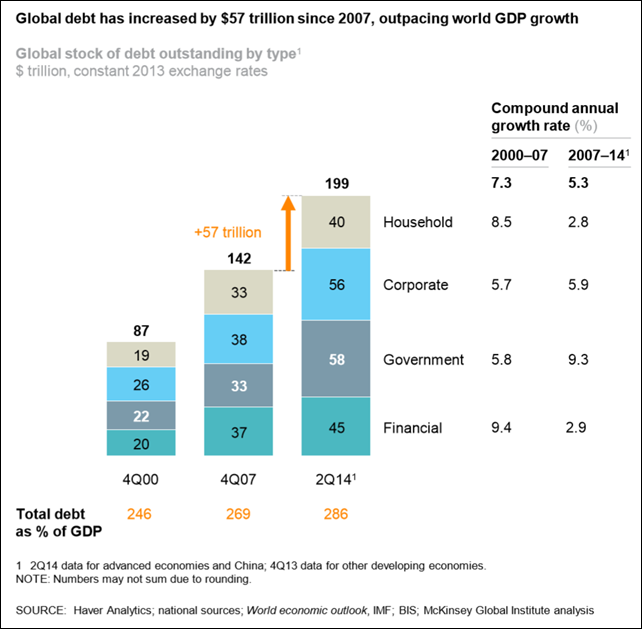

Global debt increased by $57 trillion since 2007, outpacing world GDP growth – China debt quadrupled

February 2015 (McKinsey Global Institute) – Seven years after the bursting of a global credit bubble resulted in the worst financial crisis since the Great Depression, debt continues to grow. In fact, rather than reducing indebtedness, or deleveraging, all major economies today have higher levels of borrowing relative to GDP than they did in 2007. Global debt in these years has grown by $57 trillion, raising the ratio of debt to GDP by 17 percentage points (Exhibit 1). That poses new risks to financial stability and may undermine global economic growth. A new McKinsey Global Institute (MGI) report, Debt and (not much) deleveraging [pdf], examines the evolution of debt across 47 countries—22 advanced and 25 developing—and assesses the implications of higher leverage in the global economy and in specific sectors and countries. The analysis, which follows our July 2011 report Debt and deleveraging: The global credit bubble and its economic consequences and our January 2012 report Debt and deleveraging: Uneven progress on the path to growth, focuses on the debt of the “real economy”: governments, nonfinancial corporations, and households. It finds that debt-to-GDP ratios have risen in all 22 advanced economies in the sample, by more than 50 percentage points in many cases (Exhibit 2). In our study, we pinpoint three areas of emerging risk: the rise of government debt, which in some countries has reached such high levels that new ways will be needed to reduce it; the continued rise in household debt—and housing prices—to new peaks in Northern Europe and some Asian countries; and the quadrupling of China’s debt, fueled by real estate and shadow banking, in just seven years. [more]