Drops of climate finance start to fill an ocean of need – “When you see the announcements, it never feels significant enough”

By Simon Jessop and Aidan Lewis

22 November 2022

SHARM EL-SHEIKH, Egypt (Reuters) – The biggest deal to date to forge the kind of private-public sector low-carbon collaboration sought at U.N. climate talks promises $20 billion to shut down Indonesian coal-fired power plants – and it’s a drop in the ocean.

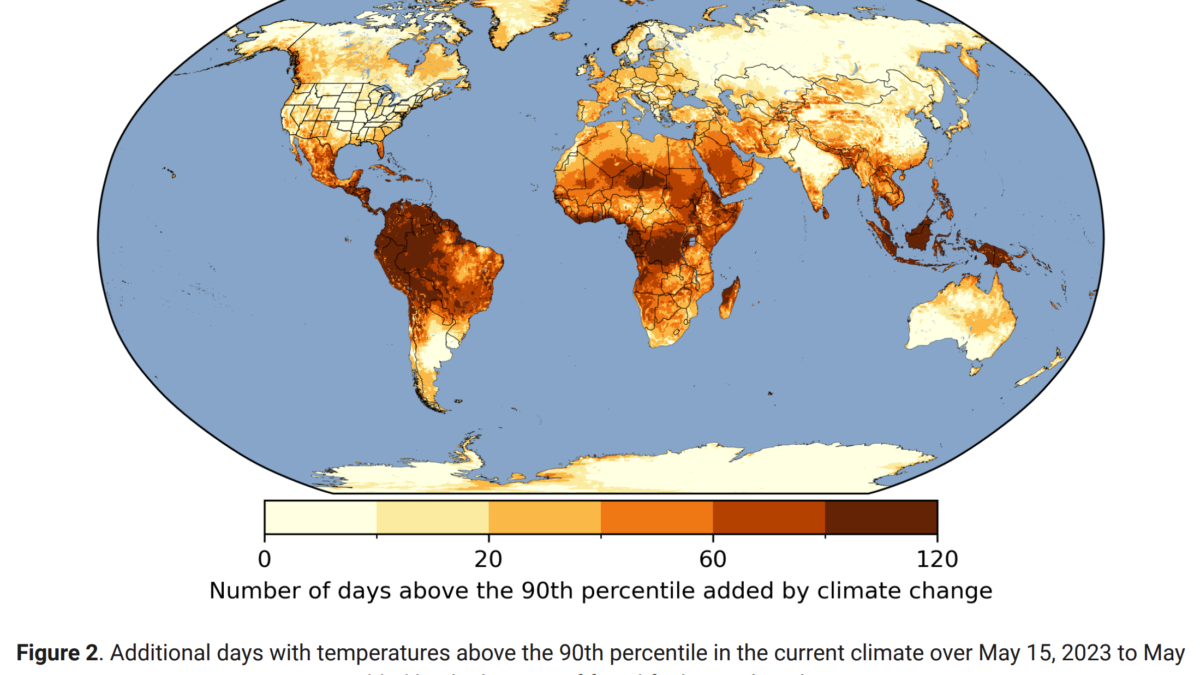

Estimates of how much external funding emerging nations need to adapt to the ravages of climate change are around $1 trillion a year by 2030, one report released during the COP27 conference that ended at the weekend found.

Most of the deals sealed on the sidelines were relatively small, though the Egyptian hosts, who retain oversight of the U.N. process until COP28 in the United Arab Emirates next year, hope to have laid the foundations for more.

“When you see the announcements, it never feels significant enough. And pretty much as soon as the announcements are made, there’s that feeling that … it’s a drop in the ocean of what’s required,” said Rob Doepel, UK and Ireland Managing Partner for Sustainability at consultants EY.

The Indonesian deal, announced at G20 talks in Indonesia that overlapped with COP27, brings together public and private money and is more than double the $8.5 billion pledged for a similar agreement with South Africa at climate talks in 2021.

Both are badged as a Just Energy Transition Partnership (JET-P) – one of the many types of financing that have been engineered by those trying to bridge the enormous climate financing gap.

Getting the second JET-P done during COP27 was seen to have injected energy into the U.N. negotiations on helping developing countries finance their shift to low-carbon energy.

At Sharm el-Sheikh, what many climate campaigners saw as an unambitious final deal was redeemed by agreement on a “loss and damage” fund to help developing countries. It tempered the bitterness caused by the rich world’s failure to meet a pledge to provide $100 billion a year in climate finance to emerging markets.

In 2020 it paid only around $83 billion, the Organisation for Economic Co-operation and Development’s most recent estimate found.

The hope of the wealthy nations is that leveraging private sector money will ultimately prove to be enough.

Governments are particularly keen for private investors to contribute to what they call “blended finance”, whereby states or development agencies form partnerships with the private sector to deliver projects such as solar power or helping farmers struggling with drought to switch to less water-intensive crops.

So far, the biggest cheques are still being written by governments.

“We need to get better coordination between public and private moving at the same time,” EY’s Doepel said. [more]

Analysis: Drops of climate finance start to fill an ocean of need