The wealth detective who finds the hidden money of the super rich – “The bottom half of Americans combined have a negative net worth”

By Ben Steverman

23 May 2019

(Bloomberg Businessweek) — Gabriel Zucman started his first real job the Monday after the collapse of Lehman Brothers. Fresh from the Paris School of Economics, where he’d studied with a professor named Thomas Piketty, Zucman had lined up an internship at Exane, the French brokerage firm. He joined a team writing commentary for clients and was given a task that felt absurd: Explain the shattering of the global economy. “Nobody knew what was going on,” he recalls.

At that moment, Zucman was also pondering whether to pursue a doctorate. He was already skeptical of mainstream economics. Now the dismal science looked more than ever like a batch of elaborate theories that had no relevance outside academia. But one day, as the crisis rolled on, he encountered data showing billions of dollars moving into and out of big economies and smaller ones such as Bermuda, the Cayman Islands, Hong Kong, and Singapore. He’d never seen studies of these flows before. “Surely if I spend enough time I can understand what the story behind it is,” he remembers thinking. “We economists can be a little bit useful.”

A decade later, Zucman, 32, is an assistant professor at the University of California at Berkeley and the world’s foremost expert on where the wealthy hide their money. His doctoral thesis, advised by Piketty, exposed trillions of dollars’ worth of tax evasion by the global rich. For his most influential work, he teamed up with his Berkeley colleague Emmanuel Saez, a fellow Frenchman and Piketty collaborator. Their 2016 paper, “Wealth Inequality in the United States Since 1913”, distilled a century of data to answer one of modern capitalism’s murkiest mysteries: How rich are the rich in the world’s wealthiest nation? The answer—far richer than previously imagined—thrust the pair deep into the American debate over inequality. Their data became the heart of Vermont Senator Bernie Sanders’s stump speech, recited to the outrage of his supporters during the 2016 Democratic presidential primary.

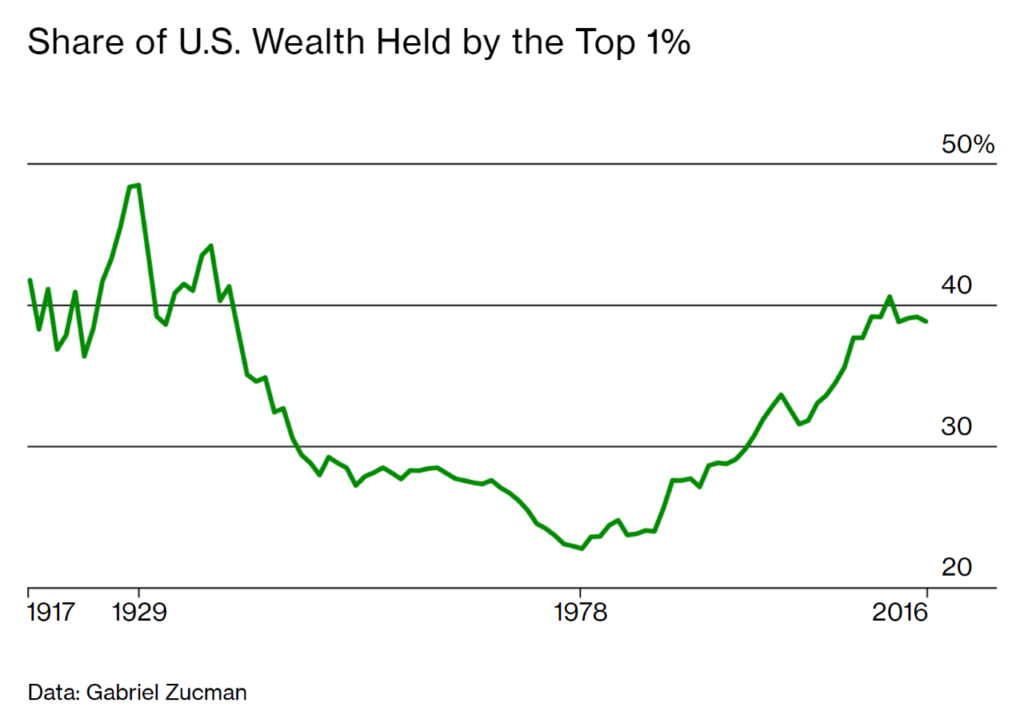

Zucman and Saez’s latest estimates show that the top 0.1% of taxpayers—about 170,000 families in a country of 330 million people—control 20% of American wealth, the highest share since 1929. The top 1% control 39% of U.S. wealth, and the bottom 90% have only 26%. The bottom half of Americans combined have a negative net worth. The shift in wealth concentration over time charts as a U, dropping rapidly through the Great Depression and World War II, staying low through the 1960s and ’70s, and surging after the ’80s as middle-class wealth rolled in the opposite direction. Zucman has also found that multinational corporations move 40% of their foreign profits, about $600 billion a year, out of the countries where their money was made and into lower-tax jurisdictions. […]

Zucman sees ominous signs in the rise of the far right—the threat that has preoccupied him since he was a teenager on the streets of Paris. Inequality, he says, paves the way for demagogues. The causes he’s identified for the widening gap in the U.S. are a host of policy changes that started in the 1980s: lower taxes on the wealthy, weaker labor protections, lax antitrust enforcement, runaway education and health-care costs, and a stagnant minimum wage. America’s skyrocketing wealth disparity, he says, reflects that “it’s also the country where the policy changes have been the most extreme.” [more]

The Wealth Detective Who Finds the Hidden Money of the Super Rich