China’s superrich decimated as economic downturn wipes out billions – “This year has seen the biggest fall in the Hurun China Rich List of the last 24 years”

By John Feng

8 November 2022

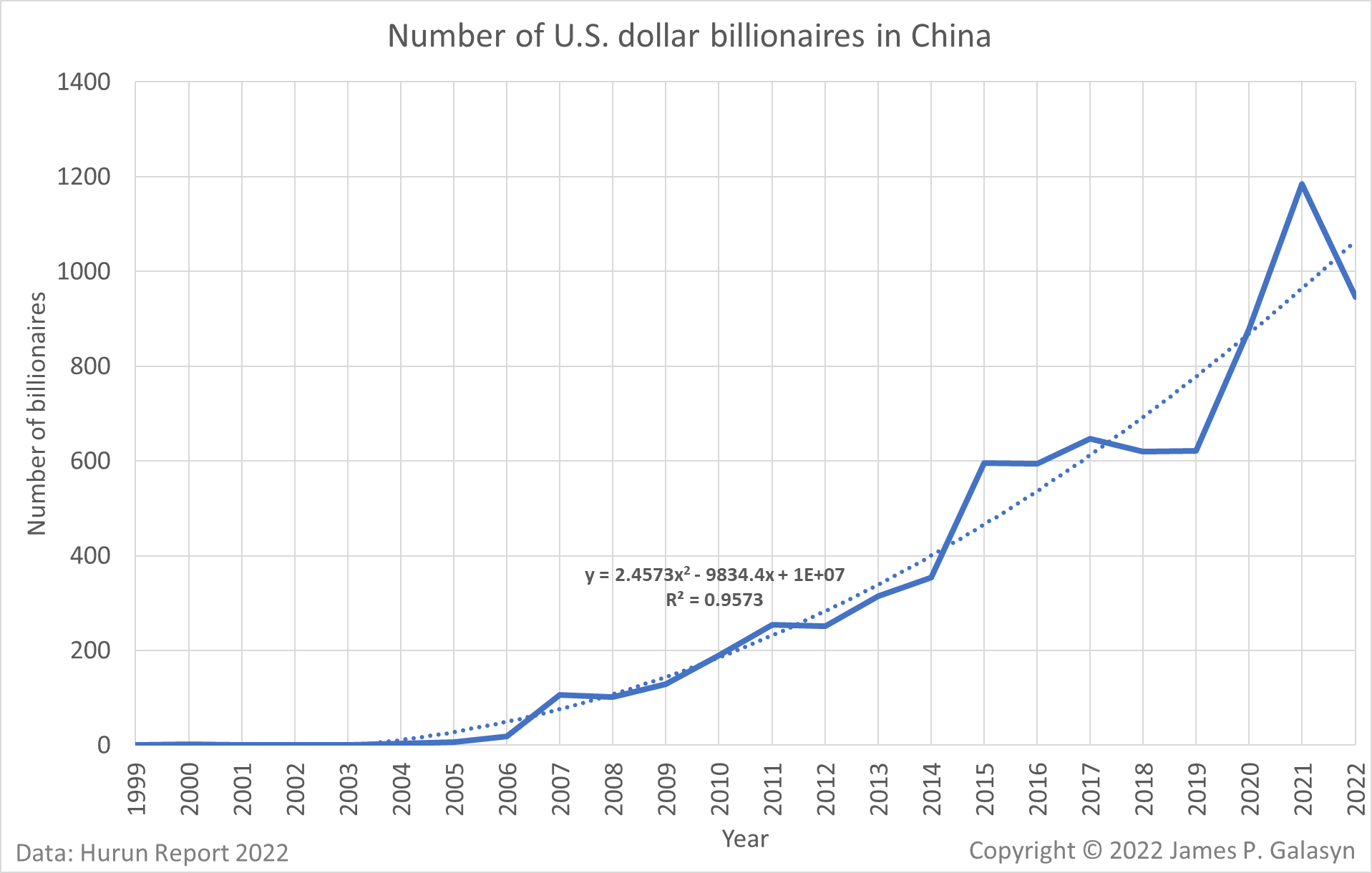

(Newsweek) – China’s wealthy lost hundreds of billions of dollars in 2022 as the global economic downturn also shook up the country’s typically high-growth industries, according to an annual rich list published on Tuesday.

The number of Chinese entrepreneurs worth 5 billion Chinese yuan ($710 million) or more on September 15 fell by 11 percent, or 160 people, to 1,305, compared to the same time in 2021, said Hurun Report 2022, which is led by Rupert Hoogewerf.

Their collective wealth dropped 18 percent to $3.5 trillion, while 293 people dropped off 2022’s China rich list altogether, said the report. Those in China’s real estate and healthcare industries suffered the biggest losses.

