Minimum wage workers can’t afford rent anywhere in America – “In no state, metropolitan area, or county can a full-time minimum-wage worker afford a modest two-bedroom rental home”

By Anna Bahney

15 July 2021

(CNN) – Housing has become so expensive in the United States that the typical minimum wage worker cannot afford rent, according to a new report.

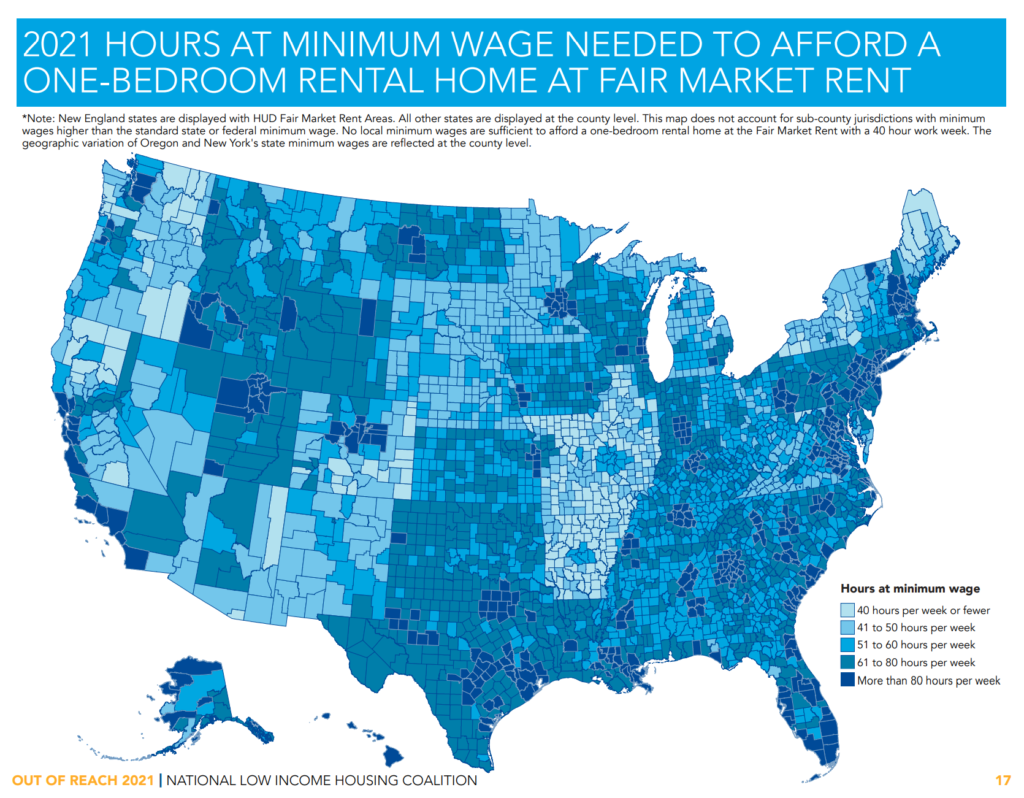

There is no state, county or city in the country where a full-time, minimum-wage worker working 40 hours a week can afford a two-bedroom rental, a report [pdf] from the National Low Income Housing Coalition showed.

A full-time minimum-wage worker can afford a one-bedroom rental in only 7% of all US counties — 218 counties out of more than 3,000 nationwide.

The federal minimum wage is $7.25.

