Global economy could ‘self-destruct’ if world carries on burning fossil fuels, leading economist warns

By Ian Johnston

5 October 2016 (Independent) – A renowned economist who helped persuade the world to start taking climate change seriously has warned the global economy could “self-destruct” if countries fail to ditch fossil fuels and embrace a clean, green, high-tech future. Professor Lord Nicholas Stern was credited with bringing about a sea change in attitudes when he calculated the cost of failing to tackle the problem in 2006. While dealing with global warming would cost one per cent of the world’s gross domestic product, doing nothing would be up to 20 times more expensive, he concluded. Now Professor Stern, former Mexican president, Felipe Calderón, and other leading figures from politics, finance and science have launched a major new report saying Governments and businesses must change course – and quickly. “The challenge is urgent: the investment choices we make even over the next two to three years will start to lock in for decades to come either a climate-smart, inclusive growth pathway, or a high-carbon, inefficient and unsustainable pathway,” said the report by The Global Commission on the Economy and Climate [pdf]. “The window for making the right choices is narrow and closing fast … The time is ripe for a fundamental change of direction.” It called for an end to vast subsidies paid to support fossil fuels by 2025 “at the latest”, saying these represented “fundamental price distortions” in the market. An estimated $550bn (about £430bn) in fossil fuel subsidies was paid out worldwide in 2014 “skewing investment away from sustainable options”, the report added. [more]

Executive Summary

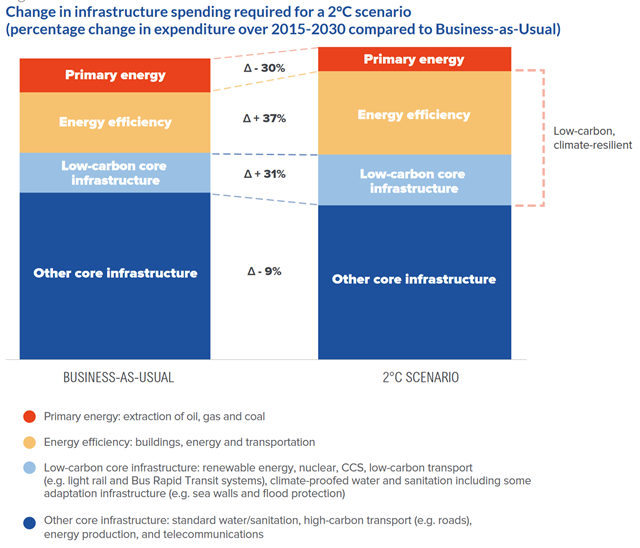

Investing in sustainable infrastructure is key to tackling three simultaneous challenges: reigniting global growth, delivering on the Sustainable Development Goals (SDGs), and reducing climate risk. Following the milestone achievements of 2015 – including the ambitious global goals set for sustainable development and its financing in Addis Ababa and New York, and through a landmark international agreement on climate action in Paris – the challenge is to now to shift urgently from rhetoric into action. Infrastructure underpins core economic activity and is an essential foundation for achieving inclusive sustainable growth. It is indispensable for development and poverty elimination, as it enhances access to basic services, education and work opportunities, and can boost human capital and quality of life. It has a profound impact on climate goals, with the existing stock and use of infrastructure associated with more than 60% of the world’s greenhouse gas (GHG) emissions. Climatesmart, resilient infrastructure will be crucial for the world to adapt to the climate impacts that are already locked-in – in particular, to protect the poorest and most vulnerable people. Ensuring infrastructure is built to deliver sustainability is the only way to meet the global goals outlined above, and to guarantee long-term, inclusive and resilient growth. A comprehensive definition of infrastructure includes both traditional types of infrastructure (everything from energy to public transport, buildings, water supply and sanitation) and, critically, also natural infrastructure (such as forest landscapes, wetlands and watershed protection). Sustainability means ensuring that the infrastructure we build is compatible with social and environmental goals, for instance by limiting air and water pollution, promoting resource efficiency and integrated urban development and ensuring access to zero- or low-carbon energy and mobility services for all. It also includes infrastructure that supports the conservation and sustainable use of natural resources, and contributes to enhanced livelihoods and social wellbeing. Bad infrastructure, on the other hand, literally kills people by causing deadly respiratory illnesses, exacerbating road accidents and spreading unclean drinking water, among other hazards. It also puts pressure on land and natural resources, creating unsustainable burdens for future generations such as unproductive soils and runaway climate change. The challenge is urgent: the investment choices we make even over the next 2-3 years will start to lock in for decades to come either a climate-smart, inclusive growth pathway, or a high-carbon, inefficient and unsustainable pathway. The window for making the right choices is narrow and closing fast, as is the global carbon budget. The time is ripe for a fundamental change of direction. Today’s low interest rates and rapid technological change mean that this is an especially opportune moment for sustainable infrastructure-led growth, and for investing in a better future. The world is expected to invest around US$90 trillion in infrastructure over the next 15 years, more than is in place in our entire current stock today. These investments are needed to replace ageing infrastructure in advanced economies and to accommodate higher growth and structural change in emerging market and developing countries. This will require a significant increase globally, from the estimated US$3.4 trillion per year currently invested in infrastructure to about US$6 trillion per year. The Global Commission has found that it does not need to cost much more to ensure that this new infrastructure is compatible with climate goals, and the additional up-front costs can be fully offset by efficiency gains and fuel savings over the infrastructure lifecycle. But many of these solutions require higher up-front financing, with the savings and other benefits accruing later. To deliver these solutions at scale, financing and investment have to be mobilised and better deployed from a multitude of different domestic and external sources, including national and local governments, multilateral and other development banks, private companies and institutional investors. International financing will be particularly important to support this transition in developing countries.

The Sustainable Infrastructure Imperative