The myth of an American ‘Saudi America’: Straight talk from geologists about the new era of oil abundance

By Raymond T. Pierrehumbert

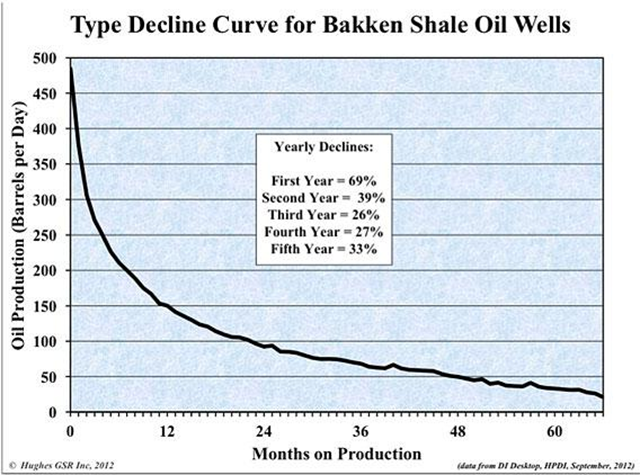

6 February 2013 (Slate) – Like swallows returning to San Juan Capistrano, every December some 20,000 geoscientists flock to San Francisco for the fall meeting of the American Geophysical Union. Slate readers have already heard about a presentation with a particularly eye-catching title, but for me some of the most thought-provoking news came in a prestigious all-Union session with the rather dry heading “Fossil Fuel Production, Economic Growth, and Climate Change.” (Search for it here.) This session dealt, in a hard-headed, geological, show-me-the-numbers way, with the claim that we are at the brink of a new era of oil and natural gas abundance. The popularity of the abundance narrative waxes and wanes, and its current ascendance comes primarily on the heels of a report by Leonardo Maugeri, a former oil-industry chief and currently a fellow at Harvard’s Belfer Center. When his cornucopian fantasy came out, I smelled a rat (or at least a not-too-deeply buried fish). But the International Energy Agency jumped on the bandwagon with breathless, and equally fishy, forecasts of the coming “Saudi America.” Most of the media swallowed the story hook, line, and sinker, with even the usually sober Economist rising to the bait. So what’s wrong with this story? Maugeri’s problems begin but don’t end with an arithmetic blunder so dumb (he compounded a percentage decline incorrectly) it would make even Steve Levitt blush. The geeky geological stuff discussed at the AGU session is more interesting and ultimately more damning. The geological considerations expose a number of common threads of faulty reasoning that pervade the current crop of starry-eyed projections of endless oil abundance.[…] There are certainly huge amounts of oil locked up in shale formations worldwide. In the United States alone, the Bakken and Eagle Ford shales contain up to 700 billion barrels, and the Green River shale under Colorado, Wyoming, and Utah has a whopping 2 trillion barrels. However, only a tiny fraction of this total is recoverable. […] At the high end of the estimates, predicted production from Bakken and Eagle Ford together amounts to perhaps a two-year oil supply for the United States at 2011 consumption rates. That’s significant but not a game-changer. Even if it were to prove possible to achieve production rates comparable to those of Saudi Arabia, that would only mean that we would deplete the resource faster and bring on an oil crash sooner. What would it take to ramp up production to such high levels? Technological developments have made it possible to tap into tight oil, but these are not the same kinds of technological developments that have given us ever more powerful computers and cellphones at ever declining prices. Oil production technology is giving us ever more expensive oil with ever diminishing returns for the ever increasing effort that needs to be invested. According to the statistics presented by J. David Hughes at the AGU session, we are now drilling 25,000 wells per year just to bring production back to the levels of the year 2000, when we were drilling only 5,000 wells per year. Worse, the days are long gone when you could stick a pitchfork in the ground and get a gusher that would produce for years. The new wells are expensive (on the order of $10 million each in the Bakken) but give out rapidly, as shown in the preceding figure from Hughes’ talk illustrating the typical production curve. [more]