Over the same period, China’s dollar billionaire club—the first country to top 1,000 people—dropped by 239 individuals to 946, Hurun said.

Topping Hurun’s rich list for the second year in a row was billionaire businessman Zhong Shanshan, 68, owner of the Nongfu Spring bottle water company, whose net worth rose 17 percent to $65 billion.

Retaining the second and third spots were Zhang Yiming, 39, founder of TikTok developer ByteDance, and Robin Zeng, 54, chairman of electric battery maker Contemporary Amperex Technology, but the economic slowdown wiped hundreds of billions of dollars from their wealth, the report said.

Zhang was now worth $35 billion and Zeng $32.9 billion, both down 28 percent from 2021.

According to Hurun’s figures, the biggest loss was suffered by Yang Huiyan, 41, majority shareholder of the Yang family’s real-estate development firm Country Garden Holdings. Her net worth decreased by $15.7 billion, enough to see her drop out of 2022’s top 20.

Pony Ma, 51, co-founder of Chinese tech and entertainment giant Tencent, lost $14.6 billion in 2022, the second-biggest drop, while the net worth of Forrest Li, 44, boss of tech conglomerate Sea, was down $13.7 billion. Ma dropped from fourth to fifth on the rich list.

“This year has seen the biggest fall in the Hurun China Rich List of the last 24 years,” Hoogewerf, Hurun’s chair and chief researcher, said in a press release.

“Part of the reason has been a global-economy downturn, led by the fallout from the Russia-Ukraine war, a sharp drop in tech prices and the generally slow post-COVID economic recovery,” he explained, “but also at the national level, the continued disruptions to the economy from localized COVID outbreaks.”

“The result? China’s stock market has fallen sharply,” Hoogewerf added, “with the Hang Seng Index and Shenzhen Component Index falling by more than 20 percent compared with the same period last year, and the Shanghai Composite Index also falling by more than 10 percent.” [more]

China’s Superrich Decimated as Economic Downturn Wipes out Billions

Hurun China Rich List 2022

8 November 2022 (Hurun Research Institute) – The Hurun Research Institute today released, in association with premium baijiu brand Hengchang Shaofang, the Hurun China Rich List 2022, a ranking of the richest individuals in China. The cut-off was CNY 5 billion (equivalent to US$710 million), and wealth calculations are from 15 September. This is the 24th year of the list.

This is a brief translation from the original Chinese-language press release, which can be found on www.hurun.net.

Hurun Research found 1,305 individuals with more than CNY 5 billion (equivalent to US$710 million), down 11% (160 individuals) from last year. The total wealth of the listed entrepreneurs dropped 18% from last year to US$3.5tn. Only 411 entrepreneurs saw their wealth increase, of which 133 were new faces. 1,187 saw their wealth decrease or remain unchanged, of which 293 dropped off the list this year. The Top 3 cities with the highest concentration of entrepreneurs on the list were Beijing, Shenzhen and Shanghai, followed by Hong Kong and Hangzhou. The average age is 58, two years older than last year.

Over the past year, global stock markets have tumbled amid a combination of shocks, including the Russia-Ukraine war, the Federal Reserve’s interest rate hikes and repeated Covid-19 outbreaks across China. As of 15 September 2022, both the Nasdaq and Hang Seng indices were down 24% from the same period last year, the Shenzhen Component Index was down 21%, and the Shanghai Composite Index was down 12 %. The renminbi fell 8% against the dollar.

Rupert Hoogewerf, Hurun Report Chairman and Chief Researcher, said:

