Global fossil fuel subsidies hit record $5.2 trillion – Efficient pricing would lower global carbon emissions by 28 percent and fossil fuel air pollution deaths by 46 percent

By Nick Cunningham

12 May 2019

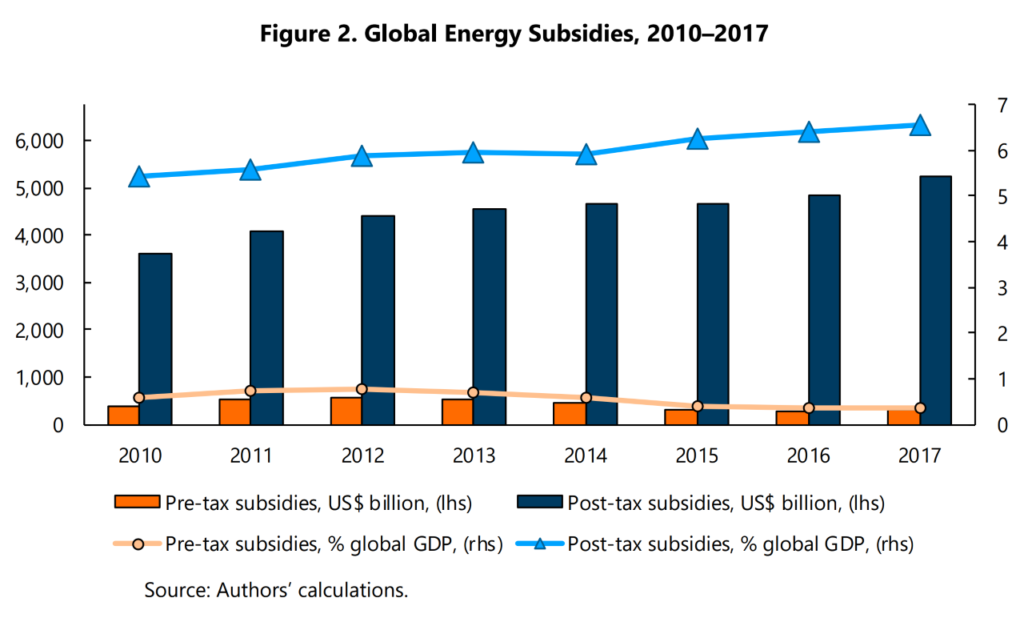

(OilPrice.com) – The world spent a staggering $4.7 trillion and $5.2 trillion on fossil fuel subsidies in 2015 and 2017, respectively, according to a new report [pdf] from the International Monetary Fund. That means that in 2017 the world spent a whopping 6.5 percent of global GDP just to subsidize the consumption of fossil fuels.

China was “by far, the largest subsidizer” in 2015 at $1.4 trillion, the IMF said. The U.S. came in second at $649 billion. In other words, the U.S. spent more on fossil fuel subsidies in 2015 than it did on the bloated Pentagon budget ($599 billion in 2015). Russia spent $551 billion, the EU spent $289 billion, and India spent $209 billion. Emerging markets in Asia accounted for 40 percent of the total while the industrialized world accounted for 27 percent, with smaller percentages found in other regions.

The subsidy figure the IMF uses incorporates a variety of supports for fossil fuels, including not pricing for local air pollution, climate change and environmental costs, as well as undercharging for consumption taxes and undercharging for supply costs.

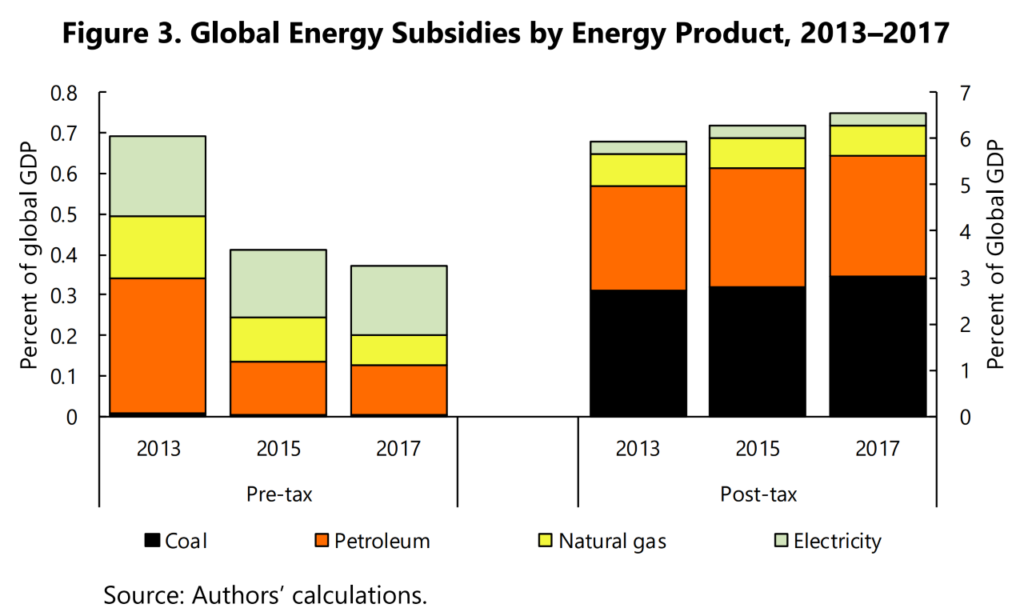

By fuel, coal is receives the most largesse, account for 44 percent of the global total. Oil was shortly behind at 41 percent, and natural gas and electricity output received 10 percent and 4 percent, respectively.

