Graph of the Day: Mitt Romney’s America

Graph by Tamino, 19 September 2012

Graph by Tamino, 19 September 2012

By Rick Ungar

17 September 2012 David Corn of Mother Jones Magazine has obtained a video recording of Mitt Romney speaking to a small group of wealthy contributors at a fundraiser wherein the Republican candidate reveals what he really thinks of people who he expects to vote for President Barack Obama. When asked by a guest how the Governor plans to pull of a win in November, Romney responded: “There are 47 percent of the people who will vote for the president no matter what. All right, there are 47 percent who are with him, who are dependent upon government, who believe that they are victims, who believe the government has a responsibility to care for them, who believe that they are entitled to health care, to food, to housing, to you-name-it. That that’s an entitlement. And the government should give it to them. And they will vote for this president no matter what. These are people who pay no income tax.” Romney goes on to say; “My job is not to worry about those people. (emphasis added) I’ll never convince them they should take personal responsibility and care for their lives.” So much for the notion of the President of the United States being the president of all the people. The video is posted on the Mother Jones website with some portions blurred so as to protect Corn’s source. It appears Governor Romney is referring to the 47 percent of Americans who did not pay federal income tax last year—22 percent of whom were elderly people on Social Security, while 17 percent were students and disabled Americans. Much of the remaining Americans who paid no federal income taxes were low-income workers who qualify under the law for the earned income tax credit but do pay payroll taxes. Ironically, many of these low-income, non-federal income tax paying people are white, working class Americans who are a part of Romney’s base of support. With the exception of the elderly on Social Security and Medicare—government benefits which they spent a lifetime contributing to in order to earn the benefits they now receive—most of these individuals do not look to the government for housing or food nor do they expect the government to give them anything else. As to whether or not any of these people consider themselves “victims”, I really couldn’t say—but ,then, neither can Governor Romney. […]

Romney Fail: Caught On Video Revealing Extraordinary Contempt For 47 Percent Of Americans

18 September 2012 (News Corpse) – Just in case anyone is wondering where Mitt Romney came up with the data behind the contemptuous affront he leveled at half of the population that he hopes to serve as president, it is a tenet of conservative philosophy that has been expressed repeatedly by pundits and politicians alike, although rarely with such disdain. Here is what Romney, a man who accuses President Obama of being divisive, told a roomful of wealthy donors:

There are 47 percent of the people who will vote for the president no matter what. All right, there are 47 percent who are with him, who are dependent upon government, who believe that they are victims, who believe the government has a responsibility to care for them, who believe that they are entitled to health care, to food, to housing, to you-name-it. That that’s an entitlement. And the government should give it to them. And they will vote for this president no matter what. … These are people who pay no income tax.

The erroneous charge concerning an alleged 47% of American freeloaders is one that has been exciting right-wingers for more than two years and has been notably championed by Fox News. To fill in the background of this story, I am re-posting an article I wrote in August of 2011 that describes the length and breadth of this fictitious political assault on the middle and working class of America. It illustrates explicitly the themes that Romney articulated to his wealthy supporters. […] This movement is not some scruffy assemblage of disorganized trust-funders seeking to upgrade their yachts. It is a coordinated campaign that has pulled together high profile proponents from politics and the press. Here is a sampling of the breadth and unity of the movement and the message:

- Rick Perry (R-TX): We’re dismayed at the injustice that nearly half of all Americans don’t even pay any income tax.

- Michele Bachmann (R-MN): A system in which 47% of Americans don’t pay any tax is ruinous for a democracy.

- Sarah Palin (R-AK): The problem is more than 40% pay no income taxes at all.

- Orrin Hatch (R-UT): 51 percent don’t pay anything.

- Jim DeMint (R-SC): Over half of Americans pay no federal income tax.

- Mitch McConnell (R-KY): In fact, about half of Americans don’t pay any income taxes at all.

- John Boehner (R-OH): Fifty-one percent — that is, a majority of American households — paid no income tax in 2009. Zero. Zip. Nada.

- Eric Cantor (R-MD): We also have a situation in this country where you’re nearing 50 percent of people who don’t even pay income taxes.

- Alan West (R-FL): Currently we have some 40-45% of Americans who are not paying any taxes.

We’re not through yet.

- Donald Trump (R-HisOwnEgo): You do have a problem because half of the people don’t pay any tax.

- Bill O’Reilly (Fox News): 50 percent of Americans don’t pay any federal income tax now.

- Stuart Varney (Fox News): About half the people who work in America, half the households, actually, pay any federal income tax at all.

- Dave Briggs (Fox News): [A]lmost half of this country pays no income tax whatsoever.

- Gretchen Carlson (Fox News): But what does that mean when you factor in that 50 percent of the nation doesn’t even pay federal income tax? Is that fair?

- [Idiot Award Winner] Steve Doocy (Fox News): With 47% of Americans not paying taxes – 47% – should those who don’t pay be allowed to vote?

- Sean Hannity (Fox News): 50 percent of Americans no longer pay taxes.

- Neil Cavuto (Fox News): I’ve discovered nearly half of this country’s households don’t pay any taxes at all.

