Bankruptcies have German solar industry on the ropes

By Stefan Schultz

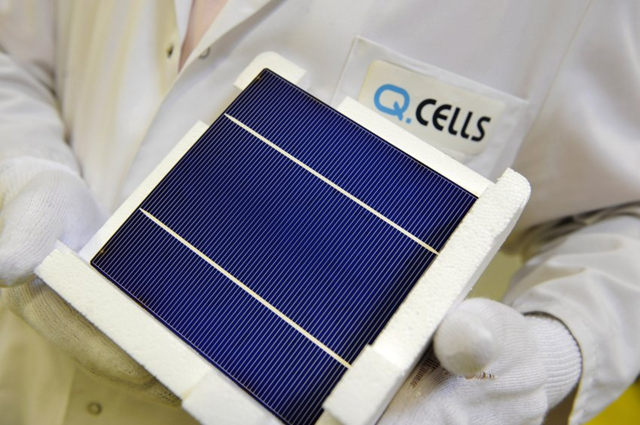

3 April 2012 The German solar industry is at a turning point. The bankruptcy of Q-Cells this week shows that the days of German solar cell production are numbered. Asian competitors took the lead years ago, and German government subsidies were part of the problem. It wasn’t so long ago that people viewed Q-Cells as an energy company of the future. At one point, it was the world’s largest manufacturer of solar cells and quarter after quarter, it topped analysts’ expectations. The company proved to be a money-making machine even during the financial crisis, with some believing it might one day grow to become part of Germany’s DAX index of benchmark companies on the stock exchange. At the end of 2007, the company was valued at close to €8 billion ($10.7 billion at today’s rates). Q-Cells’ production facilities were located in the city of Bitterfeld-Wolfen, in a former lignite mining area in the eastern German state of Saxony-Anhalt. The area was even dubbed “Solar Valley,” a play on California’s Silicon Valley. For a some time now, though, the days have been growing darker in Solar Valley, and with this week’s bankruptcy announcement by Q-Cells, things are looking to get even darker. On Tuesday, the company as expected submitted its official request to begin bankruptcy proceedings. The energy company of the future looks as though it may no longer have one. The company, it turns out, simply wasn’t prepared for the fast changes that have buffeted the industry. In 2011, Q-Cells posted a loss of €846 million. As of last Tuesday, the firm had a marginal value of only €35 million and Q-Cells’ share price had plunged to just 9 cents. In Bitterfeld-Wolfen, concerns are growing about massive job losses among the 2,200 Q-Cells workers in the city. But Q-Cells’ insolvency also comes as a great shock to the Germany’s solar industry. It is already the fourth major bankruptcy in a sector in crisis, and it underscores the degree to which German solar firms are being outpaced by competition from Asia — despite billions in German government subsidies granted each year to the industry. And despite solar energy gradually becoming more competitive, the setbacks are rapidly mounting. In December 2011, two major solar companies slid into bankruptcy: Berlin-based Solon and Erlangen-based Solar Millennium. In the case of Solon, Indian firm Microsol acquired the core business; but of the company’s 1,000 employees, only 400 remain employed today. Solar Millennium’s bankruptcy came as a major blow to thousands of small investors who had lent the firm money. In March 2012, Freiburg-based Scheuten Solar, the firm that presented what was the world’s largest solar module at the time eight years ago, declared bankruptcy. The same month, power plant producer Solarhybrid and the Frankfurt an der Oder-based Odersun, which had been prestige projects supported by political leaders in the eastern state of Brandenburg, also filed for insolvency proceedings. Other bankruptcies are likely to follow. […]