There is a long list of reasons why slashing fossil fuel subsidies is not only a good idea, but very much needed. The climate crisis is worsening. Paying for wasteful consumption saps already cash-strapped governments of much needed funds for other needs. Local air pollution also negatively impacts human health, and in some cases, to very extreme levels. “Energy pricing reform therefore remains largely in countries own interest, given that about three quarters of the benefits are local,” the IMF said.

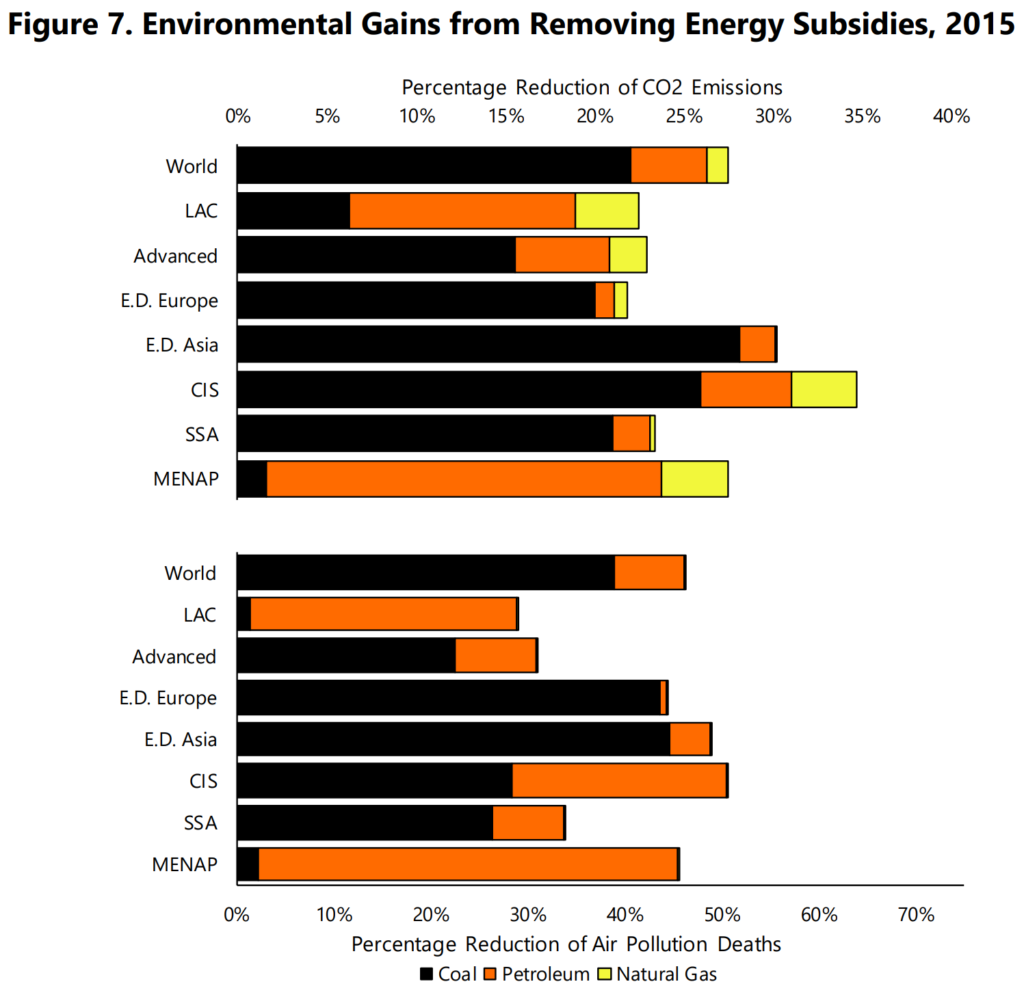

If fuel prices were set at “fully efficient levels” in 2015, global CO2 emissions would have been 28 percent lower, deaths from air pollution would have been 46 percent lower, and tax revenues would have been 3.8 percent of global GDP higher, the IMF said. [more]

Global Fossil Fuel Subsidies Hit $5.2 Trillion

ABSTRACT: This paper updates estimates of fossil fuel subsidies, defined as fuel consumption times the gap between existing and efficient prices (i.e., prices warranted by supply costs, environmental costs, and revenue considerations), for 191 countries. Globally, subsidies remained large at $4.7 trillion (6.3 percent of global GDP) in 2015 and are projected at $5.2 trillion (6.5 percent of GDP) in 2017. The largest subsidizers in 2015 were China ($1.4 trillion), United States ($649 billion), Russia ($551 billion), European Union ($289 billion), and India ($209 billion). About three quarters of global subsidies are due to domestic factors—energy pricing reform thus remains largely in countries’ own national interest—while coal and petroleum together account for 85 percent of global subsidies. Efficient fossil fuel pricing in 2015 would have lowered global carbon emissions by 28 percent and fossil fuel air pollution deaths by 46 percent, and increased government revenue by 3.8 percent of GDP.

Global Fossil Fuel Subsidies Remain Large: An Update Based on Country-Level Estimates