BP Energy Outlook 2022 edition – The carbon budget is finite, and it is running out

By Spencer Dale

14 March 2022

(BP) – At the time of writing, the world’s attention is focussed on the terrible events taking place in Ukraine. Our thoughts and hopes are with all those affected.

The scenarios included in Energy Outlook 2022 were largely prepared before the outbreak of the military action and do not include any analysis of its possible implications for economic growth and global energy markets. Those implications could have lasting impacts on global economic and energy systems and the energy transition. We will update the scenarios as the possible impacts become clearer.

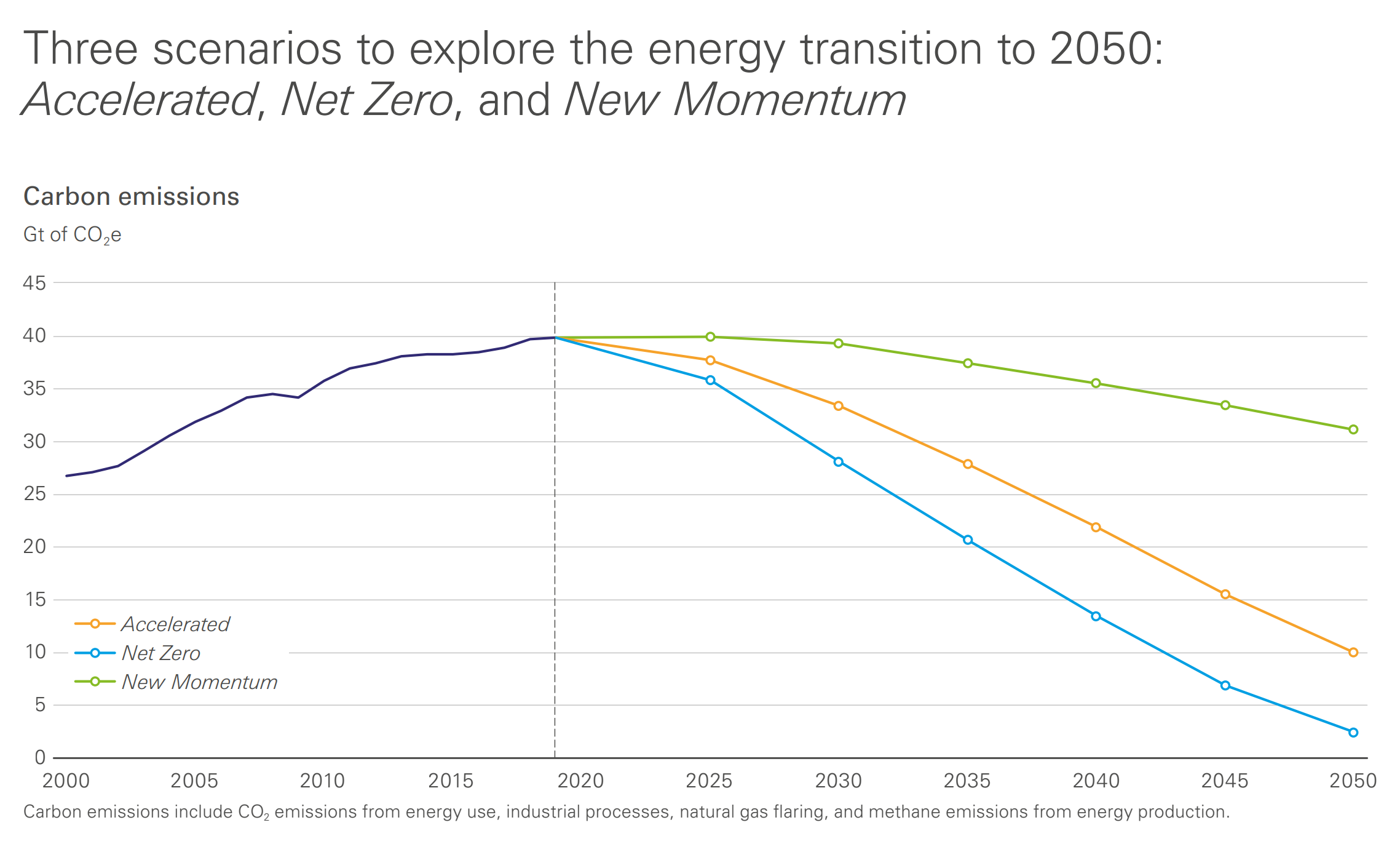

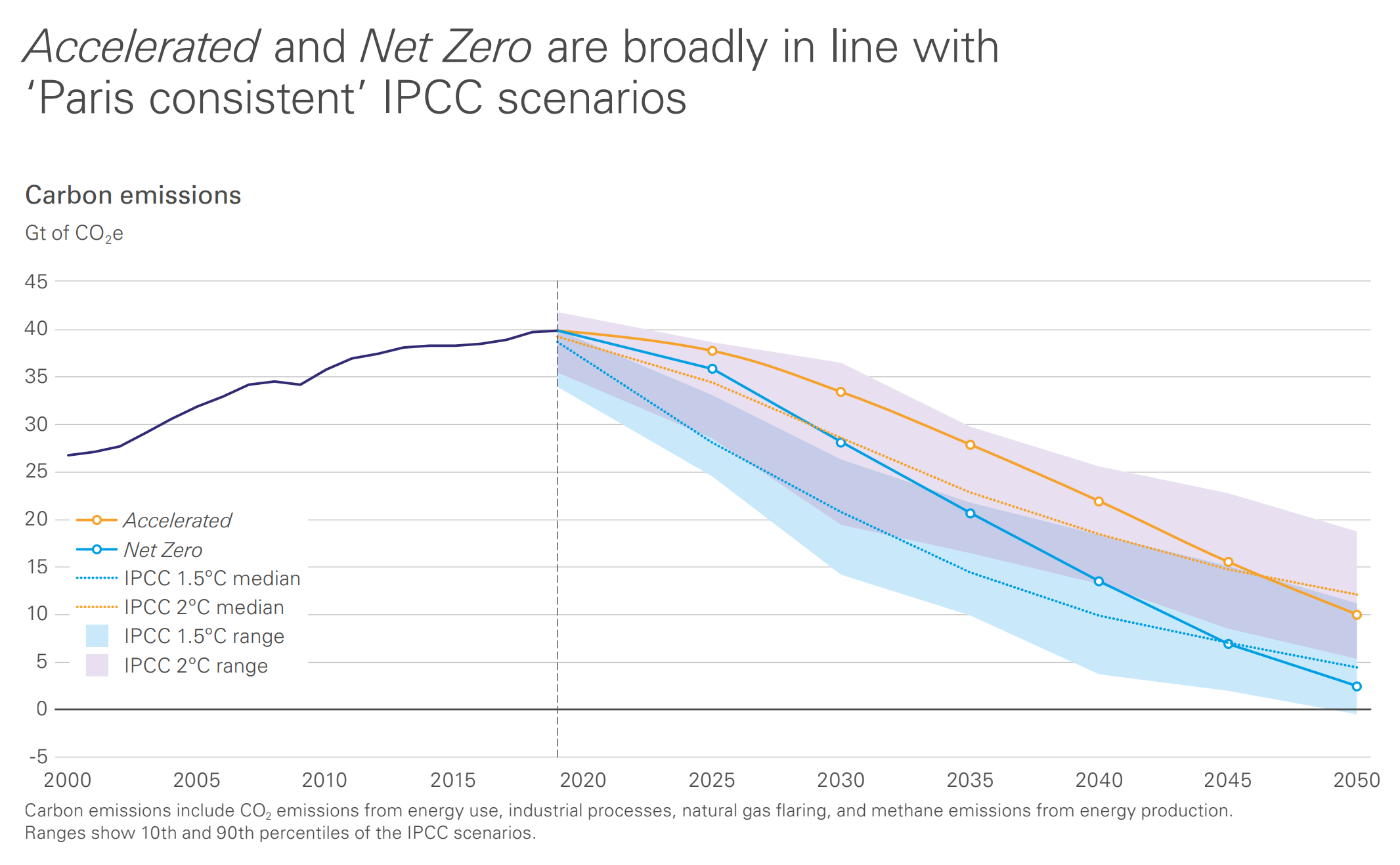

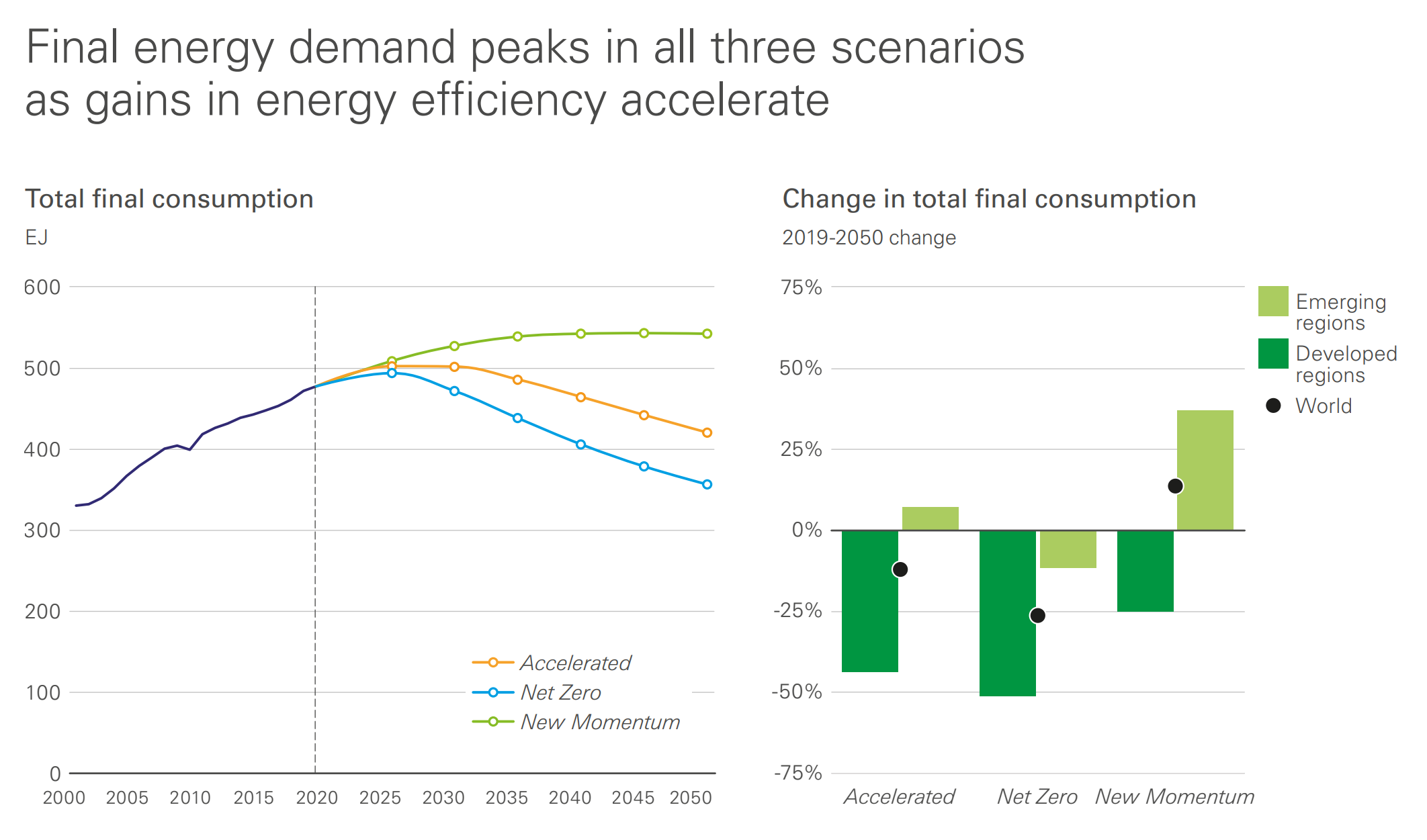

In the meantime, this year’s Outlook describes three main scenarios – Accelerated, Net Zero, and New Momentum – which explore a wide span of possible outcomes as the world transitions to a lower carbon energy system. Understanding this range of uncertainty helps to shape bp’s strategy, increasing its resilience to the different speeds and ways in which the energy system may transition over the next 30 years.

