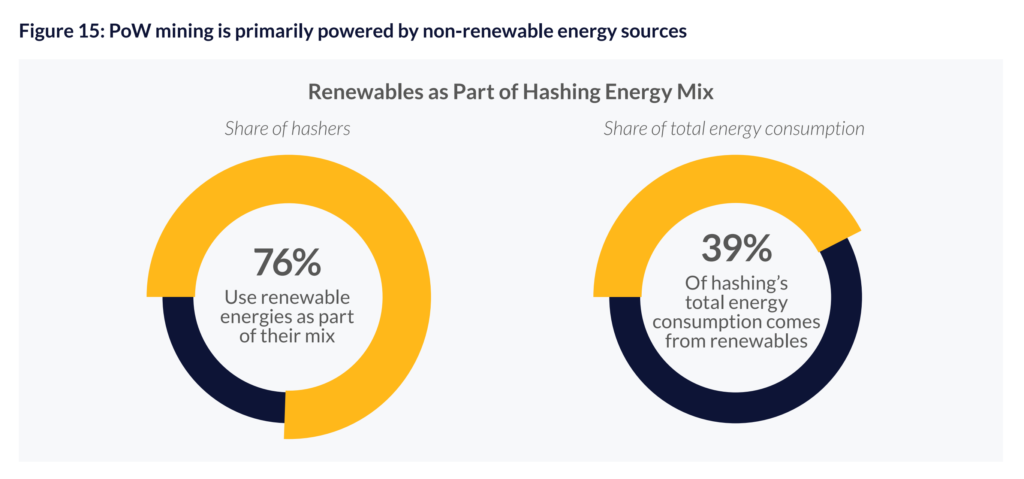

Majority of global Bitcoin energy consumption powered by non-renewable energy – Only 39 percent comes from renewables

24 September 2020 (CCAF) – The Cambridge Centre for Alternative Finance (CCAF) at the Cambridge Judge Business School today published the third edition of its Global Cryptoasset Benchmarking Studywhich highlights the industry’s efforts to address regulatory concerns over anti-money laundering (AML) and combating the financing of terrorism (CFT), but cautions that efforts to address issues such as a lack of insurance or auditing have the potential to hinder growth within the industry.

The study, which draws on data collected from more than 280 cryptoasset entities in 50+ countries, underlines that a greater share of cryptoasset service providers abide by AML/CFT obligations, a potential consequence of regulatory authorities’ efforts to harmonise their approaches to cryptoassets, such as initiated by the Financial Action Task Force (FATF). The year of 2019 saw a rise in the number of firms with an exclusive focus on cryptoassets that comply with AML/CFT regulations compared to 2018 (+67 per cent). This results both from enhanced compliance, but also an overall reduction in the number of firms exclusively supporting cryptoassets. About 30 per cent of firms that only offered cryptoassets in 2018 now support fiat currencies. […]

The new study, which has been supported by Invesco, also finds that although financial engineering in the mining industry has received significant press, only a minority of miners are experimenting with sophisticated financial products. Geographic distribution reveals that North American mining actors are twice as likely to use hashrate derivatives to hedge their risks than APAC actors. Factors, such as availability of these financial products, regulatory clarity, and financial literacy, may explain these regional discrepancies.

Other key findings of the report include:

- The growth in FTE (full time equivalent) employment that followed the 2017 market frenzy has slowed considerably, with respondents across all market segments reporting a year-on-year growth of 21 per cent in 2019, down from 57 per cent in 2018. However, not all firms are equal; individual firm employment data shows that a notable proportion of companies (26 per cent) have sustained an annualised growth in employment level above 10 per cent over a three-year period.

- On average 39 per cent of proof-of-work mining is powered by renewable energy, primarily hydroelectric energy. Globally, electricity price paid by hashers averages USD 0.046/kWh. […]

“There are several crucial issues – ranging from regulatory compliance, security audit and insurance – that are still rampant and need to be addressed for the industry to fully scale,” states Dr Robert Wardrop, Director and Co-founder of the CCAF. “Our hope is that the insights captured within this study will offer foresight into the evolution of the industry and inform decision-making as the space matures.” [more]