A record 7 million Americans are 3 months behind on their car payments, a red flag for the economy

By Heather Long

12 February 2019

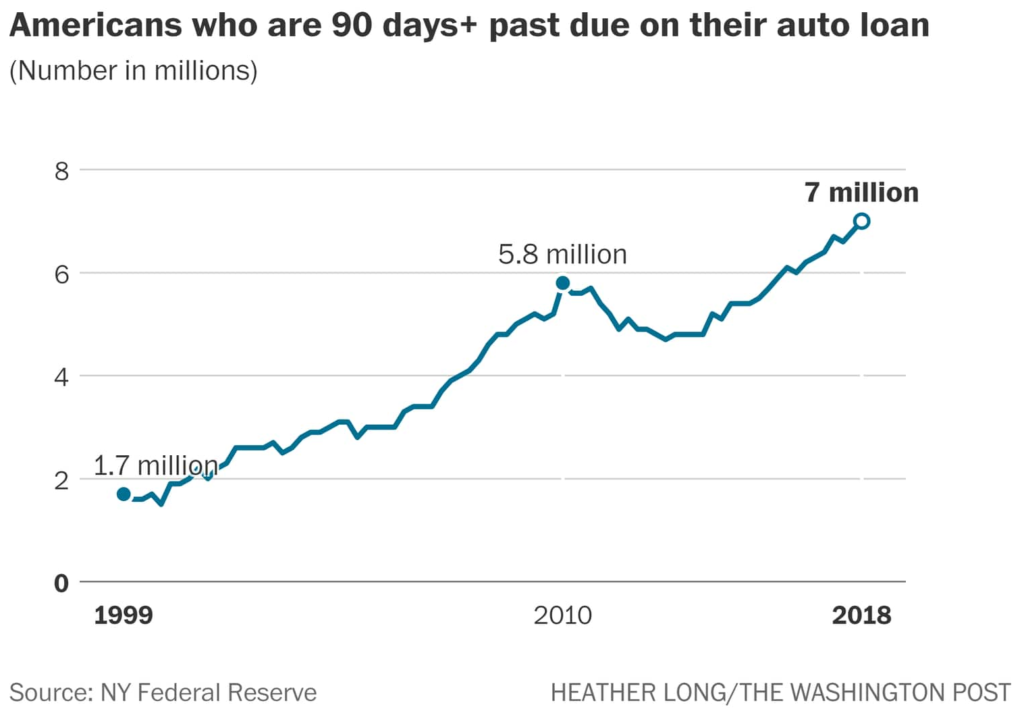

(The Washington Post) – A record 7 million Americans are 90 days or more behind on their auto loan payments, the Federal Reserve Bank of New York reported Tuesday, even more than during the wake of the financial crisis.

Economists warn that this is a red flag. Despite the strong economy and low unemployment rate, many Americans are struggling to pay their bills.

“The substantial and growing number of distressed borrowers suggests that not all Americans have benefited from the strong labor market,” economists at the New York Fed wrote in a blog post.

A car loan is typically the first payment people make because a vehicle is critical to getting to work, and someone can live in a car if all else fails. When car loan delinquencies rise, it is usually a sign of significant duress among low-income and working-class Americans.

“Your car loan is your No. 1 priority in terms of payment,” said Michael Taiano, a senior director at Fitch Ratings. “If you don’t have a car, you can’t get back and forth to work in a lot of areas of the country. A car is usually a higher-priority payment than a home mortgage or rent.” [more]

A record 7 million Americans are 3 months behind on their car payments, a red flag for the economy