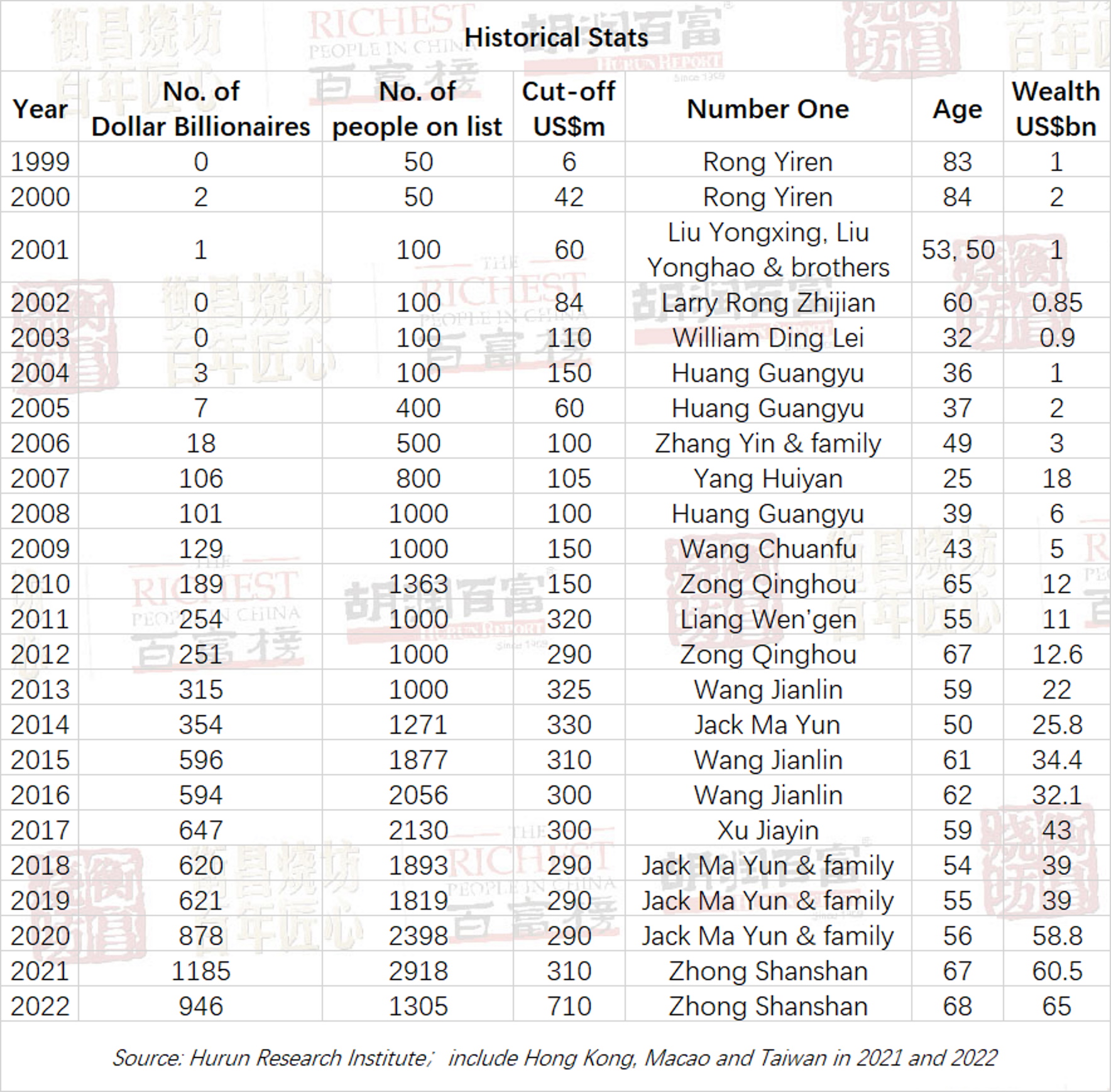

“This year has seen the biggest fall in the Hurun China Rich List of the last 24 years with the overall number of individuals down more than 10% and their wealth down by nearly 20%, driven largely by the drop in real estate and healthcare entrepreneurs. Part of the reason has been a global economy downturn, led by the fallout from the Russia-Ukraine war, a sharp drop in tech prices and the generally slow post-Covid economic recovery, but also at the national level, the continued disruptions to the economy from localised Covid outbreaks. The result? China’s stock market has fallen sharply, with the Hang Seng Index and Shenzhen Component Index falling by more than 20% compared with the same period last year, and the Shanghai Composite Index also falling by more than 10%. However, it is worth noting that although the number of individuals has decreased so much, it is still nearly 50% more than five years ago, four times that of ten years ago, and more than 400 times that of twenty years ago.”

“Where was growth coming from? More than 400 entrepreneurs saw their wealth increase over the past year, mainly in the sectors of Industrial Products, F&B and Energy.”

“The post-pandemic economy has seen a number of pandemic ‘winners’, such as California-based Eric Yuan Zheng of video conference platform Zoom, and Jiang Rensheng of vaccine maker Zhifei, drop in value, with both Yuan and Jiang losing US$10bn in the past year.”

“The number of entrepreneurs who made their fortunes from real estate continues to drop, from making up 50% of the Hurun China Rich List twenty years ago to 20% ten years ago, 15% five years ago, and 10% this year. Healthcare is on the rise, up from 6% a decade ago to 9% this year, the third largest source of wealth on the list. Industrial Products still makes up the largest source of wealth, accounting for 13% of the list.”

“Overall, the proportion of ‘hidden heroes’, entrepreneurs that sell to businesses directly rather than to consumers, has increased significantly in the past two years, with 58% of the list this year ‘hidden heroes’, such as battery maker Robin Zeng Yuqun of CATL, which serves the new energy vehicle industry. 42% sell directly to consumers, such as Zhong Shanshan of Nongfu Spring and Pony Ma of Wechat, part of the Tencent Group.”

