FAO alarmed by uncertainty over wheat harvest in Ukraine – “War could seriously escalate food insecurity globally, when international food and input prices are already high and volatile”

By Marta Rullan

26 March 2022

ROME (EFE) – The planting of the next wheat season in Ukraine, “which could significantly affect world food insecurity, is still extremely uncertain” because of the war, the director general of the United Nations Food and Agriculture Organization (FAO), Qu Dongyu, told EFE, who was also very concerned about next June’s harvest. [FAO report: The importance of Ukraine and the Russian Federation for global agricultural markets and the risks associated with the current conflict 25 March 2022 Update]

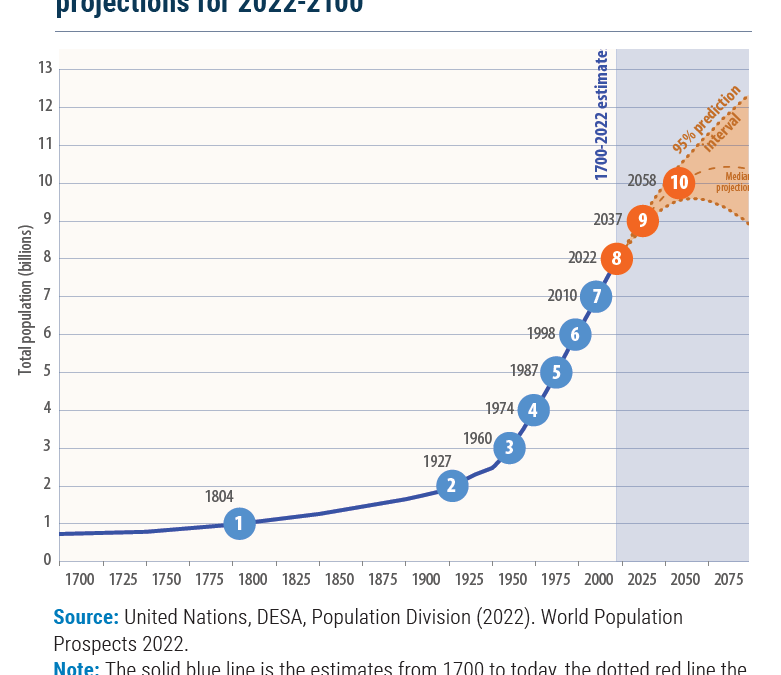

“Right now the major concern is to finish the harvest period by June and to start the next planting season,” Qu said, pointing out that Russia and Ukraine together provide more than a third of the world’s grain exports and that wheat is a staple food for more than 35% of the world’s population.

