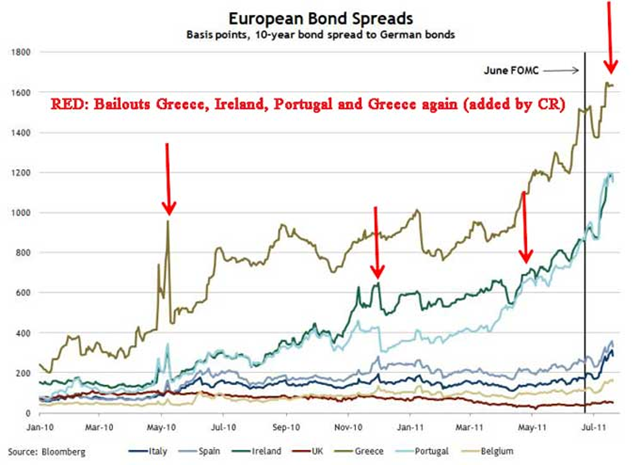

Graph of the Day: European Bond Spreads, January 2010 – July 2011

By CalculatedRisk

21 July 2011 This is a day to remember – Greece will now default – so this is probably worth one more post (I haven’t seen a rating agency downgrade them yet). For details: STATEMENT BY THE HEADS OF STATE OR GOVERNMENT OF THE EURO AREA AND EU INSTITUTIONS. Note: The history of the European bailouts is deny first, then act later. So naturally the following denial of additional defaults just raises the question of “when” for many observers. […] And here is a look at European bond spreads from the Atlanta Fed weekly Financial Highlights released today (graph as of July 20th). The spreads have declined sharply since the Euro Zone announcement. […] Note: I added arrows pointing to the various bailouts starting with the first bailout for Greece, followed by Ireland, Portugal, and then Greece again.