“The average Hurun Rich Lister is 58 years old, which means they were born on average in 1964, started out with their first business in 1993 (aged 29) and made the Hurun China Rich List for the first time in 2011 (aged 47).”

“Entrepreneurs born in the 1990s are good at serving young consumer groups. This year, 3 self-made individuals from the 1990s generation made the list, two of which are from the new consumer sector.”

“The preferred cities to live in for Hurun Rich Listers are the ‘Big Three’ of Beijing, Shenzhen and Shanghai, plus 2 (HK and Hangzhou) plus 5 (Guangzhou, Suzhou, Ningbo, Foshan and Taipei).”

“Nothing grabbed world headlines quite like the story of HK-based Calvin Choi, 44, after the July flotation of AMTD Digital. Despite revenues of only US$20 million and with only 50 employees, AMTD Digital surged to an astronomic valuation of just under US$500bn, making it for a couple of days one of the Top 10 most valuable companies on the planet from an IPO price of only US$1.5bn. This in turn made Choi one of the three richest people in China, although in the past two months, AMTD Digital has dropped down to just under US$4bn and Choi’s wealth to just under US$1bn.”

“Shanghai-based Qi Zhenbo of MCN platform Mei One has had a rollercoaster of a year. Qi must have breathed a sigh of relief when his star influencer Austin Li Jiaqi returned to live-streaming after a three month break in the summer and with their main competitor Viya off air for tax evasion, Qi and Li have a big opportunity to take a bigger market share. Qi’s wealth is calculated at US$2.5bn.”

“Former Number One Xu Jiayin of Evergrande has continued to sell off assets to pay off a reported US$300bn of debt. The latest sale is a house overlooking Hyde Park in London, listed for over US$200 million. Xu’s wealth is down a further 60% to US$4bn, more than 90% down from his peak in 2017 of US$43bn.”

“Think of the Hurun China Rich List as a snapshot of China’s private sector, with this year’s ‘photo’ taken on 15 September. Whilst wealth is always changing, in the past fortnight, the changes were more extreme, driven by US interest rate hikes and the general outlook of the China economy. The HK Hang Seng index dropped a further 19%, whilst Shanghai and Nasdaq were down 6% and 9% respectively, with China stocks on the US stock markets taking an especial battering. Pony Ma Huateng and Ding Lei saw their wealth drop a further 30%, Jack Ma Yun and Colin Huang Zheng were down a further 20%. Robin Zeng Yuqun, He Xiangjian and Qin Yinglin were down about 10%. Some barely changed, including Number One Zhong Shanshan and Wang Chuanfu, who just by staying the same ought now to be in the Top 10.”

“Wealth creation in China has changed dramatically in recent years. Only 30% of this year’s list were on the list ten years ago, meaning that 70% of entrepreneurs are new faces from the past decade. In the Top 10 from 20yrs ago, nobody is still in the Top 10 today, only Pony Ma is still there from ten years ago and Pony Ma, Jack Ma, He Xiangjian and William Ding Lei are still there from five years ago. Overall there have been 3,900 new faces this decade.”

“Wealth creation and philanthropy, This past year, several Hurun rich listers gave to the Henan flood relief efforts, with the biggest donations given by He Xiangjian of Midea, Qin Yinglin of Muyuan and Wang Xing of Meituan. There has also been an increase in establishing their own foundations, such Fujian-based Ding Shizhong of Anta.”

“Inheritance is on the rise. 7% of those on this year’s list inherited their wealth, compared with 6% last year. China will pass on the equivalent of US$7.2tn of wealth to the next generation over the next 20 years.”

“This year saw the largest number of individuals drop off the Hurun Rich List since records began 24 years ago. A closer look at the data shows that the Hurun Rich List has dropped twice a decade, in 2002 and 2008, then again in 2012 and 2018, and with this year already down, perhaps the next drop will be in 2028 and then 2032 and 2038, etc…? When looking at the fast growths of the Hurun Rich List we spotted two trends: the first was 2000 and 2001, then 2010 and 2011, next up were 2020 and 2021, which suggests that 2030 and 2031 ought to be good growth years. The second growth trend was 2005-07 and again 2015-17, suggesting that the next one is 2025-27!”

“Hurun Report has been promoting entrepreneurship through its lists and research since 1999. The rich list is annual snapshot of China’s private sector. The stories of these entrepreneurs tell the story of China’s economy. I would like to thank our title sponsor Hengchang Shaofang, a premium baijiu brand from the Maotai region, for partnering with us for the third year running.”

Deng Hong, chairman of Global Premium Wines and Spirits Group, said: “Quality, brand, scale and planning for the long-term lie at the core of Hengchang Shaofang’s hundred-year history. This, coupled with the operational strength of Global Premium Wines and Spirits Group, has won plaudits from the market.”