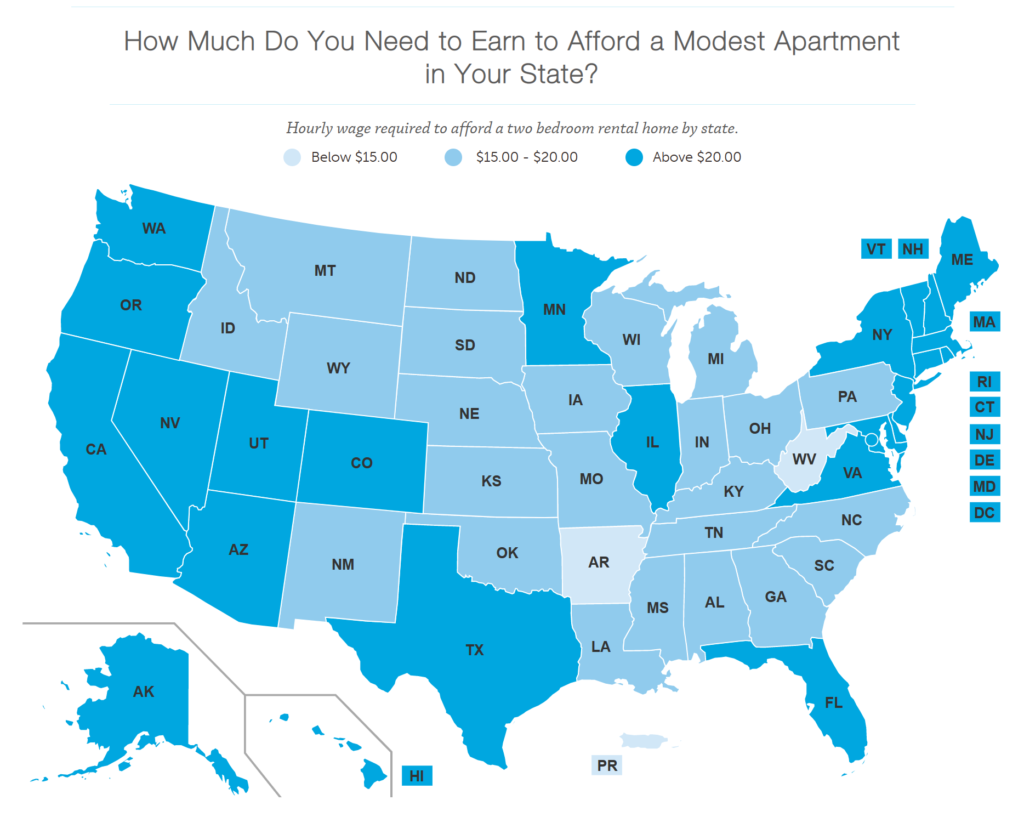

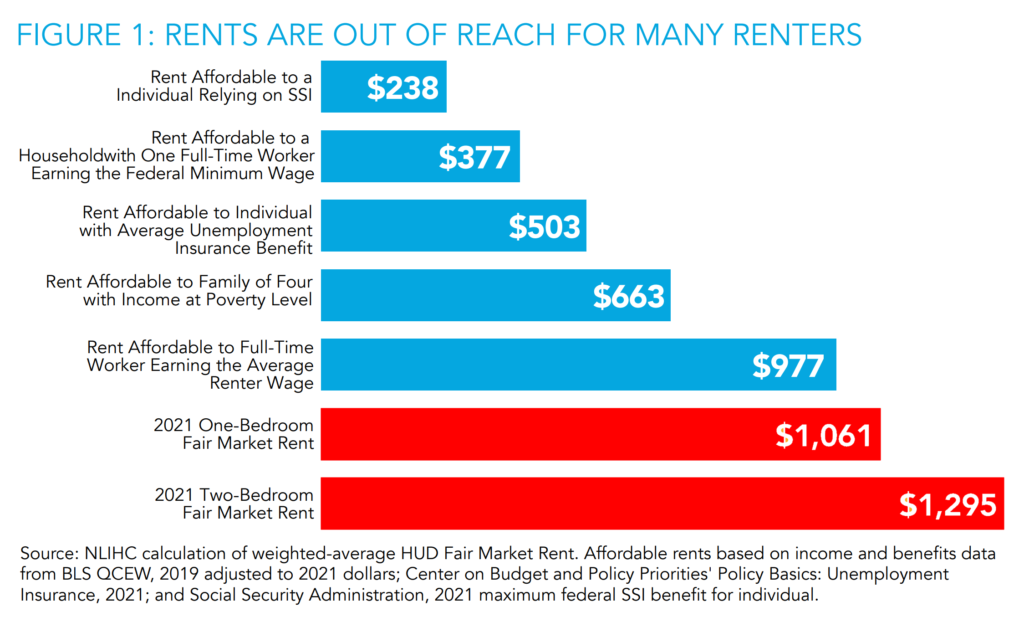

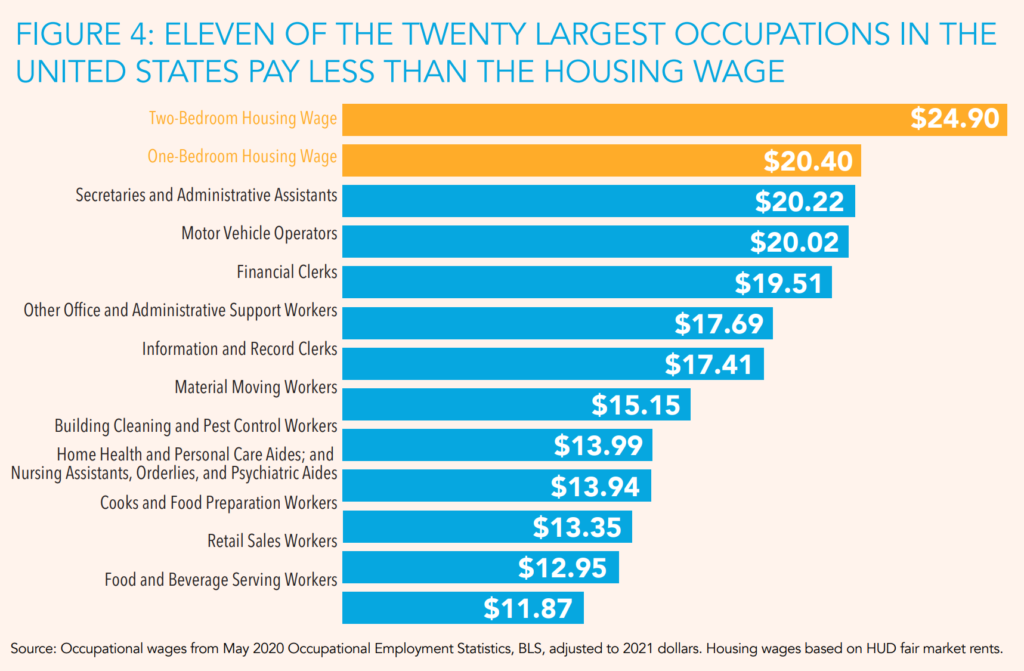

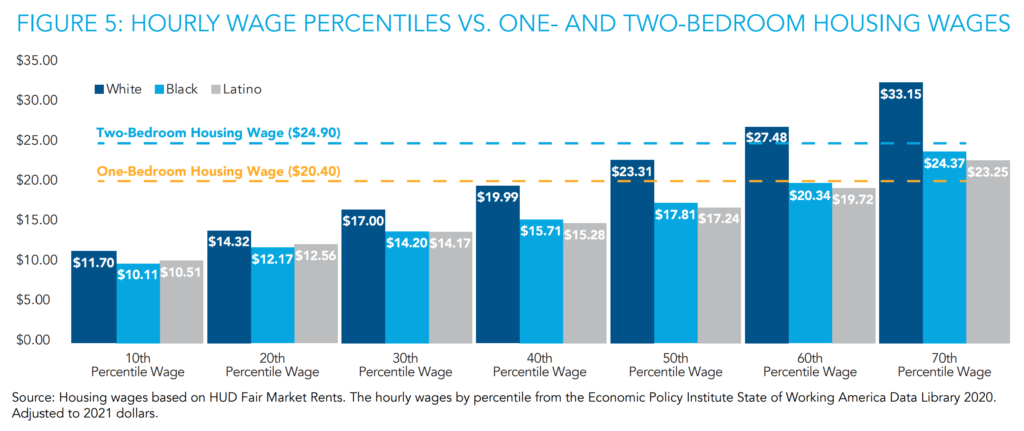

But the report showed that a worker would need to earn $24.90 per hour in order to afford a two-bedroom home at Fair Market Rent. And a $20.40 “housing wage” would be needed for a one-bedroom. Fair Market Rents are government estimates of what a person should expect to pay for a modest home in their area.

A housing wage is the amount a worker would need to earn to afford a home without spending more than 30% of their income on rent and utilities.

