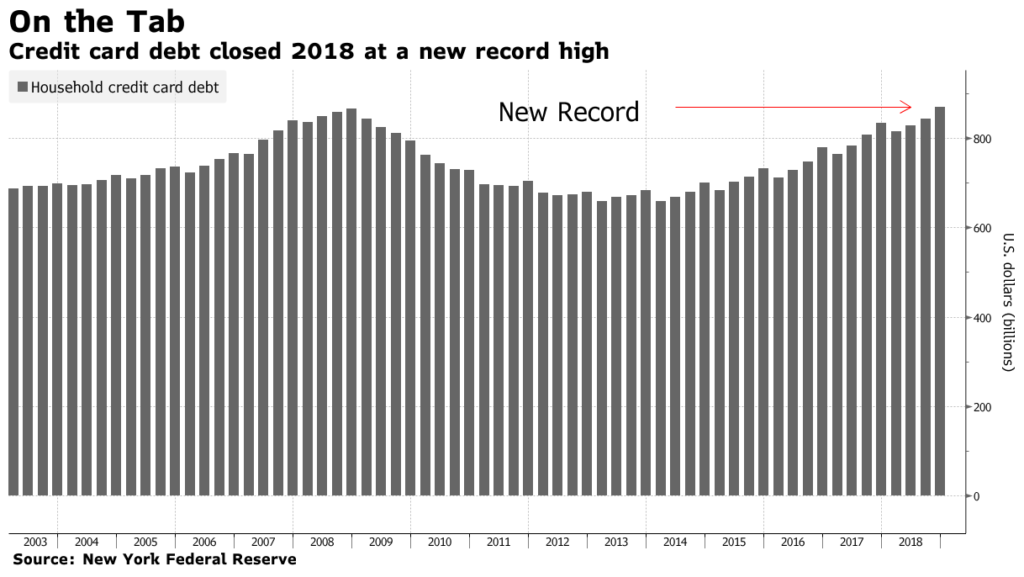

U.S. credit card debt closed 2018 at a record $870 billion – Overall consumer debt reached a record $13.5 trillion

By Alexandre Tanzi

5 March 2019

(Bloomberg) – U.S. credit card debt hit $870 billion — the largest amount ever — as of December 2018, according to the data from the Federal Reserve. Credit card balances rose by $26 billion from the prior quarter.

“The increase in credit card balances is consistent with seasonal patterns but marks the first time credit card balances re-touched the 2008 nominal peak,” according to the report.

Nearly 480 million credit cards are now in circulation — up by more than 100 million since hitting bottom after the recession a decade ago.

At the end of last year, credit cards were the fourth-largest portion of consumer debt in the U.S. after mortgage, student loan, and auto debt. But the quarterly increase in credit card debt was faster than the other categories. Overall debt reached a record $13.5 trillion. […]

Older Americans are holding a significant portion of credit card debt, with those over age 60 accounting for about 30 percent of the total. [more]