Graph of the Day: Delinquency Rates at Commercial Banks, 1991-2009

From Calculated Risk:

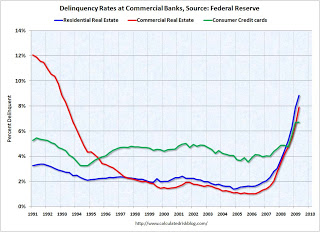

The Federal Reserve reports that delinquency rates rose in Q2 in all categories. This graph shows the delinquency rates at the commercial banks for residential real estate, commercial real estate and consumer credit cards. Commercial real estate delinquencies (7.91%) are rising rapidly, and are at the highest rate since the early ’90s (as delinquency rates declined following the S&L crisis). Residential real estate (8.84%) and consumer credit card (6.7%) delinquencies are at the highest levels since the Fed started tracking the data (since Q1 ’91). Although there is credit deterioration everywhere, the rise in these three categories is especially significant. There was also a significant increase in C&I delinquencies (commerical & industrial) and Agricultural loans. …

Fed: Delinquency Rates Surged in Q2 2009