Droughts, Ukraine war push global grain stocks toward worrying decade low – “It’s lining up to be like 2012. No one wants to admit it, but it’s true.”

By Tom Polansek

26 September 2022

CHICAGO (Reuters) – The world is heading toward the tightest grain inventories in years despite the resumption of exports from Ukraine, as the shipments are too few and harvests from other major crop producers are smaller than initially expected, according to grain supply and crop forecast data.

Poor weather in key agricultural regions from the United States to France and China is shrinking grain harvests and cutting inventories, heightening the risk of famine in some of the world’s poorest nations.

Importers, food manufacturers and livestock producers had hoped crop availability would improve after war-torn Ukraine resumed shipments from Black Sea ports this summer and U.S. farmers planted large crops. But the United States, the world’s top corn producer, is now expected to harvest its smallest corn crop in three years. Drought also punished European harvests and is threatening South America’s upcoming planting season.

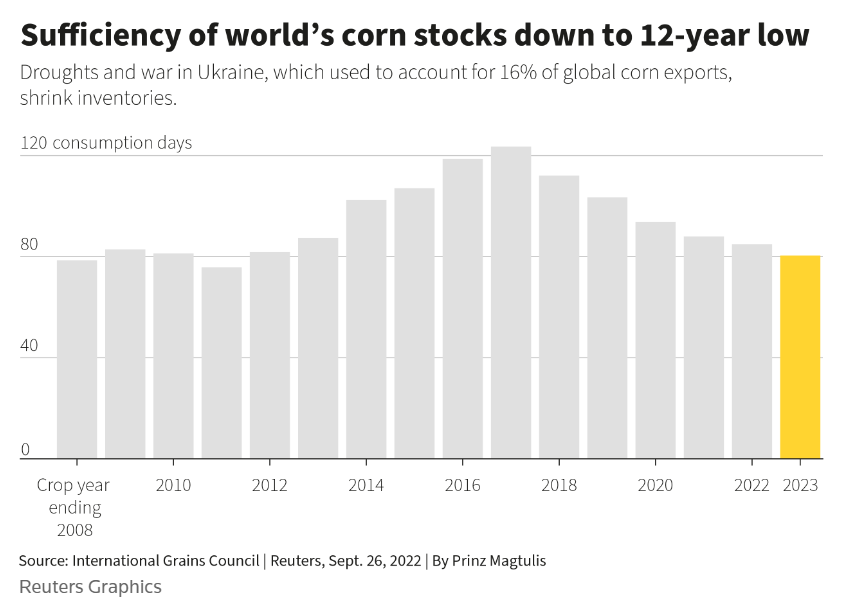

By the end of the 2022/23 crop year, the world’s buffer stocks of corn will be enough for just 80 days’ worth of consumption, down 28% from five years ago and the lowest level since 2010/11, according to figures compiled for Reuters by the International Grains Council, an intergovernmental organization.

That would be fewer days of corn stocks than the world had in 2012, when the last global food crisis spurred riots.

Policymakers are worried.

The World Bank has earmarked $30 billion to help offset food shortages worsened by war, and U.S. President Joe Biden last week announced nearly $3 billion in additional funding to combat global food insecurity.

Half a million Somali children face hunger in the worst famine anywhere this century, according to the United Nations, as a severe drought grips the Horn of Africa.

Thousands of miles away in the United States, South Dakota corn grower Mark Gross expects to harvest as few as 20 bushels per acre on some fields this autumn, down more than 80% from the local average last year, after drought and fierce winds ravaged his land.

Gross said the weather remained too dry in the spring and then two derecho windstorms brought destructive 100-mile-per-hour (160 kph) gusts across fields in Hutchinson County and southeastern parts of the state.

“It’s lining up to be like 2012,” Gross said. “No one wants to admit it, but it’s true.”

Tight grain supplies reflect the impact of climate change on crop production as well as growing global demand for livestock that feed on corn, eating away at stockpiles. Inventories of all harvested grain on hand globally will reach an eight-year low at the end of this crop year, the International Grains Council said on Thursday.

More poor weather could further reduce global inventories, particularly if the current dry weather in South America continues into the main planting season, as the crop cycle shifts to the southern hemisphere.

Crop forecasts in Argentina, the world’s No. 3 corn exporter, are already being scaled back due to dry weather.

‘Very little water’

In the Mayenne region in northwestern France, the European Union’s top grain-producing country, farmer Dominique Defay, said some corn plants have few ears and he is bracing for a crop 35% below his average.

He had been hoping for at least 135 bushels per acre, near the low-end of his five-year average. He may get only about 90 bushels after France suffered its worst recorded drought since 1958.

“These are crops that have had very little water,” Defay said.

On average less than 1 cm of rain fell across France in July. River tributaries dried up as successive heatwaves and wildfires devastated the countryside.

EU production is expected to hit a 15-year low, a decline that will push the bloc to increase 2022/23 imports from Ukraine by about 30% from the previous year to 10.4 million tonnes, consultancy Strategie Grains said.

Bigger European import demand means less for places like the drought-stricken Horn of Africa.

Ukraine’s exports of corn and wheat have risen since a U.N.-brokered deal with Russia allowed shipments to restart from ports that had been blockaded since the war started. But it remains to be seen how much Ukraine can export, especially if the war drags on.

“It’s sort of a false hope that Ukraine is going to bridge the current gap in supply and demand,” said Gary Blumenthal, head of Washington-based agricultural consultancy World Perspectives.

Ukraine is expected to harvest 25 to 27 million tonnes of corn in 2022, down from 42.1 million tonnes in 2021, following Russia’s invasion, according to official estimates.

Sanctions related to the war mean Russia has also struggled to export what is expected to be a record-large wheat crop.

Shipments of wheat and other agricultural products from Ukraine have been a fraction of pre-war levels, said Kevin Hack, a global vice president for ingredients supplier Univar Solutions (UNVR.N).

“The supply that’s coming from that area can be cut off at a moment’s notice,” he said. [more]

Droughts, Ukraine war push global grain stocks toward worrying decade low