Developments since the previous Outlook was published in 2020 show some signs of progress. Government ambitions globally to tackle climate change have increased markedly. And key elements of the low-carbon energy system critical for the world to transition successfully to net zero – installation of new wind and solar power capacity; sales of electric vehicles; announcements of blue and green hydrogen and CCUS projects – have all expanded rapidly. There are signs of a new momentum in tackling climate change.

Despite that, other than the COVID-19-induced dip in 2020, carbon emissions have risen in every year since 2015, the year of the Paris COP. The carbon budget is finite, and it is running out: further delays in reducing CO₂ emissions could greatly increase the economic and social costs associated with trying to remain within the carbon budget.

Although there is considerable uncertainty, some features of the energy transition are common across all the main scenarios in this year’s Outlook and so may provide a guide as to how the energy system may change over the next few decades:

- Wind and solar power expand rapidly, supported by an increasing electrification of the world.

- A range of energy sources and technologies is required to support deep decarbonization of the global energy system, including electric vehicles, blue and green hydrogen, bioenergy, and CCUS.

- Oil and natural gas continue to play a critical role for decades, but in lower volumes as society reduces its reliance on fossil fuels.

- The energy mix becomes more diverse, with increasing customer choice and growing demands for integration across different fuels and energy services.

The importance of the world making a decisive shift towards a net-zero future has never been clearer. The opportunities and risks associated with that transition are significant. I hope this year’s Energy Outlook is useful to everyone trying to navigate this uncertain future and accelerate the transition to net zero.

As always, any feedback on the Outlook and how we can improve would be most welcome.

Spencer Dale

Chief economist

March 2022

Key themes from Energy Outlook 2022

The Outlook can be used to identify aspects of the energy transition which are common across the main scenarios and so may provide a guide as to how the energy system may evolve over the next 30 years

- The carbon budget is running out: CO₂ emissions have increased in every year since the Paris COP in 2015, except in 2020. Delaying decisive action to reduce emissions sustainably could lead to significant economic and social costs.

- Government ambitions globally have grown markedly in the past few years pointing to new, increased momentum in tackling climate change. But there is significant uncertainty as to how successful countries and regions will be in achieving those aims and pledges.

- The structure of energy demand changes, with the importance of fossil fuels gradually declining, replaced by a growing share of renewable energy and increasing electrification. The transition to a low-carbon world requires a range of other energy sources and technologies, including low-carbon hydrogen, modern bioenergy, and carbon capture, use and storage (CCUS).

- The movement to a lower carbon energy system leads to a fundamental restructuring of global energy markets, with a more diversified energy mix, increased levels of competition, shifting economic rents, and a greater role for customer choice.

- Oil demand increases to above its pre-COVID-19 level before falling further out. Declines in oil demand are driven by the increasing efficiency and electrification of road transportation. Natural declines in existing hydrocarbon production imply continuing investment in new upstream oil and gas is required over the next 30 years.

- The use of natural gas is supported, at least for a period, by increasing demand in fast-growing emerging economies as they continue to industrialize and reduce their reliance on coal. Growth in liquefied natural gas plays a central role in increasing emerging markets’ access to natural gas.

- Wind and solar power expand rapidly, accounting for all or most of the increase in global power generation, underpinned by continuing falls in their costs and an increasing ability of power systems to integrate high concentrations of variable power sources. The growth in wind and solar power requires a substantial increase in the pace of investment in both new capacity and enabling technologies and infrastructure.

- The use of modern bioenergy increases substantially, providing a low-carbon alternative to fossil fuels in hard-to-abate sectors.

- The use of low-carbon hydrogen increases as the energy system progressively decarbonizes, carrying energy to activities and processes which are difficult to electrify, especially in industry and transport. The production of low-carbon hydrogen is dominated by green and blue hydrogen, with green hydrogen growing in importance over time.

- CCUS plays a central role in supporting a low-carbon energy system: capturing emissions from industrial processes, providing a source of carbon dioxide removals, and abating emissions from fossil fuels.

- A range of carbon dioxide removals – including bioenergy combined with carbon capture and storage, natural climate solutions, and direct air capture with storage – may be needed for the world to achieve a deep and rapid decarbonization. [more]