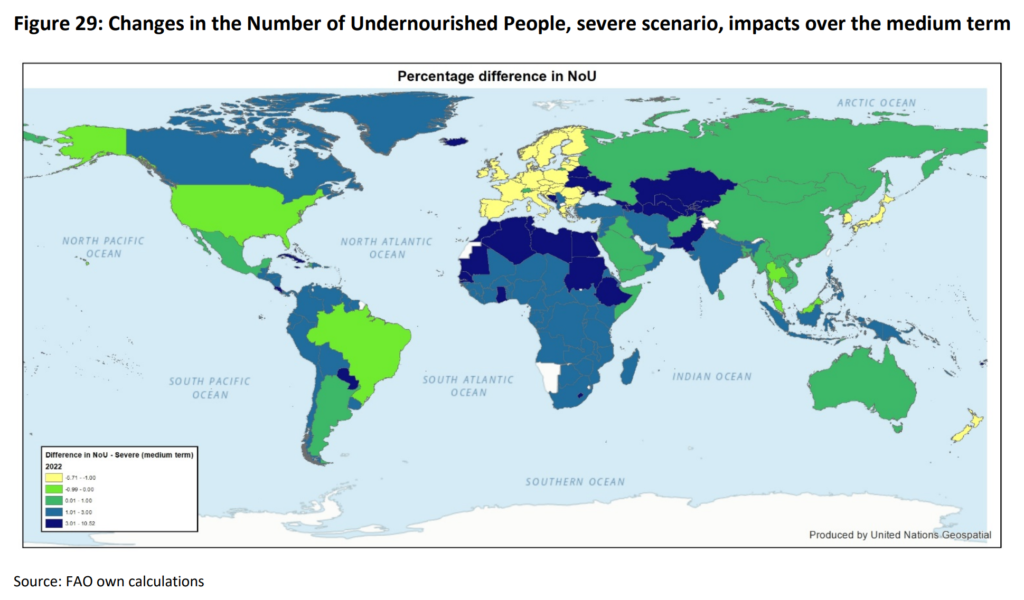

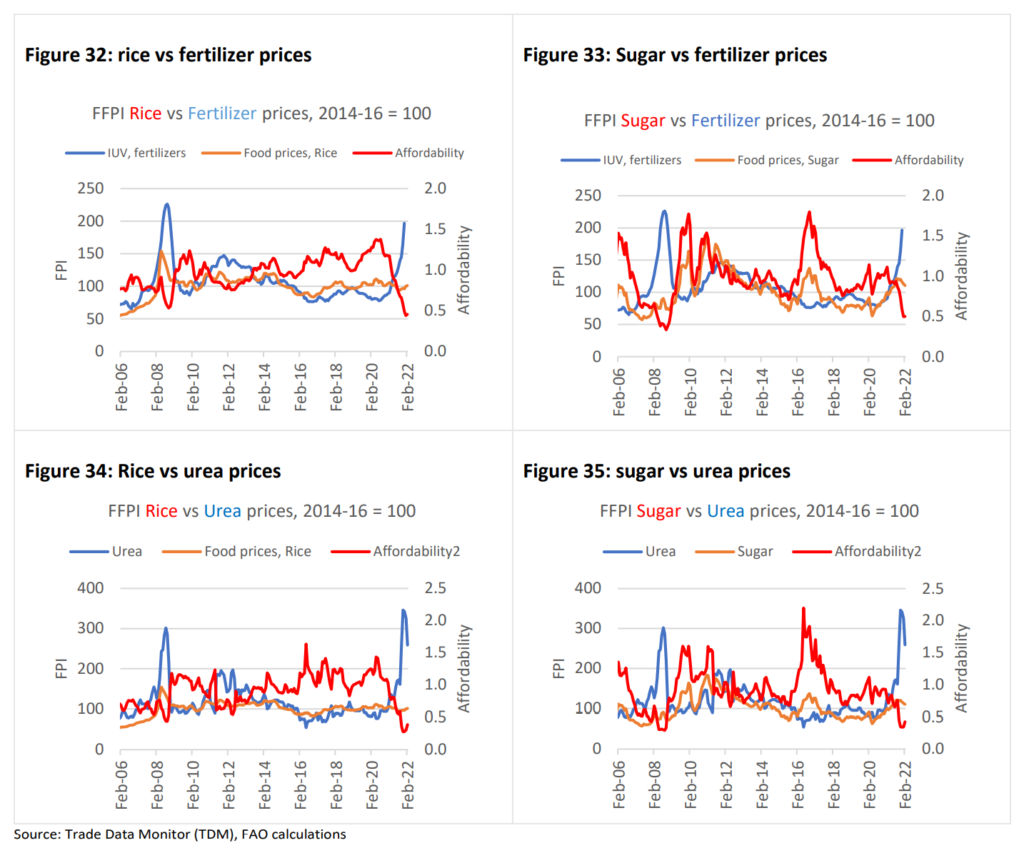

A “sudden and steep reduction in wheat exports” from both countries because of the war “could seriously escalate food insecurity globally, when international food and input prices are already high and volatile” and “it is still unclear whether other exporters would be able to fill this gap.”

Stocks are running low

Qu explained that Russia is the world’s largest wheat exporter and Ukraine the fifth largest: together they supply 19% of the world’s barley, 14% of wheat and 4% of corn. They are also the main suppliers of rapeseed and account for 52% of the global sunflower oil export market, while the world’s fertilizer supply is also highly concentrated, with Russia the main producer.

“Wheat inventories are already running low in Canada, and exports from the United States, Argentina, and other countries are likely to be limited as governments will try to ensure domestic supply,” while those from import-dependent countries such as Egypt, Turkey, Bangladesh and Iran, which buy more than 60% of their wheat from Russia and Ukraine, will increase, “adding further pressure on global supplies”.

Tunisia, Yemen, Libya, and Pakistan also rely heavily on those two countries for their wheat supplies, the FAO official said, before adding that the “global maize trade is likely to shrink due to expectations that the export loss from Ukraine will not be filled by other exporters, and because of high prices.”

Harvesting and planting

“Whether farmers in Ukraine would be able to harvest and deliver the remaining exports of cereals to the market is unclear. Massive population displacement has reduced the number of agricultural laborers and workers. Accessing agricultural fields would be difficult,” the director general said of next June’s harvest, before adding that livestock and poultry farming and fruit and vegetable production would also be “constrained.”

He added that Ukrainian Black Sea ports “are no longer viable” and even “if inland transport infrastructure remains intact, shipping grain by rail would be impossible because of a lack of an operational railway system.”

“Rising insurance premiums for the Black Sea region would exacerbate the already high costs of shipping, compounding the costs of food imports. Whether storage and processing facilities would remain intact and staffed is also still unclear,” the FAO director-general SAID.

“With regards to planting for the next season, which could significantly affect world food insecurity, this is still extremely uncertain and will depend on” several factors, notably “how fast the conflict stops and the conditions in which it stops,” as well as “on the level of damage to the logistical infrastructure of the agricultural system in Ukraine, the ability to make seeds, fertilizers and all necessary inputs available, and the ability of the agricultural labor force to resume its activities.”

Rising prices

Qu stressed that while Russia’s Black Sea ports “are open for now, and no major disruption to agricultural production is expected in the short term,” the sanctions on Moscow “have caused an important depreciation which, if continued, could undermine productivity and growth and ultimately further elevate agricultural production costs.”

The UN agency’s top official also referred to the negative impact of higher energy prices on the agricultural sector due to the war: “Russia is a major player in the global energy market, accounting for 18% of global coal exports, 11% of oil, and 10% of gas. Agriculture requires energy through fuel, gas, electricity use, as well as fertilizers, pesticides, and lubricants. Manufacturing feed ingredients and feedstuffs also require energy.”

To address this situation, FAO has indicated five policy recommendations: “keep global food and fertilizer trade open”, “find new and more diverse food suppliers”, “support vulnerable groups, including internally displaced people”, “avoid ad hoc policy reactions” and “strengthen market transparency and dialogue”, it concluded.