Graph of the Day: National Current-Account Balances as a Percentage of World Gross Product, 1996-2013

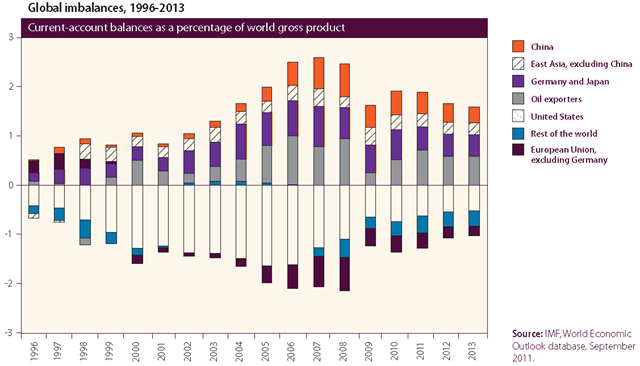

The large and persistent external imbalances in the global economy that have developed over the past decade remain a point of concern for policymakers. Reducing these imbalances has been the major focus of consultations among G20 Finance Ministers under the G20 Framework for Strong, Sustainable and Balanced Growth and the related Mutual Assessment Process (MAP) during 2011. The imbalances have declined during the current economic downturn, but there is concern that in the absence of corrective actions, they will rise again as the world economy recovers. The Cannes Action Plan for Growth and Jobs, adopted by the G20 leaders at the Cannes Summit on 4 November 2011, includes some concrete policy commitments towards such corrective action. In practice, after a substantial narrowing during the Great Recession, the external imbalances of the major economies stabilized at about half of their pre-crisis peak levels (relative to GDP) during 2010-2011 (figure I.9). The United States remained the largest deficit economy, with an estimated external deficit of about $450 billion (3 per cent of GDP) in 2011, but the deficit has come down substantially from the peak of $800 billion (6 per cent of GDP) registered in 2006. The external surpluses in China, Germany, Japan and a group of fuel-exporting countries, which form the counterpart to the United States deficit, have narrowed, albeit to varying degrees. China, for instance, registered a surplus of about $250 billion (less than 4 per cent of GDP) in 2011, dropping from a high of 10 per cent of GDP in 2007. Japan is estimated to have registered a surplus of 2.5 per cent of GDP in 2011, a reduction of one percentage point of GDP compared with the level in 2010 and about half the size of the peak level reached in 2007. While Germany’s surplus remained at about 5 per cent of GDP in 2011, the current account for the euro area as a whole was virtually in balance. Large surpluses, relative to GDP, were still found in oil-exporting countries, reaching 20 per cent of GDP or more in some of the oil-exporting countries in Western Asia. At issue is whether the adjustment of the imbalances in major economies has been mainly cyclical or structural. In the United States, some of the corresponding adjustment in the domestic saving-investment gap seems to be structural. For example, the household saving rate has increased from about 2 per cent of disposable household income before the financial crisis to about 5 per cent in the past few years. Despite a decline in recent months, it is likely that the average saving rate will stay at this level in the coming years, given the changes that have taken place in house financing and the banking sector after the financial crisis. On the other hand, the significant decline in the business investment rate and the surge in the Government deficit in the aftermath of the financial crisis are more likely to be cyclical. Business investment has been recovering slowly, while the budget deficit is expected to decrease somewhat. As a result, in the baseline scenario, the external deficit of the United States may stabilize at about 3 per cent of GDP in the medium run. With regard to the surplus countries, the decline in the external surplus of China has also been driven in part by structural change. China’s exchange-rate policy has become more flexible, with the renminbi appreciating gradually but steadily vis-à-vis the United States dollar over the past year. Meanwhile, the Government has scaled up measures to boost household consumption, aligning the goal of reducing China’s external surplus with that of rebalancing the structure of the economy towards greater reliance on domestic demand. However, the process of rebalancing can be only gradual over the medium to long run so as to prevent it from being disruptive. In Japan, a continued appreciation of the yen has contained its external surplus. In Germany, room remains for policies to stimulate more domestic demand so as to further narrow its external surplus. The surpluses in oil-exporting countries are of a quite different nature from those in other economies, as these countries need to share the wealth generated by the endowment of oil with future generations via a continued accumulation of the surplus into the foreseeable future.