Graph of the Day: Credit Crisis Indicators

From Calculated Risk:

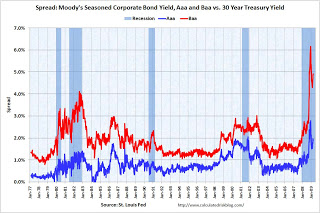

Here is a quick look at a few credit indicators: First, the British Bankers’ Association reported that the three-month dollar Libor rates were fixed at 1.166%. The LIBOR was at 1.30% a couple of weeks ago, and peaked at 4.81875% on Oct 10, 2008. This is near the January 14th low of 1.0825%. The graph shows the spread between 30 year Moody’s Aaa and Baa rated bonds and the 30 year treasury. There has been some increase in the spread the last few weeks, but the spread is still below the recent peak. The spreads are still very high, even for higher rated paper, but especially for lower rated paper. Of course the default risk has increased significantly, especially for lower rated paper. Yesterday, Moody’s warned of the worst corporate default rate since at least WWII. …