Graph of the Day: Insured catastrophe losses, 1970-2012

ZURICH, 27 March 2013 (Swiss Re) – Natural catastrophes and man-made disasters cost society about USD 186 billion in 2012. Most of the losses were due to Hurricane Sandy, which devastated the northeastern coast of the US. The storm also affected the Caribbean and Canada, making it the largest North Atlantic hurricane on record in terms of wind span. The impact of the winds and ensuing flooding from the storm surge caused about USD 70 billion in economic losses. Last year, Italy suffered the most damaging earthquake in its history in terms of total economic losses. The earthquake caused significant property damage and disrupted local manufacturing activity, estimated to be over USD 16 billion. Man-made disasters are estimated to have caused roughly USD 8 billion in damages. The cruise liner Costa Concordia running aground off the Tuscan coast in Italy and damaging fires and explosions on drilling platforms and in other oil and gas facilities were among the costliest man-made disasters of 2012.

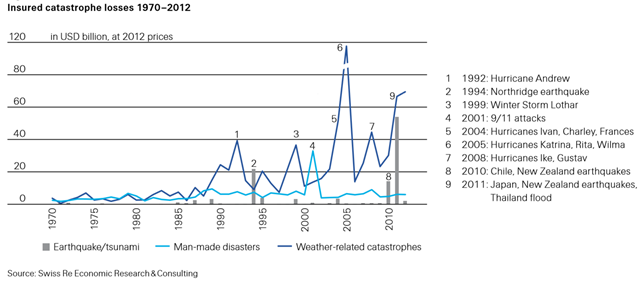

Insured losses of USD 77 billion make 2012 the third most expensive year ever

Of the USD 186 billion in total damage caused by catastrophic events in 2012, more than USD 77 billion (see Figure 3), were covered by insurance. According to the sigma records, this makes 2012 the third-most expensive year for the insurance industry, after 2011, the year in which record earthquakes and floods contributed to losses of over USD 126 billion, and 2005, when Hurricanes Katrina, Wilma, and Rita alone caused claims of over USD 100 billion. Most of the losses in 2012 resulted from weather-related events in the US, such as Hurricane Sandy, the drought in the Corn Belt.

Of the USD 71 billion insured losses from natural catastrophes, USD 69 billion were due to weather-related events, while roughly USD 2 billion were triggered by earthquakes.

Nine disasters triggered insured losses of USD 1 billion or more in 2012 (see Table 4, page 19). For the first time since 2008, a hurricane – Sandy – was the costliest event with insured losses of USD 35 billion. This figure includes USD 20 to 25 billion of private insurance industry loss and flood claims covered by the National Flood Insurance Program (NFIP). The second largest insured loss was the drought in the US, which caused an estimated insured loss of USD 11 billion including the payouts from the Federal scheme. Among the other events were tornado outbreaks and a violent line of storms in the Great Plains, Texas and Southeast/Ohio Valley. The largest loss outside the US was triggered by the deadly earthquake shocks in Italy in May. Of the man-made insured losses of roughly USD 6 billion in 2012, the biggest were the cruise liner Costa Concordia running aground in January, fires at offshore drilling platforms in Nigeria and in the North Sea, the explosion at a large oil refinery in Venezuela and explosions at various chemical plants.