In aftermath of drought, U.S. corn movement turns upside down

By Julie Ingwersen, with additional reporting by Karl Plume and K.T. Arasu in Chicago; Editing by Dale Hudson

29 October 2012

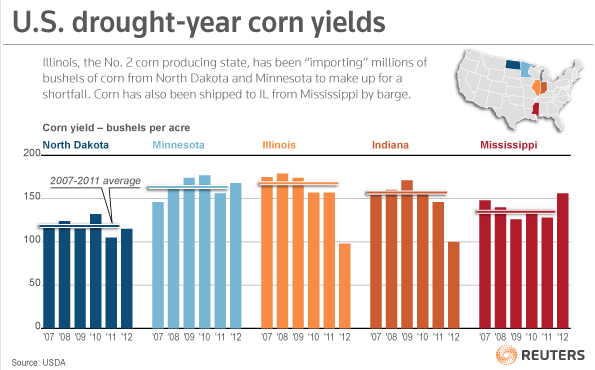

CHICAGO (Reuters) – The devastating U.S. drought and ensuing crop disease are upending traditional grain movement patterns, with dozens of trains and barges shipping North Dakota or Mississippi corn into the Corn Belt rather than out to the coasts. Processors and ethanol producers in No. 2 corn state Illinois, where the average corn yield was the lowest in nearly 25 years, are “importing” millions of bushels of the grain – an unprecedented volume – from North Dakota, which produced a record crop this year, trade sources said. Northern corn is even reaching key livestock states such as Texas and Oklahoma. Some southern states, which were also spared the worst of the most extensive drought in half a century this year, are shipping barges of corn up the Mississippi River to the interior, reversing the normal trade flow, traders say. While atypical shipments are not unheard of in the agricultural market, traders say the scale of this year’s upheaval is unprecedented. It is being fueled both by the dramatic difference between drought-hit Midwest crops and bumper harvests in fringe states, as well as the prevalence of a naturally occurring toxin, aflatoxin, that can harm livestock. The unusual grain flow could foreshadow a scramble for quality corn supplies in the months to come as end-users work through the smallest U.S. harvest in six years. By next September, corn stocks are projected to drop to just 5.5 percent of annual demand, the bare minimum of operational requirements. The market dislocations could benefit logistics firms and big merchants such as Cargill, which reported a four-fold rise in earnings this month and said “atypical trade flows” would spur more demand for its trading expertise. Railway companies, which are already reaping windfall profits from upheaval in the oil market, are also moving quickly to take advantage of the scramble in grain trading. BNSF Railway last month posted rates on its website for shuttle services from Minnesota and the Dakotas to Illinois, which traders said was a first for the route. BNSF said it changes rates based on consumer demand and market conditions but declined to comment further. Canadian Pacific Railroad has responded to “increased demand for corn from the Northern Plains to be moved to eastern parts of the country”, a spokesman said, declining further comment. Signs of a supply squeeze were already evident in global trading patterns, with U.S. livestock producers booking corn from Brazil in the wake of soaring feed costs. But they have become more evident in the cash market for U.S. grains since the Midwest harvest began in September, illuminating the uneven impact of the drought. The average 2012 corn yield in Illinois is projected at 98 bushels per acre, a 24-year low. By contrast, producers at the edges of the Corn Belt grew record or near-record crops with excellent quality. Production in North Dakota surged 80 percent; Mississippi’s yield jumped to a record high. “Test weights are fantastic. We have never seen corn like this in our lives,” said David Fiebiger, manager of the Finley Farmers Elevator in North Dakota, a shuttle-loading facility that has dispatched one train of corn to the Midwest. […]

In aftermath of drought, U.S. corn movement turns upside down