In tougher times, China falls back on coal – “There’s a deep contradiction in this”

By Stephanie Yang

23 December 2019

BEIJING (The Wall Street Journal) – China’s efforts to wean itself off coal are losing steam, as the world’s biggest carbon emitter is putting economic growth and energy security above its ambitions to be a leader in combating climate change.

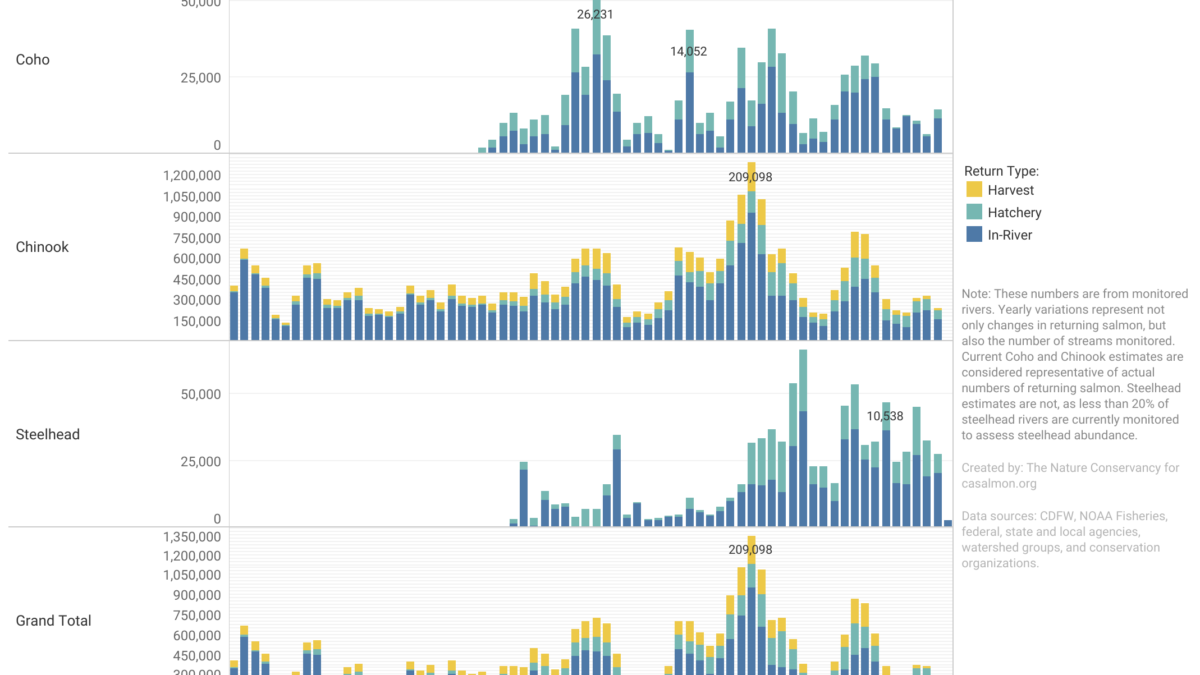

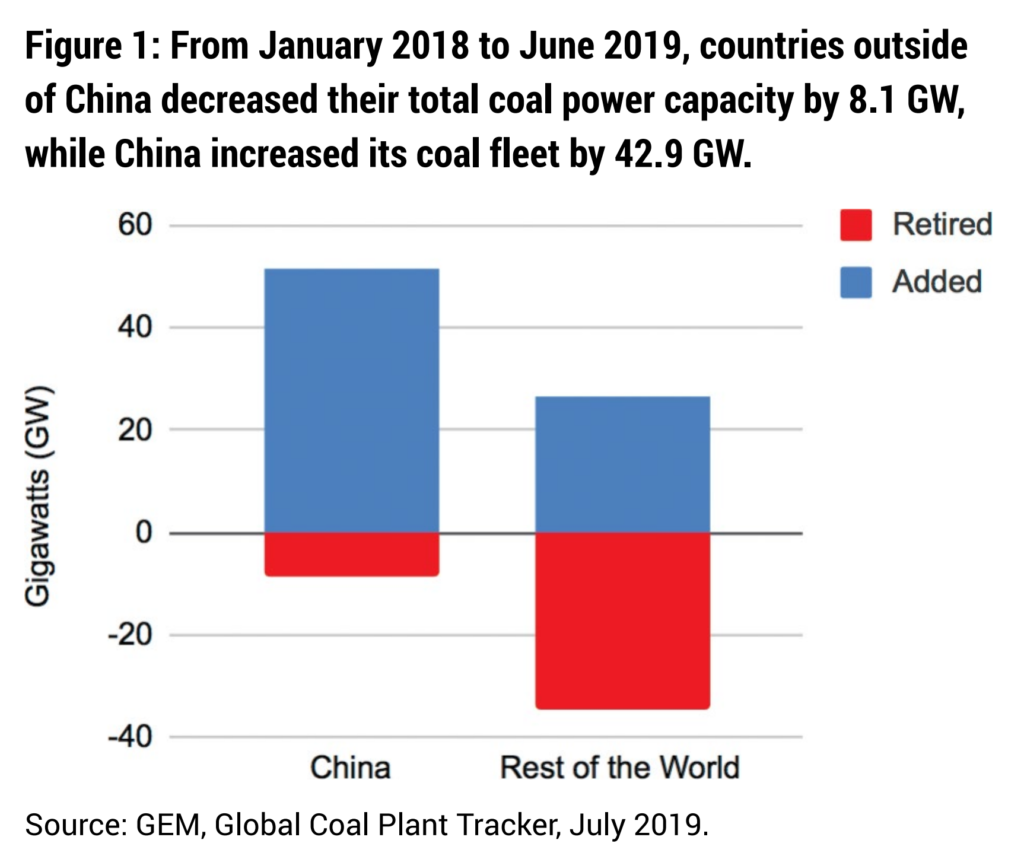

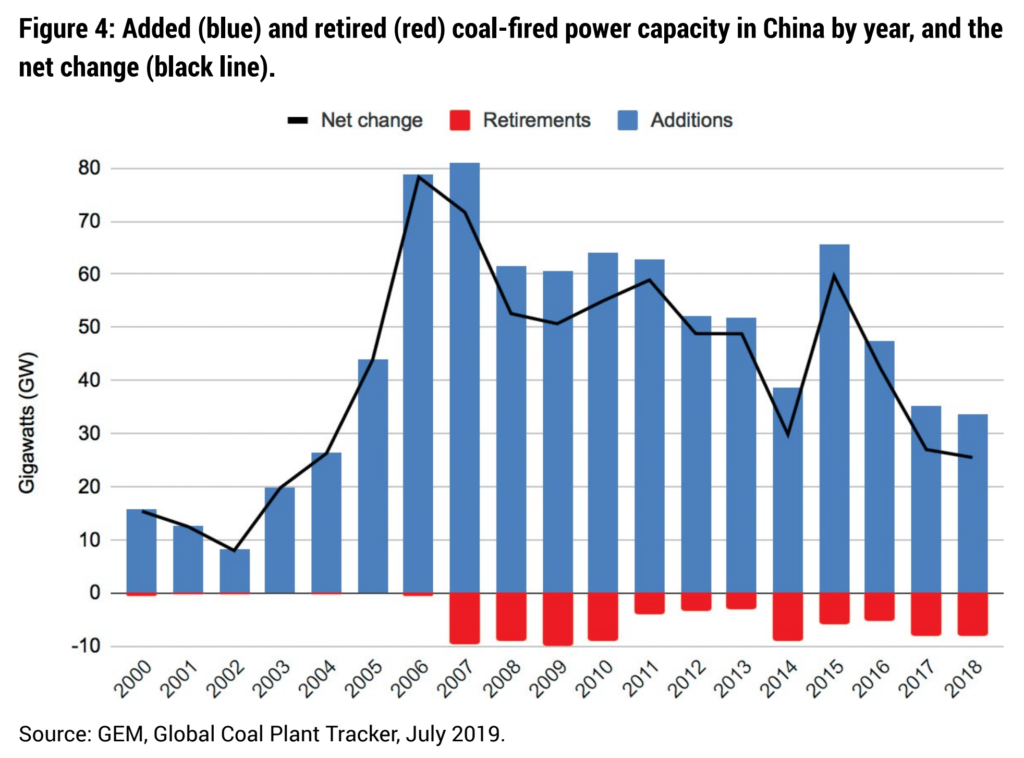

Coal consumption is back near peak levels after rebounding over the past three years, despite China’s pledges to make steep cuts in what is the country’s most prevalent and polluting source of energy. The country is building more coal-fired plant capacity than the rest of the world combined.

Infrastructure stimulus measures to offset the impact of the prolonged trade war with the U.S. have boosted consumption, while Beijing has taken a softer stance on coal use after a missile attack in September on Saudi Arabia, China’s biggest source of oil imports, underscored the country’s reliance on foreign energy.

The renewed focus on coal has raised doubts among analysts over China’s commitment to cutting carbon emissions and frustrated the European Union, which has leaned on China to uphold the Paris Agreement since President Trump pulled the U.S. out in 2017. While China is on track to meet its goals through 2020 and 2030, its mixed signals on coal suggest Beijing is less willing to pursue green-energy goals and join the EU in setting more ambitious emission targets.

“China was seen, particularly by the developing and emerging economies, as the leader, saying look at all the wonderful stuff we’re doing,” said Philip Andrews-Speed, senior principal fellow at the Energy Studies Institute at the National University of Singapore. But the country has continued construction on new coal plants even as it aims to phase out the fossil fuel, he said: “There’s a deep contradiction in this.” […]