Oh yes, there’s more.

- Dave Ramsey (Fox News): This idea that 42% of Americans don’t pay anything … that’s just morally wrong.

- Brian Kilmeade (Fox News): Fifty-one percent of the country isn’t paying any taxes at all.

- Eric Bolling (Fox News): 43 percent of households don’t pay any federal tax.

- Glenn Beck (Right-Wing Radio): There was like 48 percent say they pay their right amount of taxes and 49 percent don’t pay any tax.

- Rush Limbaugh (Right-Wing Radio): Meanwhile, 45% of Americans pay nothing.

- Gary Bauer (Right-Wing Evangelist): But the reality is that nearly half of Americans don’t pay any income tax.

- Rick Warren (Right-Wing Evangelist): HALF of America pays NO taxes. Zero.

- Ted Nugent (Right-Wing Douchebag): This, of course, will not apply to those 50 percent of Americans who pay no income taxes.

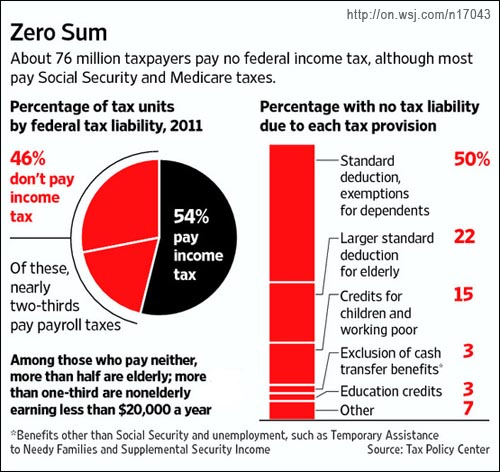

Is there anyone who could seriously argue that this is not a coordinated effort aimed at demonizing low-income and working class citizens? The conformity and ubiquity of the identical messaging from such a broad spectrum of players is audacious and disturbing. And what’s worse, it is deliberately misleading and/or false. First of all, claims that half the population pay no taxes at all are factually wrong. (See the chart above from The Wall Street Journal). There are about 46% who do not pay federal income taxes, but most of them do pay many other taxes including Social Security, state and local, sales, property, gas, etc. Secondly, it should come as no surprise that those with little or no tax liability have little or no income. The majority of this group is comprised of senior citizens, students, the disabled, and the unemployed. Those are the folks that the right wants to tap for new revenue rather than the rich who they have taken to calling “job creators” despite the fact that they haven’t created any jobs since they got the Bush tax cuts a decade ago. […] [Romney] is, after all, the same guy who said “I’m not concerned about the very poor.” He’s the same guy who said “If you’re looking for free stuff you don’t have to pay for, vote for the other guy.” His denigration of Americans struggling during hard time is entirely on message, just as RNC chairman Reince Preibus said following the release of the video. […]

The Roots Of Romney’s Rage: Where His 47% Fiasco Came From

By Scott A. Hodge

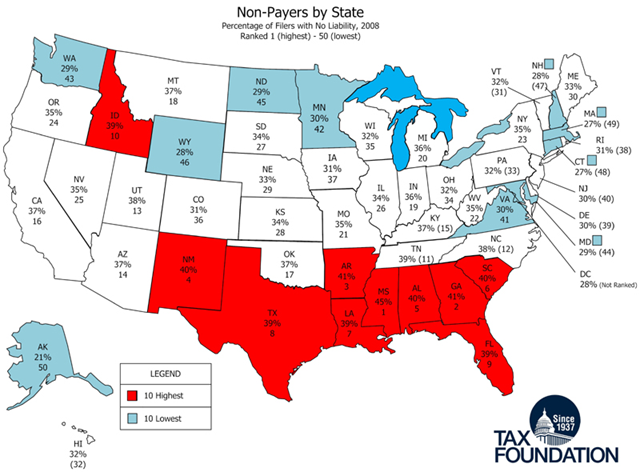

24 May 2010 Fiscal Fact No. 229 Southern States Have Highest Percentages of “Nonpayers”

One of the most reported topics during the latest tax filing season was the record number of Americans who filed an income tax return but had no income tax liability after taking their credits and deductions. According to the latest IRS figures for 2008, a record 52 million filers—36 percent of the 143 million who filed a tax return—had no tax liability because their credits and deductions reduced their liability to zero. Indeed, tax credits such as the child tax credit and earned income tax credit have become so generous that a family of four earning up to about $52,000 can expect to have their income tax liability erased entirely. There are millions of other Americans who have some income but not enough to be required to file a tax return. The Tax Policy Center has estimated that when these people are added to the 52 million nonpaying filers, some 47 percent of all households pay no income taxes at all. New data from the IRS allow us to calculate the number of nonpayers in each state who filed a tax return. Here we compare the percentage of nonpayers in each state, both the absolute number of returns and the percentage of returns filed in each state. […]

States Vary Widely in Number of Tax Filers with No Income Tax Liability Mitt Romney’s America

Republicans are misquoted, "47% of RICH Americans don't pay any taxes …"