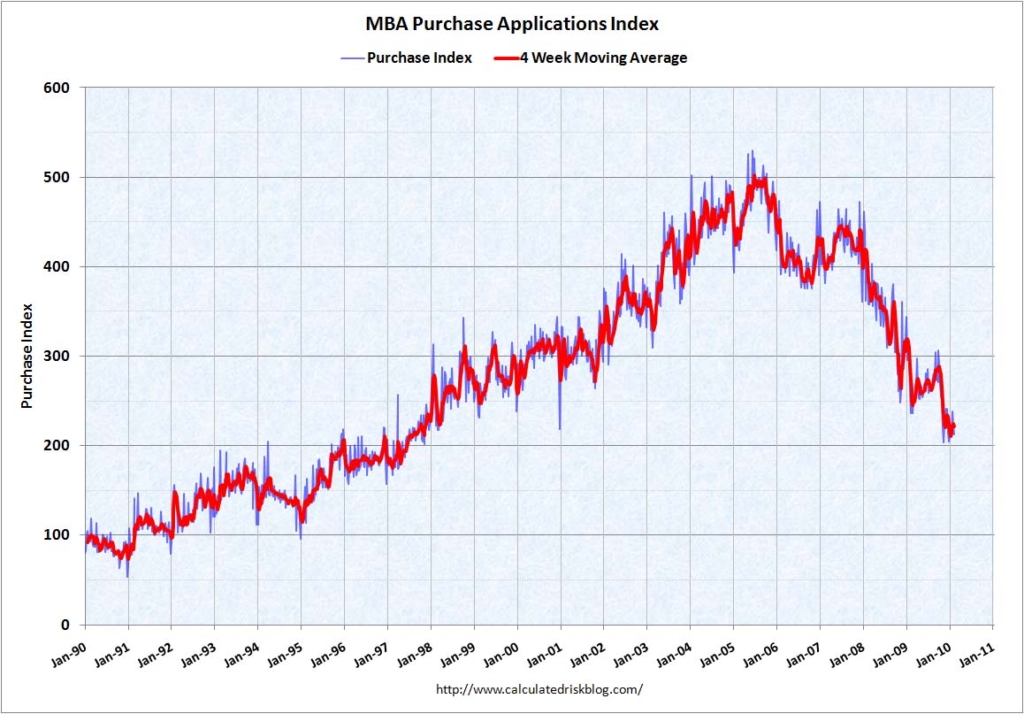

Graph of the Day: Mortgage Purchase Applications, Jan 1990 – Jan 2010

The MBA reports: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Market Composite Index, a measure of mortgage loan application volume, decreased 2.1 percent on a seasonally adjusted basis from one week earlier. … The Refinance Index decreased 1.2 percent from the previous week and the seasonally adjusted Purchase Index decreased 4.0 percent from one week earlier. … The average contract interest rate for 30-year fixed-rate mortgages remained unchanged at 4.94 percent, with points increasing to 1.09 from 1.06 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

This graph shows the MBA Purchase Index and four week moving average since 1990. The 4 week average of the seasonally adjusted purchase index declined to 221.7, just above the 12 year low set in early January. Refinance activity also declined even with rates below 5%, since most borrowers who are able to refinance already have – and the other half of homeowners with mortgages are unable to refinance for several reasons. (see: Dina ElBoghdady and Renae Merle at the WaPo: Refinancing unavailable for many borrowers ).

MBA: Mortgage Purchase Applications Decline