Affordable housing crisis spreads throughout world

By Laura Kusisto and Peter Grant

21 August 2019

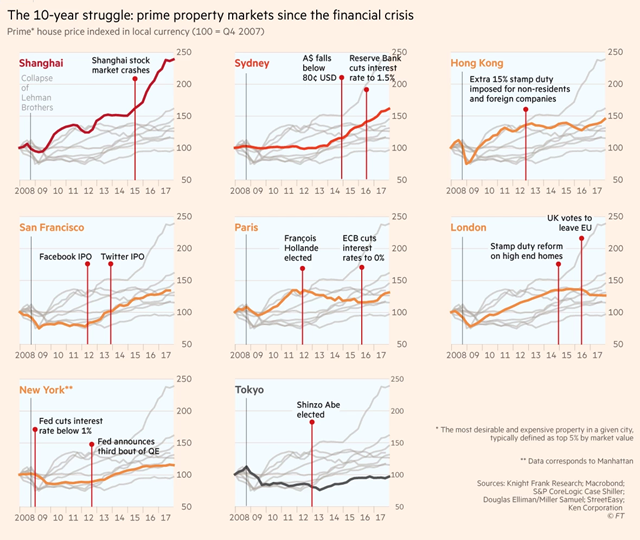

(The Wall Street Journal) – Cities around the world, from New York to London to Stockholm to Sydney, are struggling to solve growing affordable housing crises. [cf. How the 2008 financial crash made cities unaffordable worldwide – Property markets in the world’s major cities have “synchronised”, leaving behind nations and citizens. –Des]

Acute shortages are persisting despite millions of dollars invested and hundreds of thousands of units built. Some countries have focused on solutions promoting unshackled free markets while others have turned more to rent control and subsidies.

But no approach has solved the crises and most have other negative ripple effects.

Across 32 major cities around the world, real home prices on average grew 24% over the last five years, while average real income grew by only 8% over the same period, according to Knight Frank, a London-based real-estate consulting firm.

Economists say it is striking that affordability has worsened even during a period of global prosperity over the last six years. But income growth has been unable to keep pace with a rapid run-up in home prices.

Inflation-adjusted home-price gains have outpaced income growth over the last five years in 18 out of 25 world cities in the Knight Frank report. In two other places—Dubai and São Paulo—real incomes have fallen more than home prices, creating similar challenges.

Migration patterns have been partly to blame. Cities have thrived over the last decade, as jobs and people have migrated back downtown from far-flung suburbs.

“Global cities are suffering from affordability issues, partially as a result of their own success,” said Liam Bailey, global head of research at Knight Frank.

Soaring prices are also being fuelled by increasing demand from investors.

These have included domestic “mum-and-pop” investors buying second homes and foreign investors taking advantage of new technologies and an increasingly globalised financial system.

Governments haven’t had the money to subsidise new supply. Most budgets are strained by an ageing population with growing pension and health-care needs.

The private sector has also fallen short.

In numerous hard hit cities, developers have built hundreds of thousands of units but most of them are priced at upscale buyers and renters, not the middle and working class people who are being priced out of the market. [more]