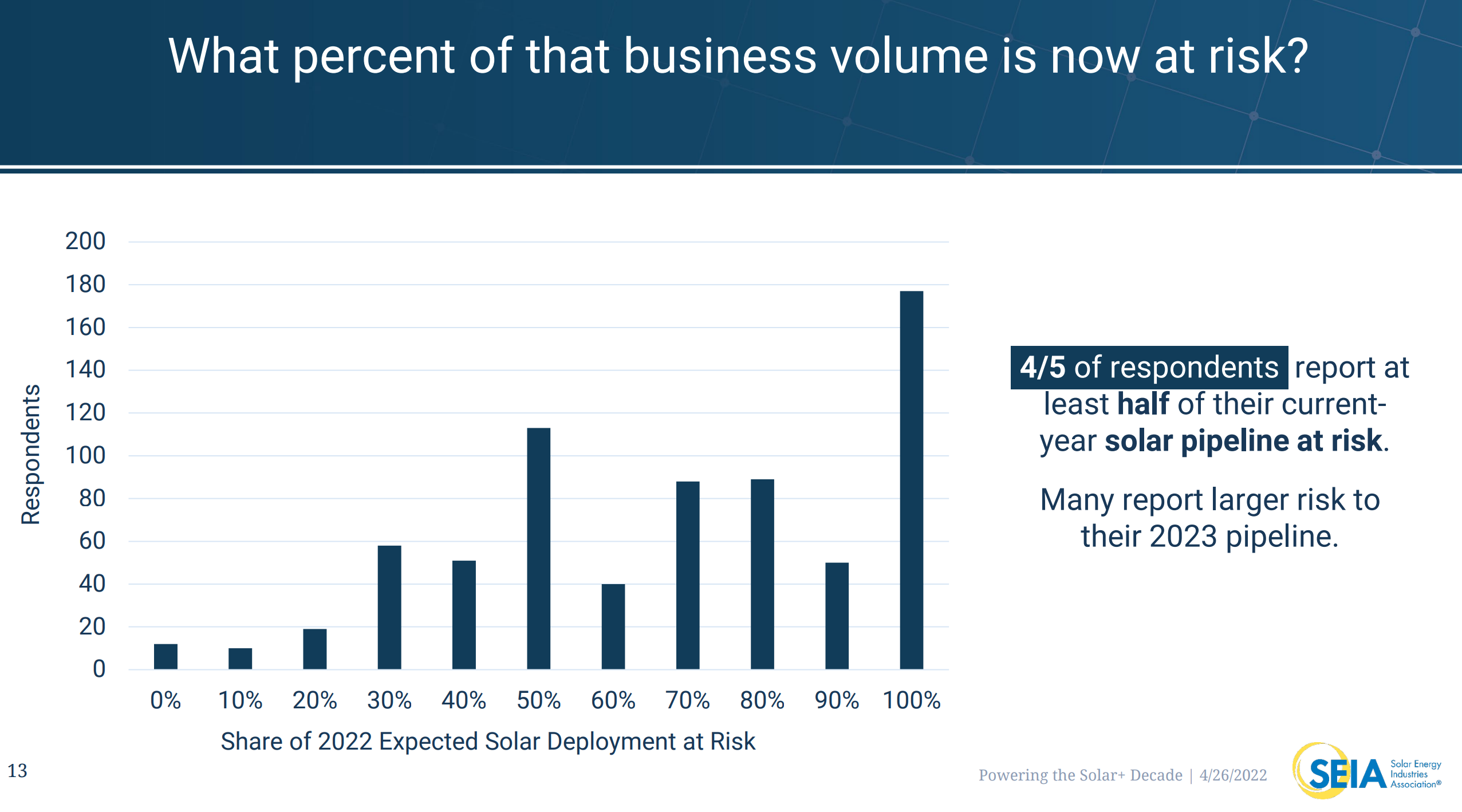

A survey in late April by the Solar Energy Industries Association, a non-profit trade association, found 318 solar projects in the US had already been delayed or canceled, and several CEOs told CNN they expect more to follow. Industry leaders fear the probe could also have a devastating impact on the solar workforce.

The Commerce Department has defended it as a transparent and necessary process, but several solar industry experts and executives told CNN it has also essentially frozen most solar imports into the US because of the threat of steep, retroactive tariffs.

“With this administration and this much support, we’re in a position where we’re going to be laying off people in the renewables industry,” George Hershman, CEO of utility solar contractor SOLV Energy, told CNN. “While you say all those things we agree with, we’re getting crushed because we literally can’t buy a module today. It’s so frustrating.”

The investigation was launched after one small US-based company, Auxin Solar, filed a complaint in February. Auxin CEO Mamun Rashid told CNN that the complaint “was existential” for his company.

“When prices of finished panels from Southeast Asia come in below our bill of materials cost, American manufacturers cannot compete,” Rashid said, adding that “if foreign producers are circumventing U.S. law and causing harm to U.S. producers like Auxin Solar, it needs to be addressed.”

Rashid told CNN it’s “lamentable” that frustration is aimed at his company, rather than the “foreign suppliers” that he says are circumventing US law. Rashid also noted that Auxin is “here and can quickly scale up to meet needs of utilities within 2 to 3 quarters if we have the purchase order today.

“Solar industry leaders have been communicating with the Commerce Department and have also communicated their concerns about the probe to Biden’s top climate officials — including McCarthy and US Climate Envoy John Kerry — a person familiar with the conversations said.”

The administration has been in touch with and is engaging with all kinds of solar stakeholders including the trade associations but also labor, communities, and NGOs,” a White House official told CNN. [more]

Solar energy projects are grinding to a halt in the US amid investigation into parts from China