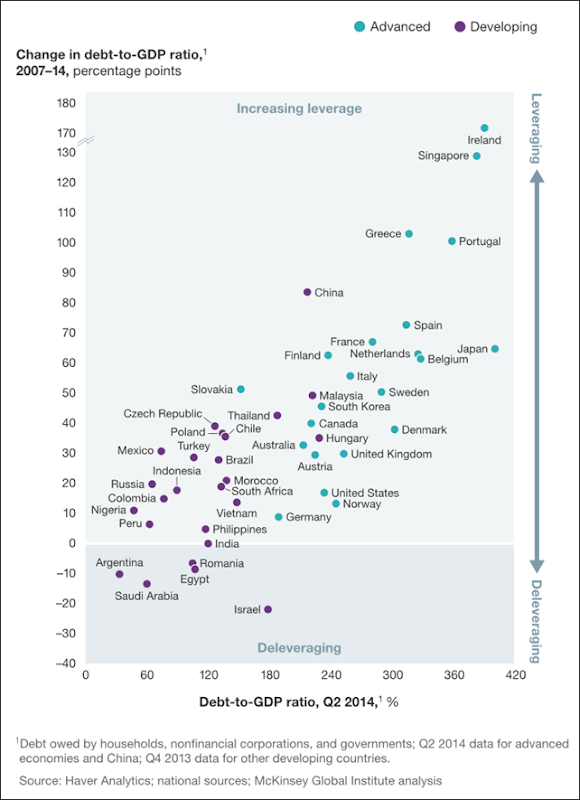

Graph of the Day: Change in debt-to-GDP ratio in advanced and developing nations, 2007-2014

February 2015 (McKinsey Global Institute) – A new McKinsey Global Institute (MGI) report, Debt and (not much) deleveraging [pdf], examines the evolution of debt across 47 countries—22 advanced and 25 developing—and assesses the implications of higher leverage in the global economy and in specific sectors and countries. The analysis, which follows our July 2011 report Debt and deleveraging: The global credit bubble and its economic consequences and our January 2012 report Debt and deleveraging: Uneven progress on the path to growth, focuses on the debt of the “real economy”: governments, nonfinancial corporations, and households. It finds that debt-to-GDP ratios have risen in all 22 advanced economies in the sample, by more than 50 percentage points in many cases (graph). [more]

Debt and (not much) deleveraging