“These amounts are far higher than many Americans — including seniors, people with disabilities, and working families — can spend on housing,” wrote Marcia L. Fudge, secretary of the US Department of Housing and Urban Development, in the preface to the report. [more]

Minimum wage workers can’t afford rent anywhere in America

NLIHC Released Today “Out of Reach 2021: The High Cost of Housing” Report

Washington, DC, 14 July 2021 (NLIHC) – NLIHC released today its annual report, Out of Reach 2021: The High Cost of Housing, which concludes that millions of low-wage renters were struggling to afford their homes before the pandemic and will remain in an economically precarious position without significant congressional action. The report highlights the mismatch between the wages people earn and the price of decent rental housing in every state, metropolitan area, and county in the U.S. The report calculates the “Housing Wage” a full-time worker must earn to afford a rental home without spending more than 30% of their income on housing costs. This year’s national Housing Wage is $24.90 per hour for a modest two-bedroom home at fair market rent and $20.40 per hour for a modest one-bedroom rental home.

Throughout the pandemic, millions of renters were at grave risk of contracting and spreading the virus as they struggled to pay their bills and stay in their homes, and many accumulated rental debt. One reason the pandemic was also an economic catastrophe for so many households is because, even before the pandemic, they could not afford their homes.

“We all deserve the opportunity to live with security and dignity,” said HUD Secretary Marcia L. Fudge, author of the report’s preface. “The Biden-Harris administration is proud to partner with the National Low Income Housing Coalition in taking bold action to address our nation’s affordable housing crisis head on. Together, we can help put an affordable and stable home within reach for every American.”

“Housing is a basic human need and should be regarded an unconditional human right,” said NLIHC President and CEO Diane Yentel. “With the highest levels of job losses since the Great Depression and an ongoing global pandemic, low-income workers and communities of color were disproportionately harmed. The enduring problem of housing unaffordability requires bold investments in housing solutions that will ensure stability in the future. Without a significant federal intervention, housing will continue to be out of reach for millions of renters.”

Out of Reach 2021 finds that in no state, metropolitan area, or county can a full-time minimum-wage worker afford a modest two-bedroom rental home, and these workers cannot afford modest one-bedroom apartments in 93% of U.S. counties. Over 7.5 million extremely low-income renters are severely housing cost-burdened, spending more than half of their incomes on housing. Such cost burdens lead too often to housing instability and homelessness. More than 226,000 people in the U.S. experienced homelessness on sidewalks or other unsheltered locations on a given night in 2020, and another 354,000 experienced homelessness in emergency shelters, with limited ability to self-isolate. In addition, more than 2.7 million renters live in overcrowded housing conditions, making social distancing from an infected housemate all but impossible.

The report highlights that housing affordability is a racial justice issue, made clearer than ever during the pandemic. Historic and continuing racist housing policies and practices result in people of color disproportionately facing greater challenges accessing decent and affordable homes. Black and Latino workers earn less than white workers, and Black and Latino households are more likely to spend more than 30% of their incomes on housing: while 25% of white households are housing cost-burdened, 41% of Latino households and 43% of Black households are cost-burdened. Structural injustices, unequal access to housing and healthcare, and greater exposure in low-wage and frontline jobs have resulted in people of color disproportionately contracting COVID-19 and being at high risk of losing their homes. Throughout the downturn, unemployment rates have been higher for Black and Latino workers than for white workers, and the Census Household Pulse Survey has consistently shown the Black and Latino renters are more likely to have fallen behind on their rent.

Even if the economy recovers rapidly and completely from the downturn caused by the pandemic, millions of renters will continue to struggle without significant congressional action.

NLIHC and our partners throughout the country are calling on Congress to take urgent action to ensure low-wage workers and other low-income renters do not simply return to a pre-pandemic status quo. Solving the housing affordability crisis requires expanding rental assistance to all eligible renters in need and making deep, sustained investments in the national Housing Trust Fund and public housing to create, preserve, and rehabilitate affordable homes. Congress should also create a permanent National Housing Stabilization Fund to provide temporary assistance for households at risk of eviction and strengthen and enforce renters’ protections.

The full Out of Reach 2021: The High Cost of Housing report is available at: https://reports.nlihc.org/oor

NLIHC Released Today “Out of Reach 2021: The High Cost of Housing” Report