China’s steel output reached a record high of 750 million metric tons in 2019, but will likely come back down in 2020 as housing construction slows, according to Fitch Ratings associate director Charles Li. Data from the Centre for Research on Energy and Clean Air show that coal demand has increased by 7 percent and 11 percent in metals and chemicals sectors, respectively, this year through October. Its use to produce cement and glass have also increased. […]

China’s import dependency on oil reached 72 percent last year, the highest in the past 50 years, according to BP’s 2019 Statistical Review. Oil imports climbed to a record high in November 2019, according to ship-tracking firm Kpler, with much of the increase coming from Saudi Arabia.

China’s reliance on Saudi Arabian oil has grown as its other sources of imports have been squeezed by U.S. sanctions on Iran and Venezuela and the continuing trade war, which has affected U.S. imports.

China is also expected to become the world’s largest importer of natural gas in 2020. The country has pushed aggressively to transition into cleaner-burning fuels and clear its skies of pollution, at times falling short of the supply needed. In 2017, some residents and factories in northern China were left without heating and fuel in the middle of winter. […]

A November report from Global Energy Monitor, an anti-fossil-fuel nonprofit, highlighted China’s investment in coal-fired power plants. The amount of coal-power capacity under construction in China exceeds the rest of the world combined, the group said, though much of the build-out is a continuation of coal-fired plants that were permitted before 2017. [more]