Instead of eliminating the U.S. debt, Trump will add $8.3 trillion

By Kimberly Amadeo

3 June 2019

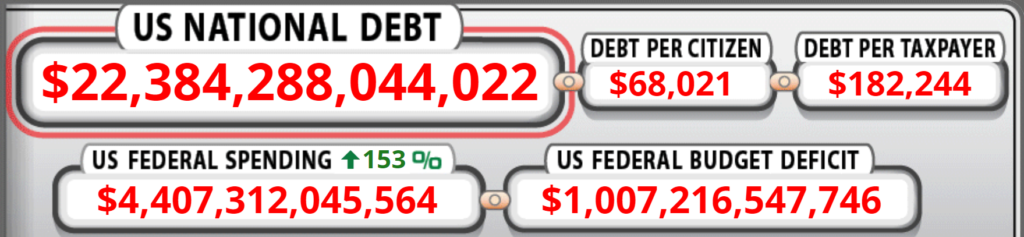

(The Balance) – During the 2016 presidential campaign, Republican candidate Donald Trump promised he would eliminate the nation’s debt in eight years. Instead, his budgets would add $9.1 trillion during that time. It would increase the U.S. debt to $29 trillion according to Trump’s budget estimates. […]

Trump has a cavalier attitude about the nation’s debt load. During the campaign, he said the nation could “borrow knowing that if the economy crashed, you could make a deal.” He added, “The United States will never default because you can print the money.”

Trump thinks about the national debt as he does personal debt. A 2016 Fortune magazine analysis revealed Trump’s business is $1.11 billion in debt. That includes $846 million owed on five properties. These include Trump Tower, 40 Wall Street, and 1290 Avenue of the Americas in New York. It also includes the Trump Hotel in Washington D.C. and 555 California Street in San Francisco. But the income generated by these properties easily pays their annual interest payment. In the business world, Trump’s debt is reasonable.

But sovereign debt is different. The World Bank compares countries based on their total debt-to-gross domestic product ratio. It considers a country to be in trouble if that ratio is greater than 77 percent. The U.S. ratio is 104 percent. That’s the $21.516 trillion U.S. debt as of September 28, 2018, divided by the $20.658 trillion nominal GDP. […]

Trump is wrong to assume that the United States could simply print money to pay off the debt. It would send the dollar into decline and create hyperinflation. Interest rates would rise as creditors lost faith in U.S. Treasurys. That would create a recession. He’s also wrong in thinking that he could make a deal with our lenders if the U.S. economy crashed. There would be no lenders left. It would send the dollar into a collapse. The entire world would plummet into another Great Depression.

At first, it seemed Trump was lowering the debt. It fell $102 billion in the first six months after Trump took office. On 20 January 2017, the day Trump was inaugurated, the debt was $19.9 trillion. On 30 July 2017, it was $19.8 trillion. But it was not because of anything he did. Instead, it was because of the federal debt ceiling.

On 8 September 2017, Trump signed a bill increasing the debt ceiling. Later that day, the debt exceeded $20 trillion for the first time in U.S. history. On 9 February 2018, Trump signed a bill suspending the debt ceiling until 1 March 2019. It was $22 trillion. In just two years,Trump has overseen the fastest dollar increase in the debt of any president.

Trump’s Fiscal Year 2020 budget projects the debt would increase $5 trillion during his first term. That’s as much as Obama added while fighting a recession. Trump has not fulfilled his campaign promise to cut the debt. Instead, he’s done the opposite. [more]